Breakthrough in policy credit in Nghe An

(Baonghean) - After nearly 5 years of implementing Directive No. 40 on "Strengthening the Party's leadership over social policy credit", policy bank loans in Nghe An have actively contributed to poverty reduction, helping hundreds of thousands of poor households and policy families to develop economically.

"INCUBATING" FROM POLICY CAPITAL

As scheduled, today, the Social Policy Bank (SPB) of Thanh Chuong district came to transact at the People's Committee of Thanh Thuy commune. Early in the morning, Ms. Tran Thi Xuyen in Hamlet 3, Thanh Thuy went to the meeting room of the Commune People's Committee to disburse loans from the preferential credit program for forest planting households under the WB3 program.

|

| Up to now, after more than 15 years of operation with the achieved results, the Social Policy Bank has been affirming its important role in implementing credit solutions to achieve socio-economic development goals. Photo: Thu Huyen |

|

| Ms. Tran Thi Xuyen in Hamlet 3, Thanh Thuy Commune, Thanh Chuong Province, borrowed capital from the WT3 program of the Vietnam Bank for Social Policies to protect and develop 13 hectares of forest. Photo: Thu Huyen |

Ms. Nguyen Thi Lan - Head of the Savings and Loan Group (TK&VV) where Ms. Xuyen is a member said: Village 3, Thanh Thuy commune is adjacent to the border area, previously it was mainly bare hills. To develop the forest economy and at the same time protect the border area, we were given favorable conditions by the policy bank to borrow capital for forest planting.

The group has 46 members, most of whom have borrowed capital to develop the forest economy. Since receiving loans from the policy bank, the forest has been covered; the whole village has several hundred hectares of acacia, and the members' lives have been improving day by day.

Not only Ms. Xuyen's family in Thanh Thuy, Thanh Chuong, but also in many mountainous districts, the policy capital to serve ethnic minorities in economic development has really been effective.

In Quy Hop, we visited the family of Ms. Vi Thi Dao in Thai Quang hamlet, Chau Thai commune. She used to be a near-poor household. After being approved for a loan and using the capital effectively, her family has now escaped near-poverty.

|

| Officers of the Quy Hop People's Credit Fund visited the family of Ms. Vi Thi Dao in Thai Quang hamlet, Chau Thai commune, Quy Hop - an effective loan borrower in the area. Photo: Thu Huyen |

Ms. Dao said: I have borrowed capital from the policy bank twice. In 2014, I borrowed 30 million VND to invest in 4 hectares of acacia; in 2017, I paid off the debt and continued the cycle, borrowing 40 million VND to develop the farm economy, dig ponds to raise fish, raise buffaloes and cows...

Along with lending to poor and near-poor households, implementing Directive 40, in recent times, Nghe An Social Policy Bank has lent to the job creation program and from here, thousands of workers have been created jobs, exported labor, bringing a prosperous life.

|

| Officers of the People's Credit Fund of Quy Hop district inspected the loan model for economic development of Mr. Chu Quoc Tru's family in My Dinh hamlet, Chau Dinh commune (Quy Hop). Photo: Thu Huyen |

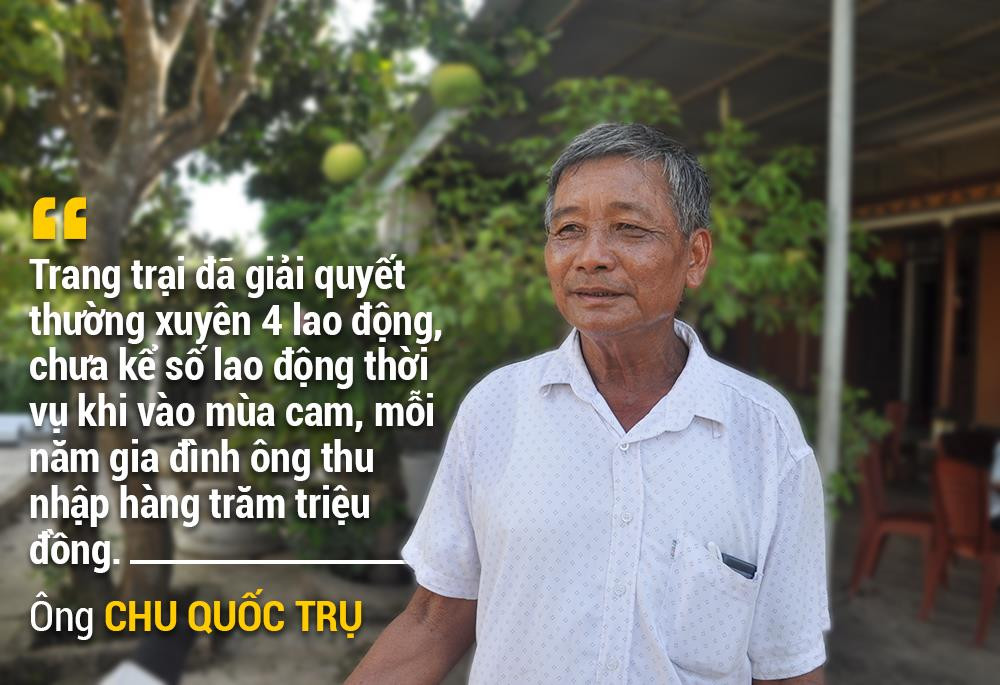

When you visit Chau Dinh commune, Quy Hop, and ask about Mr. Chu Quoc Tru's family in My Dinh hamlet, everyone will know him because he is a role model for economic development in the area. After retiring from his government job, Mr. Tru returned to Quy Hop to develop the farm economy.

Initially, when he started building the farm, with the small amount of capital he had accumulated, plus more than 1 billion VND in job creation loans from the district's Social Policy Bank, he invested in 6 hectares of oranges, built cow barns, dug ponds to raise fish; as the economy developed, he invested in buying a pickup truck to serve the transportation and consumption of products.

|

“We recommend that the Vietnam Bank for Social Policies pay more attention to increasing the GQVL loan capital source for Nghe An. This is a loan program according to Decree 61 of the Government, but the scale of the capital source is still too small, not meeting the actual needs,” Mr. Tru suggested.

For commune-level authorities, implementing Directive 40, policy capital sources have increased significantly, better meeting people's capital needs. The entire political system has participated, and the effectiveness of local policy credit has increased significantly.

|

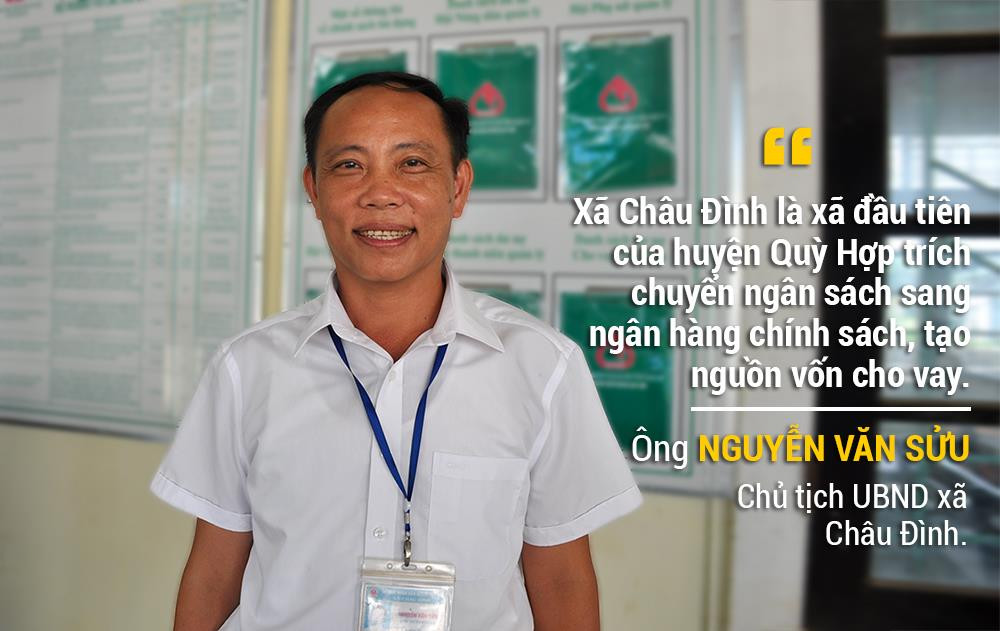

Mr. Nguyen Van Suu - Chairman of Chau Dinh Commune People's Committee said: Since the implementation of Directive 40, policy capital sources have increased significantly, more adequately meeting the capital needs of the people. Outstanding credit balance in the area reached over 37 billion VND, thereby helping to reduce hunger and poverty, and develop the economy. As a member of the Board of Directors, we have developed a plan, allocated budget sources, and annually contributed 20 million VND to increase the reserve for households borrowing capital.

CREATE POSITIVE CHANGE

Directive No. 40 is considered a breath of fresh air that positively changes social policy credit. During our visits to disadvantaged areas borrowing capital from the programs of the Vietnam Bank for Social Policies, we clearly felt that the long-dormant land and human resource potentials have been awakened. Policy capital has made an important contribution to the construction of new rural areas, changing the face of the whole countryside.

|

| General Director of the Vietnam Bank for Social Policies Duong Quyet Thang presents gifts to policy families in Ky Son. Photo: Thu Huyen |

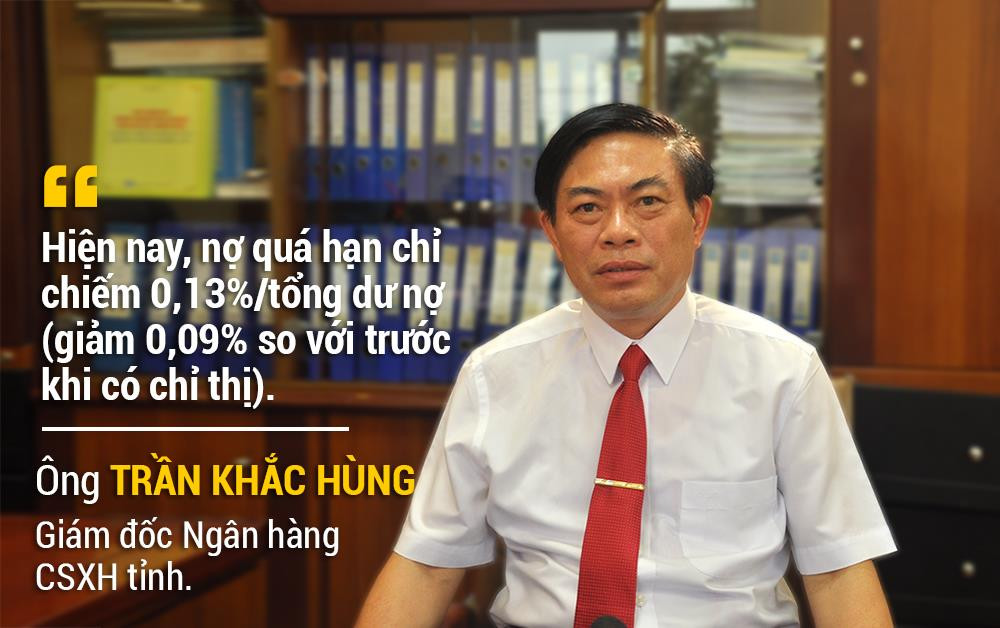

Mr. Tran Khac Hung - Director of the Provincial Social Policy Bank shared: Implementing Directive 40, the Provincial Party Standing Committee issued Directive No. 29 to strengthen the Party's leadership over social policy credit.

Accordingly, Party committees and authorities at all levels have paid more attention to leading, directing, and creating favorable conditions in all aspects for policy credit activities in improving the quality of social policy credit; allocating capital from the State budget entrusted through social policy for lending; consolidating credit quality; arranging for the Chairman of the People's Committee at the commune level to participate in the Representative Board of the Board of Directors of the Social Policy Bank at the district level; paying attention to arranging the location, time, security, and safety for the working sessions of the Social Policy Bank at the commune transaction points.

|

Along with credit growth, the quality of policy credit is constantly improved; regularly entrusted by all levels, sectors, socio-political organizations and the Bank for Social Policies to closely monitor the process of capital use for customers in combination with training and guidance for borrowers to improve the efficiency of capital use; actively urge debt collection, handle debt for customers facing risks due to objective reasons, etc. Thanks to that, borrowers use capital for the right purpose, effectively, and fulfill their debt repayment responsibilities.

As of June 30, 2019, the Nghe An Provincial Branch of the Vietnam Bank for Social Policies is implementing 19 Government policy credit programs (an increase of 6 programs compared to before the Directive) with a total capital of VND 8,237 billion (an increase of VND 1,996 billion compared to before the Directive).

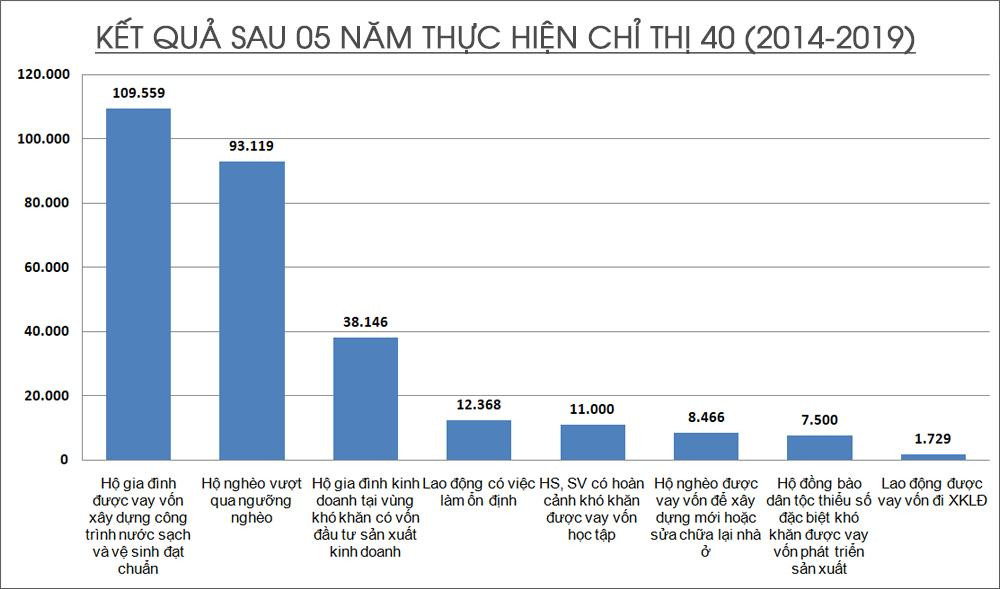

In 5 years (2014-2019), Nghe An Social Policy Bank has disbursed 12,719 billion VND to 461,250 poor households and policy beneficiaries. Total outstanding loans for policy credit programs in the area reached 8,222 billion VND, an increase of 1,991 billion VND compared to the time before Directive 40-CT/TW (average annual growth rate reached 7.1%), with 241 thousand customers with outstanding loans.

|

|

| The integrated livestock farm of Nguyen Thi Thao and her husband in Giang Son Dong commune (Do Luong). With the loan capital from the NHCS, her family farm has a revenue of more than 1 billion VND/year, which is the dream of many farming households in the district. Photo: Thu Huyen |

The current issue is to pay attention to capital sources for policy credit, meeting the borrowing needs of policy subjects. Vice Chairman of the Provincial People's Committee Le Hong Vinh emphasized: After 5 years of implementing Directive 40 of the Central Party Secretariat, Nghe An province has made a clear change.

In the period of 2015 - 2019, policy credit implemented by the Provincial Bank for Social Policies was truly a bright spot in implementing the poverty reduction target, contributing to ensuring social security, economic development and new rural construction in the area.

|

| Anh Son residents borrow capital from the program for production and business in disadvantaged areas to develop household economy. Photo: Thu Huyen |

To effectively implement policy credit programs, in the coming time, it is recommended that localities continue to allocate budgets for trust, direct relevant departments and branches to advise on lending to specific subjects. Maximize resources for social policy credit, concentrate policy credit capital sources originating from the state budget to a single focal point, the Social Policy Bank, for effective management and lending...