Warning about disadvantages when withdrawing social insurance at one time

(Baonghean.vn) - Recently, the number of people withdrawing social insurance at one time has increased in the whole country in general and in Nghe An province in particular. This is not only a disadvantage for the workers themselves but also affects the social security goals of the Party and the State.

Withdraw social insurance once just to solve immediate difficulties

Mr. HKD (Ha Huy Tap ward, Vinh city) said that he is a worker and has participated in compulsory social insurance for more than 10 years. In general, workers' salaries are not high, so the social insurance contribution is also low. Meanwhile, the current family situation is difficult, the one-time social insurance payment will solve some immediate family problems. Mr. D. shared: "After much deliberation, withdrawing social insurance at once is not something he wants, but the situation is too difficult."

Similarly, Ms. NKN in Nghi Thuan commune (Nghi Loc) used to work as a worker at a company in the district and participated in social insurance for 4 years. When the company encountered difficulties, and at the same time, she felt that she was no longer suitable to be a worker, she quit her job. Due to not having a monthly income and facing many difficulties, Ms. N. submitted an application to receive a one-time social insurance payment.

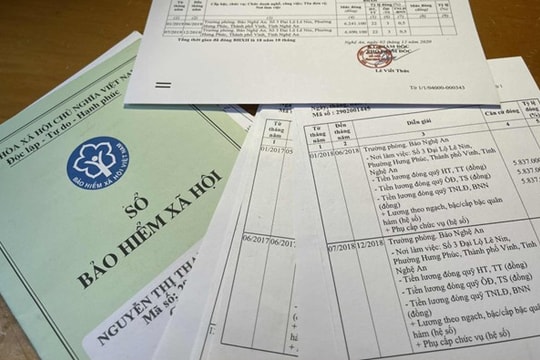

|

| People come to do procedures at the one-stop department of Nghe An Social Insurance. Photo: Dinh Tuyen |

Recently, the number of people requesting one-time social insurance benefits in the province has tended to increase. In 2022, the provincial Social Insurance sector received 19,412 applications for one-time social insurance benefits. In the first 3 months of 2023, this number was 6,585 applications, an increase of 39.8% over the same period in 2022.

According to statistics from Vietnam Social Security, workers receiving one-time social insurance are concentrated in the age group of 20-40 (accounting for 80.9%), of which the largest concentration is in the 20-30 age group (accounting for 42.7%), the 30-40 age group accounts for 38.2%. This shows that workers withdraw one-time social insurance at a young age.

The reason is that the difficult life due to the Covid-19 epidemic has made many workers request to receive social insurance in one lump sum to have some money to spend and cover their living expenses. In addition, a few people, for immediate benefits, want to withdraw social insurance in one lump sum to have some money and hope to find another opportunity. Some workers think that waiting too long to receive their pension. Although they have been carefully advised, workers still request to be resolved in one lump sum.

Loss of many benefits

According to the representative of Nghe An Provincial Social Insurance, the social insurance policy brings benefits to employees that no other savings can compare to. Currently, for employees participating in compulsory social insurance, the contribution to the social insurance fund is equal to 25.5% of the employee's monthly salary, of which the employee contributes 8% and the employer contributes 17.5%. Specifically, if the employee's salary is 5 million VND/month, the monthly contribution to the social insurance fund is 1 million 275 thousand VND. Of which, the employee contributes 400 thousand VND and the employer contributes 875 thousand VND.

When participating in social insurance, employees are entitled to the following benefits: Sickness, maternity, work accidents, occupational diseases, retirement and death. In particular, when meeting the prescribed conditions, employees will enjoy retirement benefits with many long-term benefits. With the social insurance contribution level as in the example above, just calculating the maximum pension that employees receive, equivalent to 3.75 million VND/month, is much larger than the amount that employees have to pay, which is 400 thousand VND/month.

|

| Nghe An Social Insurance officers advise people to participate in Social Insurance and Health Insurance. Photo: Duc Anh |

For self-employed workers, when participating in voluntary social insurance, workers can choose the contribution level that suits their conditions, the lowest being equal to the poverty line in rural areas (currently 1 million 500 thousand VND). Thus, with a monthly contribution rate of 22%, the minimum monthly contribution is 297,000 VND (the State has supported 10%), but the maximum pension rate is up to 75% of the average contribution level.

In addition, pensioners are also granted a free health insurance card during the entire pension period with a benefit rate of 95% for medical examination and treatment. Relatives are entitled to death benefits when the social insurance participant passes away.

When receiving social insurance one time, although the employee will have a sum of money to cover immediate expenses, he will lose the opportunity to enjoy retirement benefits when he reaches retirement age. In addition, the person receiving social insurance one time must accept a huge disadvantage.

First of all, there is the disadvantage in terms of benefits. The amount of money received in one-time social insurance will be much less than the amount of social insurance paid. Specifically, in 1 year, the social insurance payment is equal to 2.64 months of salary, while the employee only receives an amount equivalent to 1.5 months of salary for the years paid before 2014 and 2 months of salary for the years paid from 2014 onwards. Thus, the employee loses 0.64 months of salary for each year of receiving social insurance in one time. If compared with the additional savings to receive pension, the disadvantage is incalculable.

In addition, the period of social insurance payment that has been calculated for one-time social insurance benefits is not included in the time used as a basis for calculating other social insurance benefits. Currently, there are many cases where one-time social insurance benefits are received and people want to pay back the money to restore the number of years of social insurance participation to qualify for pension, but the law on social insurance has not yet regulated this case.

In addition, workers also lose the opportunity to receive monthly pensions when they reach retirement age or if they are eligible, the pension level is low, due to the deduction of the time of social insurance payment received once, leading to having to depend on children or relatives when they are no longer able to work. Not only that, when withdrawing social insurance one time, workers also lose the opportunity to be granted a free health insurance card (with a benefit of 95% of medical examination and treatment costs) during the period of receiving pensions for health care; relatives are not entitled to funeral benefits and death benefits if the person who received social insurance one time unfortunately passes away.

The most effective way to have a peaceful old age, not dependent on children and grandchildren is to have a stable financial source through monthly pension when retired, and be granted a Health Insurance Card to take care of health during the pension period. Therefore, Nghe An Provincial Social Insurance recommends that employees should consider carefully before deciding to receive one-time social insurance.

For workers who are facing economic difficulties, they should receive unemployment insurance and take advantage of the State's support packages. If they no longer participate in businesses or units, they should switch to voluntary social insurance, choose a level of contribution that is suitable for them, and maintain it so that they can receive pensions when they are old.

In the long term, the Social Insurance Law is currently being considered for amendment, which allows 15 years of contributions to be eligible for pension, so workers who are patient for a while longer will receive the results of their social insurance contributions.

.jpg)