BAC A BANK launches incentive program with limit of 3,000 billion VND

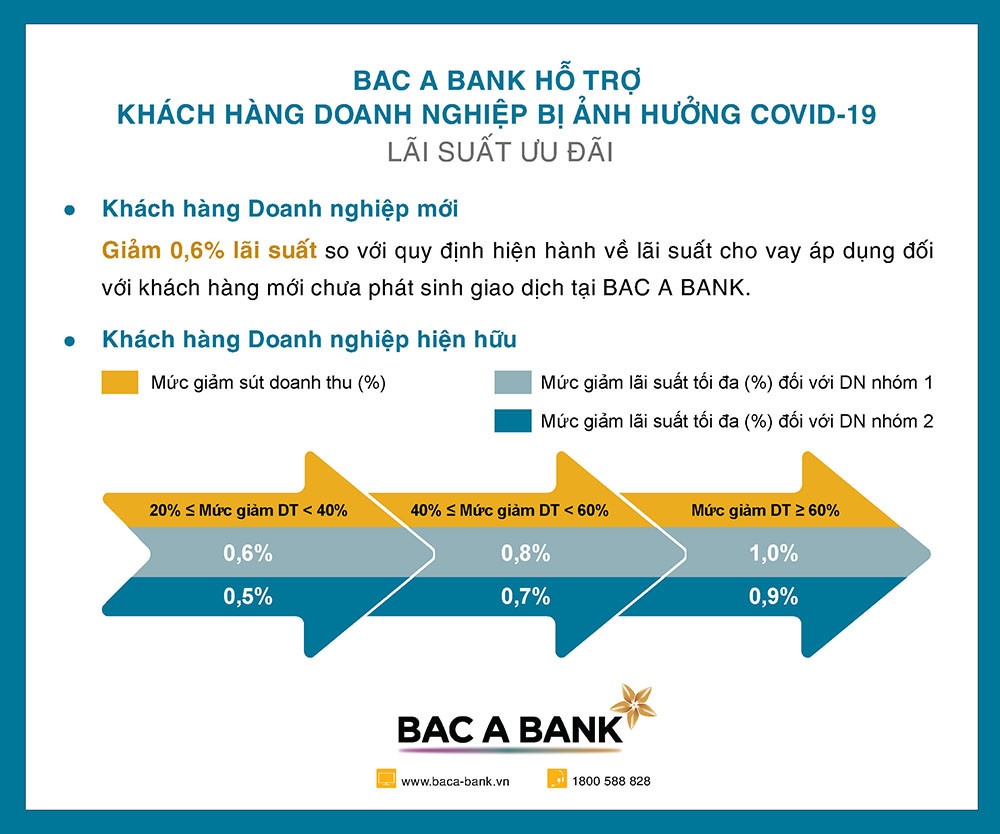

(Baonghean.vn) - Bac A Commercial Joint Stock Bank is implementing the incentive program "BAC A BANK supports corporate customers affected by Covid-19" with a limit of up to 3,000 billion VND. The incentive is for businesses that have a need to borrow from BAC A BANK to supplement working capital for production and business with secured assets.

Limit of 3,000 billion VND at all BAC A BANK branches

The complicated developments of the Covid-19 pandemic have caused serious consequences for the domestic and world economies as production and business activities stagnated and the consumer market shrank, causing the revenue and profits of many businesses to decline seriously, while directly threatening the lives of workers.

Based on the motto "Serving customers best for development", in this difficult period, Bac A Commercial Joint Stock Bank has proactively sought appropriate solutions to support businesses to restore and stabilize production and business, and overcome damage caused by the epidemic.

From April 1, 2020 to June 30, 2020, Bac A Commercial Joint Stock Bank will launch the incentive program "BAC A BANK supports corporate customers affected by Covid-19" with a limit of up to VND 3,000 billion at all BAC A BANK branches nationwide.

|

| BAC A BANK launches a business incentive program with a limit of up to 3,000 billion VND. Photo: PV |

Reduced interest rates on existing debt

Meanwhile, BAC A BANK also provides new loans with an interest rate 0.6% lower than the current regulations on loan interest rates applied to customers who have never made transactions at BAC A BANK.

|

| Many incentives for business customers facing difficulties due to the Covid-19 pandemic. Photo: PV |

With streamlined processes and procedures, BAC A BANK will create maximum conditions for businesses to easily access this cheap credit source in accordance with the business situation of each business according to the Bank's assessment and appraisal.

“Responding to the State Bank of Vietnam's policy to remove economic difficulties and ensure social security to cope with the pandemic, Bac A Commercial Joint Stock Bank hopes that the preferential interest rate package for businesses affected by Covid-19 will be one of the "pushes" to help customers gradually recover and stabilize production and business. Through this credit program, BAC A BANK wishes to always accompany and stand side by side with the business community to improve operational efficiency, promote growth, and contribute to the overall economic recovery." - Mr. Tran Thanh Hai, Director of Wholesale Banking Division of Bac A Commercial Joint Stock Bank shared.

For detailed information about the BAC A BANK Customer Support Program for businesses affected by Covid-19, please visit:www.baca-bank.vnor contact Customer Service Center 1800 588 828.