How to pay for government bond transactions

The Ministry of Finance has just issued Circular 46/2017/TT-BTC guiding the payment activities of government bonds, government-guaranteed bonds and local government bonds.

|

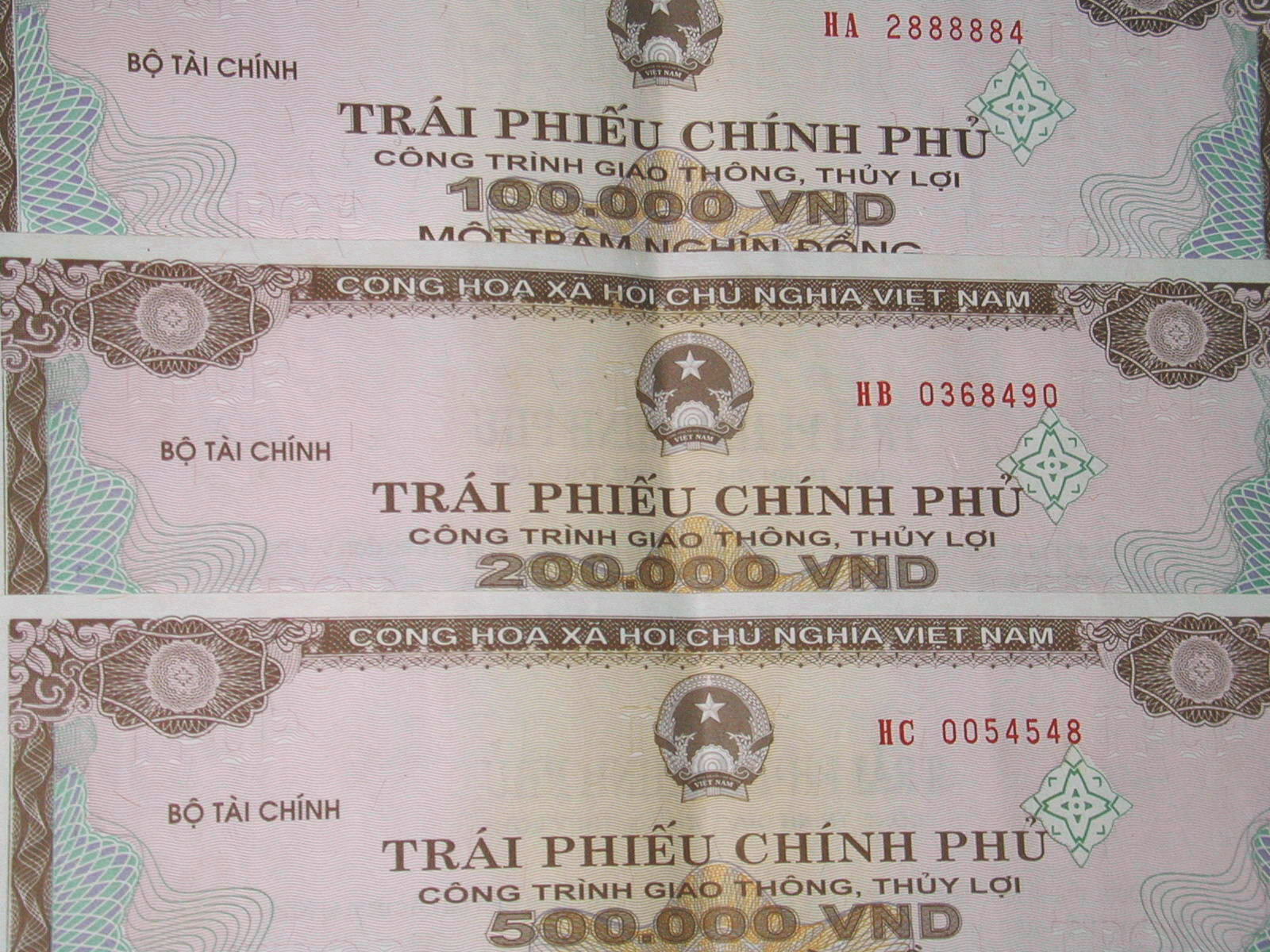

| Illustration photo |

The Circular clearly stipulates the method and principles for organizing the payment system for government bond transactions. Accordingly, the payment for the purchase and sale of government bonds listed on the Stock Exchange is carried out according to the payment method for each transaction.

Based on transaction data provided by the Stock Exchange, the Vietnam Securities Depository determines the payment obligations of each related party for money and government bonds and sends payment information to the State Bank of Vietnam.

The transfer of Government bonds is carried out on the system of the Vietnam Securities Depository Center on the basis of transferring Government bonds between the depository accounts of the regulated organizations and ensuring the principle that the seller must have enough Government bonds to transfer on the payment date, and the buyer must have enough money to make payment for the Government bond transaction.

Payment of government bond transactions between organizations making direct payments via the State Bank of Vietnam as prescribed in this Circular is made on the inter-bank electronic payment system.

The time for payment of government bond transactions is decided by the State Securities Commission in agreement with the State Bank of Vietnam. The Vietnam Securities Depository provides guidance on the order and procedures for payment of government bond transactions.

The Circular also specifies measures to overcome the temporary shortage of payment capacity for government bond transactions.

Specifically, an indirect payment organization that is temporarily unable to pay for government bond transactions may use loans from a member bank in accordance with a payment support agreement signed between the parties in accordance with the provisions of law. In case the payment support agreement between the two parties stipulates the use of securities as collateral for the loan, the Vietnam Securities Depository shall freeze the securities at the request of the member bank.

Payment member banks and depository members are commercial banks and direct account opening organizations are commercial banks that temporarily lack the ability to pay for government bond transactions and are supported by the State Bank of Vietnam through overdraft and overnight lending operations to make payments for government bond transactions.

Handling of violations against depository members, organizations opening direct accounts, and member banks lacking payment capacity is regulated as follows: Depository members, organizations opening direct accounts, and member banks lacking payment capacity for government bond transactions must apply support mechanisms or have their payment deadlines postponed or their transaction payments eliminated, and will be considered for handling depending on the level of violation. Handling of violations is carried out in accordance with current legal regulations. In particular, depository members must also comply with the regulations of the Vietnam Securities Depository Center.

This Circular takes effect from August 1, 2017.

According to Lan Phuong/chinhphu.vn

| RELATED NEWS |

|---|