The secret to not losing money in your bank account

(Baonghean.vn) -Recent cases of customers losing money in their accounts have made many people worried. To avoid losing money unjustly, cardholders should know how to protect their assets.

Understanding the following situations where bank card account information is stolen by bad guys will help users proactively protect themselves.

Do not disclose card information

When using an ATM card, you should never reveal your password or lend your bank card to anyone. In addition, you should not set your password with easily guessable information such as your date of birth, ID number, phone number, license plate number, etc. to avoid the situation where someone else picks up your card and steals your money. You should also change your card password regularly.

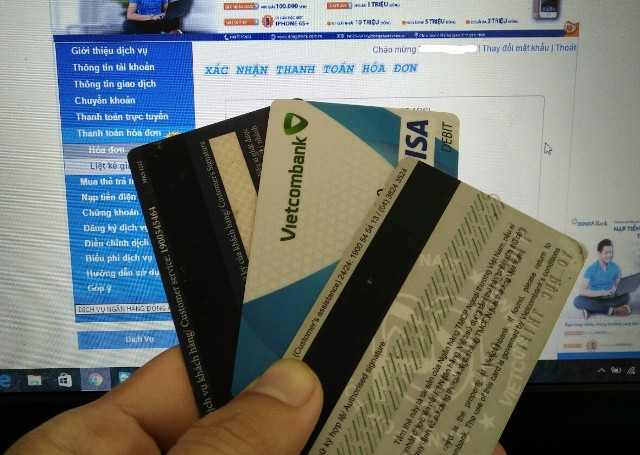

To avoid the risk of others seeing card information, especially the CVV code (the last 3 digits on the back of the card), some people actively memorize the code and cover it up.

Do not take photos of payment cards and send them via phone.

There are also cases where people take photos of both sides of their visa card and send them to you via phone to ask you to order online. The card photos circulating online are not secure. If they fall into the wrong hands, you will definitely lose money.

Beware of scam messages

This is an old-fashioned method that is still used by scammers. Users may receive a message from someone pretending to be a bank representative with a warning message about security vulnerabilities and request to call a toll-free support number. They will then ask for an account and PIN number to confirm.

|

| Users should be careful to protect their account information to avoid being stolen by criminals to steal money. |

Be careful when making online payments

When transacting online, cardholders should pay attention to the following issues. Users should use anti-virus software on computers and phones, not reply to strange emails, not click on unclear links or requests to enter personal information, card information, etc.

In addition, you should type the address of the electronic bank directly into the browser when making online transactions. You should not click on links sent via email or links suggested by Google (in case of searching by Google) because the links can be faked to look almost like the actual address.

At the same time, you should only shop and pay online at reputable, official websites of banks and reliable online sales units with https security protocol.

In any case, cardholders absolutely do not provide confidential card information via social networks (facebook, skype, viber, zalo...) and use international prepaid cards for some necessary cases and deposit the correct amount of money needed for the transaction to control the amount of money in the card.

Monitoring when paying directly by card

For customers using magnetic cards, the disadvantage of this card is that the technology is not yet advanced, so it is easy to counterfeit. To ensure customer safety, many banks have implemented projects to convert from magnetic technology cards to smart chip technology.

However, to protect their finances, customers still need to be careful when using cards. Accordingly, when shopping or paying by card at supermarkets, restaurants, hotels, stores, etc., the cashier is often the one who directly holds your bank card and makes the transaction. This can lead to information being stolen.

Therefore, you must keep the card in sight and observe the cashier carefully, to avoid them trying to memorize the information printed on your card. In addition, users also need to monitor to control whether the cashier enters the correct amount of money they have to pay or not.

Protect your computer from spyware

Malware can infiltrate and steal your personal information and card details, and when you shop online, all of that information is sent to criminals.

There have been many warnings about Chinese computers having spyware pre-installed. Therefore, it is necessary to choose the type of computer, or avoid being infected with this type of software in various ways such as clicking on a link on the Internet and downloading or following an email as an attachment. Do not visit unknown websites, do not listen to invitations to click on strange links. Computers should be regularly scanned for viruses with the latest updates.

Always keep information confidential when using electronic banking services

For passwords to access electronic banking services and personal emails, users need to set difficult-to-guess passwords, change passwords regularly, and should not use password saving features to automatically log in for the next time. In particular, you need to limit the use of computers and public wifi networks when accessing the electronic banking system.

Use automatic transaction notification service

According to experts, to be safe in using cards, cardholders should use automatic transaction notification services and balance notification via text messages so that when a transaction occurs, the cardholder will receive information and handle it immediately when a suspicious transaction occurs.

In some unfortunate cases where there is a risk of losing money in the card or card account for unknown reasons, users should stay calm, immediately contact the issuing bank to request to lock the card and coordinate with the bank and related parties, provide documents (if any) ... to receive instructions and support to resolve the issue.

Be careful when downloading and using banking applications.

Most banks have their own applications to help customers make transactions more easily on smartphones and tablets. However, there have been cases of criminals creating "fake" applications to deceive and steal customer information.

In addition, even if you have downloaded the correct “official” application, users still need to regularly download upgrades. Citibank once warned that their smartphone application had security holes, so they recommended users download updates immediately to avoid being exploited by hackers.

Remember your bank's contact information for 24/7 use.

Credit cards, debit cards or bank accounts can be used 24/7. Therefore, when a card is lost or account information is leaked, consumers must immediately notify the bank. The sooner the notification is made, the higher the risk reduction because thieves tend to use the card as soon as it is stolen.

Therefore, to promptly notify in case of card loss, consumers need to remember how to contact the bank or usually the bank's customer care phone number printed on the back of the card.

Lost money in account, what to do to get it back?

Losing money in your bank card is something no one wants. However, if one day you suddenly receive a message from the bank switchboard and the money in your card "disappears" even though you did not make any transaction, stay calm and immediately take the following steps to protect your card and your treasury.

- Lock the card: Instead of being confused and trying to find out why your money is lost, you need to calmly call the bank's hotline and request to lock the card. This action will help you avoid losing more money in your account and at the same time notify the bank that your card is being illegally accessed.

- Check the card status: The next thing you need to do is calmly recall your most recent card transactions, and check your bills and cards to see if they are still intact and in your possession.

-Request a card investigation: You need to do this as soon as possible. You can call the credit hotline of the cardholder's bank or go to the nearest branch of the card-issuing bank to request an investigation.

Some tips when making transactions at ATMs

|

| Cover the keyboard with your hand when entering your PIN. |

- When withdrawing money at an ATM, you should observe strange devices attached to the ATM, especially the area in front of the keyboard to see if there is a camera or not (the bank managing the ATM never installs a camera in this location). If the ATM is not equipped with a keyboard cover, you should use your hand to cover the keyboard when entering the PIN to withdraw money to avoid bad guys filming to steal data.

- Make sure that the person behind you is waiting for their turn to make the transaction and that person cannot see the PIN you enter or the transaction value you intend to make.

- Take your money, card and transaction receipt immediately after you complete the transaction.

- If you see anyone acting suspicious, cancel the transaction and leave immediately.

- If you need to make a transaction at night, if possible, bring someone with you.

|

| For Internet banking transactions, carefully protecting your Token or phone SIM (if the phone number is used to send the authentication code) will ensure the safety of your transaction. |

Some “good” habits to remember when using your card:

- Regularly change your password (pin code). This doesn't take much time but helps you avoid the risk of losing money.

- Register for text messages from the bank, so that when money in your account is lost, you will know and be able to handle it promptly.

- Don't keep too much money in your card. If you have a large amount of money, you should save it. It's safer and also more profitable.

- Do not link ATM and Visa cards, because the risk of losing money from both cards will double.

- When accessing internet banking, do not save your password on your device. If you log in from a strange device, check to see if you have logged out of your account carefully.

Ngoc Anh

(Synthetic)

| RELATED NEWS |

|---|