Need to increase resources to meet workers' demand for policy loans

(Baonghean.vn) - Currently, the demand for policy loans in Nghe An is very large, especially for workers returning from the southern provinces due to the impact of the pandemic, but the capital provided by the central government is limited, so meeting the loan needs of workers is difficult.

On the morning of October 21, the Provincial Social Policy Bank held its 69th regular meeting of the Board of Directors. Comrade Le Hong Vinh - Member of the Provincial Party Committee, Permanent Vice Chairman of the Provincial People's Committee, Head of the Board of Directors chaired the meeting.

|

| Director of the Provincial People's Credit Fund Tran Khac Hung reports on activities in the third quarter of 2021. Photo: Thu Huyen |

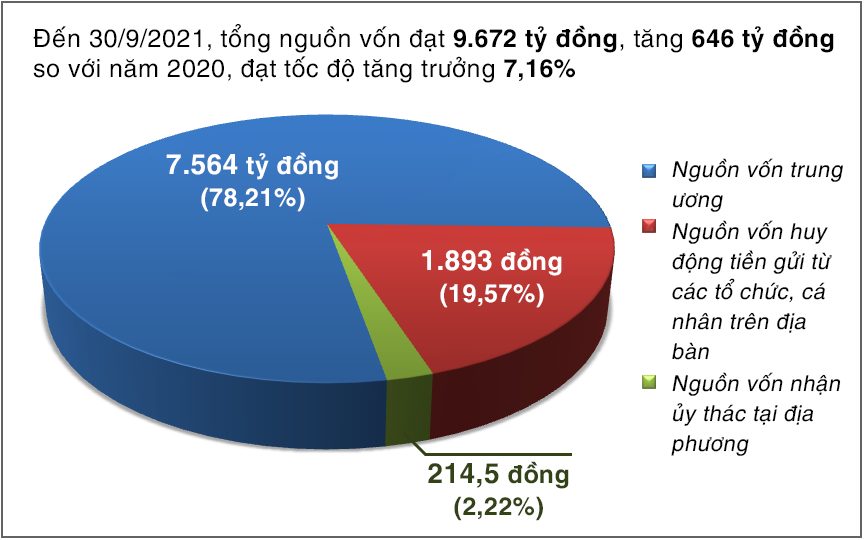

As of September 30, 2021, total capital reached VND 9,672 billion; loan turnover reached VND 2,433 billion, up 3.2% over the same period last year, of which 13/20 credit programs are continuing to provide capital.

Some programs have large loan turnover such as: Loans for newly escaped poor households 636 billion VND, loans for near-poor households 635 billion VND, loans for construction of clean water and environmental sanitation works in rural areas 360 billion VND, loans for production and business households in difficult areas 347 billion VND; loans to support employment 140 billion VND,... The remaining 7/20 programs do not generate turnover due to the end of the implementation period, only managing and collecting debts.

|

| Graphics: Huu Quan |

Implementing Resolution No. 68 of the Government, the Branch has disbursed nearly 3.9 billion VND to 24 enterprises to pay salaries to 854 employees. Restructured debt repayment time for 1,814 customers/45.2 billion VND affected by the Covid-19 pandemic. 673 customers received additional loans torestore production and business, creating jobs for poor households and policy beneficiaries affected by the pandemic with an amount of 30.4 billion VND.

|

| Ms. Nguyen Thi Thu Thu - Director of the State Bank of Vietnam, Nghe An branch, spoke at the meeting. Photo: Thu Huyen |

However, the Covid-19 pandemic broke out and became complicated, at times 21/21 districts, cities and towns in the province had to implement Directives No. 15 and 16 of the Prime Minister, which greatly affected the implementation of policy credit activities in particular. The whole province had to stop many transactions at the commune level, the profit collection results in the third quarter were low, inspection and supervision activities on all channels could not be carried out according to the schedule established by the plan, and the plan completion rate was still low.

The policy credit program to support workers to borrow capital to work abroad cannot be disbursed, workers cannot complete exit procedures.

Concluding remarks at the meeting, Permanent Vice Chairman of the Provincial People's CommitteeLe Hong Vinhacknowledged and highly appreciated the efforts of the Board of Directors at all levels for their responsibility, timely and decisive direction in performing their tasks well, ensuring safe operations, achieving positive results, and contributing significantly to the completion of the province's socio-economic goals in the first 9 months of the year.

|

| Standing Vice Chairman of the Provincial People's Committee Le Hong Vinh spoke at the meeting. Photo: Thu Huyen |

Currently, the demand for loans in Nghe An is very large, especially for workers returning from the southern provinces due to the impact of the pandemic, but the capital provided by the central government is limited, so meeting the workers' loan needs is difficult. Therefore, in the coming time, the Head of the Representative Board assigned members of the Representative Board of the Department of Finance and the Finance Department to advise the People's Committee at the same level to arrange the 2022 budget to entrust the Vietnam Bank for Social Policies to lend to poor households and other policy beneficiaries; resolutely direct to organize and promptly and effectively implement credit policies for lending to employers to pay for work suspension and production recovery wages for workers affected by the pandemic according to Resolution No. 68 of the Government and Decision No. 23 of the Prime Minister.

Flexibly transfer resources, direct quick disbursement of capital for programs, meet the needs of production and social security loans for poor households and policy beneficiaries.

|

| The model of borrowing capital from the Vietnam Bank for Social Policies to develop farm economy has brought high efficiency in Nam Dan district. Photo: Thu Huyen |

Continue to consolidate, improve and enhance the quality of operations of the Savings and Loan Group network; build a network of Savings and Loan Groups and a team of Group Management Boards to ensure the criteria for the Group model when applying digital banking in the coming time./.