Sweet car insurance offers, but when problems arise, there are all kinds of ways to avoid them.

Customers are sought after and promised many benefits when they are offered to buy auto insurance, but when they encounter an accident causing damage, the "god" has to suffer to claim compensation.

Many car owners said that when they bought insurance, they were offered many promises, even just to make it easier to approve their loan application, but when they had an accident and their car was damaged, the insurance consultants were indifferent, "harassed" them with all kinds of requests, and even "set up" them to make them fall into a situation where they were refused payment or had to pay a large amount of compensation.

Matrix of customer confusion

After VietNamNet reported on the case of Mr. Thong Minh Chanh (Tan Thanh, Ham Tan, Binh Thuan) accusing BSH Saigon Insurance of deliberately "setting a trap" with an alcohol test result above 0 to refuse compensation, many customers complained of the same situation.

Mr. Ta Van Phong (residing in Hanoi) purchased car physical damage insurance 30G-873.XX at BSH. On February 10, 2022, the car driven by driver Le Tien Dung had an accident and BSH also required the driver to take an alcohol test. After that, based on the result of 1.85 mmol/l, this insurance company refused to compensate under the general exclusion clause.

Not only BSH, another insurance company, MIC (Military Insurance), also made customers angry because of similar tricks.

That was the case of Tay Nghe An Company's car having an accident at 8:00 p.m. on December 28, 2021 in Do Luong district, Nghe An. MIC Insurance in the notice sent to customers on April 1, 2022 concluded that based on the driver's blood alcohol concentration test at 0.5 mmol/l, it violated the insurance exclusion clause and refused to pay.

The reason is that the Rules on compulsory civil liability insurance of motor vehicle owners stipulate that the insurance company will refuse to compensate for damages to drivers whose breath contains alcohol but does not specify the alcohol concentration.

Meanwhile, according to the List of specialized technical processes in biochemistry issued with Decision No. 320 of the Ministry of Health, the normal value of blood alcohol concentration is less than 10.9 mmol/L. That is, due to eating, living and natural substances in the blood, people who do not drink beer or wine can have an alcohol level of more than 0.

In the case of Ms. Do Thi Kim Tho (Chau Thanh, Kien Giang) - the owner of a 7-seat Kia Rondo car with license plate 68A-119.XX, Bao Minh Kien Giang Insurance Company ignored the conclusion of the police agency and insisted on applying a 50% deduction.

Specifically, on June 13, 2021, Ms. Tho's car collided with a Chevrolet Aveo at the intersection with Mai Chi Tho Street (Rach Gia, Kien Giang). The traffic police report of Rach Gia City Police clearly stated that the fault lay with the driver of Ms. Tho's car. If the insurance contract was followed, Ms. Tho would have been covered by insurance for the repair costs of the two cars, which was nearly 86 million VND. However, Bao Minh Kien Giang Insurance said that the Chevrolet (the crashed car) was also at fault and because this accident was a "mixed fault" (both drivers were at fault), the company only approved 50% of the repair costs.

As a result, Ms. Tho had to pay out of her own pocket to have both cars repaired.

|

Scene of the car collision on June 13, 2021 that led to Ms. Do Thi Kim Tho's insurance event. |

Inserting unfavorable terms

Mr. Nguyen Khac Xuan - Director of InFair Insurance Support Services LLC said that recently, he has received many requests for advice from car users who have encountered problems when claiming insurance, in which, some tricks of insurance assessors have emerged to "trap" customers, leading to compensation denial or large deductions.

One of the common "tricks" is that the appraiser asks for police records when an accident occurs.

“It is wrong for the insurance company not to pay compensation without a police record. A police record is a necessary document but not required for the insurance company to carry out its appraisal obligation to determine the cause. The insurance company must collect it itself to carry out its appraisal obligation,” said Mr. Xuan.

According to Mr. Xuan's analysis, Circular 63/2020/TT-BCA of the Ministry of Public Security stipulates that the traffic police only provide documents to the insurance company. At the same time, Article 48 of the Law on Insurance Business stipulates that the insurance company is responsible for appraisal to determine the cause and extent of the loss. The appraisal cost is borne by the insurance company, and cannot be requested from the customer and is considered a tool to cause difficulties in order to avoid responsibility.

The second common trick is to take advantage of many customers' taste for car modification. For example, if a customer modifies the tires of the car to be larger than the original registered car, when an accident occurs, the insurance company will immediately refuse to pay compensation, even if this change is not the cause of the accident.

The third trick is to insert terms that are unfavorable to the customer into the contract. Only when an accident occurs will the customer realize the absurdity of the situation.

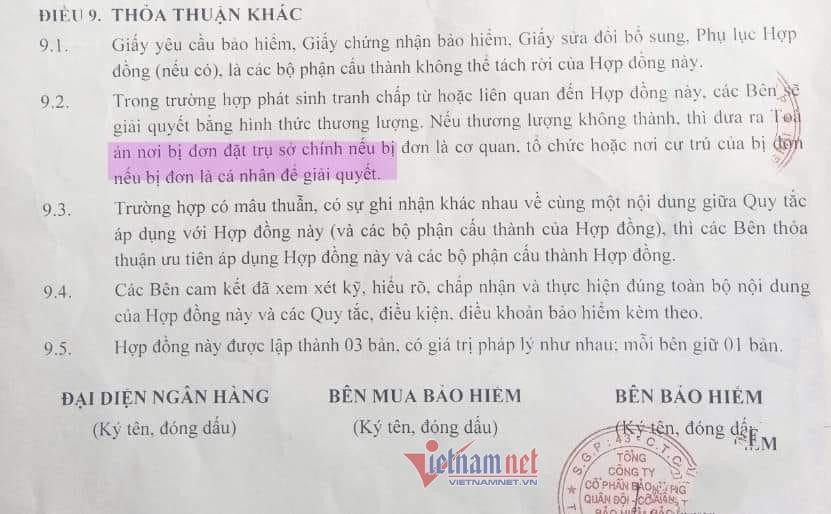

For example, the terms"If the negotiation fails, bring the case to the court where the defendant has its headquarters."This means that if a customer in Ca Mau sues an insurance company headquartered in Hanoi, they will only find it costly to travel, get discouraged and give up," Mr. Xuan commented.

|

Clause 9.3 of MIC's insurance contract will discourage customers who are far from the insurer's headquarters from filing a claim. |

Even more sophisticated, there are cases where the insurance company has introduced ridiculous terms such as "not applicable when the truck operates in a mineral exploitation area" in the dispute between the owner of truck 90C-102.46 and BIDV Insurance Corporation Bac Bo (BIC Bac Bo) about the accident that occurred on April 25, 2020 at the quarry of Vissai Ha Nam Cement Factory. Meanwhile, this location is the place where the truck owner operates.

If you look closely, there are cases where insurance companies insert terms that are completely different from the terms in the standard contract registered with the Ministry of Finance. This violation is usually only discovered by lawyers when an incident occurs, and few customers suspect it.

Lawyer Truong Thanh Duc - Director of ANVI Law Firm said: "Recently, there have been too many cases showing that insurance companies always try to wash their hands of the matter, cause difficulties or deny responsibility. The cause may come from loopholes in legal policies."

"It is necessary to urgently amend the Law on Insurance Business to put insurance companies and customers in a more balanced position, because currently customers are in a weak position, sometimes as if they receive a favor when receiving insurance compensation," said Mr. Duc.