Warning: Gold price is over 80 million VND/tael

The world has just experienced unprecedented shocks, but it seems that is not all. Efforts to rescue the economy have unpredictable consequences. Gold prices are predicted to double in the next 18 months.

Unpredictable fluctuations

The gold market has been volatile recently, rising sharply and then falling sharply. At the end of the session on April 22 (Vietnam time), the spot gold price in the Asian market jumped back above the threshold of 1,700 USD/ounce after falling sharply at the end of last week.

The price of gold in the past few months has not followed the usual pattern: when the financial and geopolitical markets are unstable, gold increases, when the USD decreases, gold increases,... but has fluctuated erratically: increasing even when the USD increases, decreasing when the USD decreases, and decreasing when the world stock markets plummet.

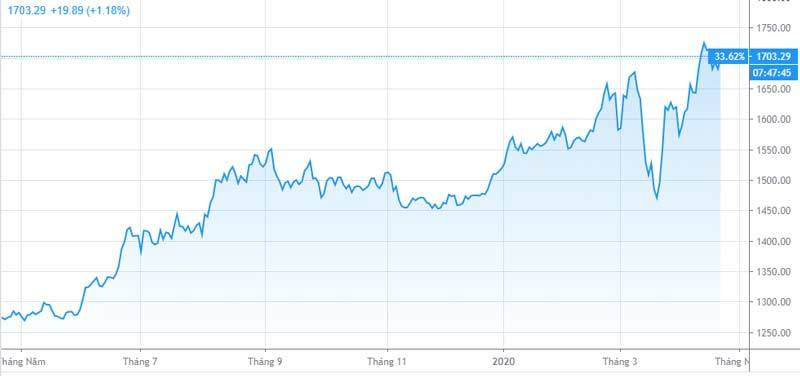

In less than 4 months, the price of gold has fluctuated up and down by hundreds of dollars, from the opening level of 2020 at 1,517 USD/ounce, increasing sharply to 1,680 USD/ounce on March 9, then falling to a bottom of 1,471 USD/ounce on March 19, before soaring to 1,727 USD/ounce on April 14.

Compared to previous years, the fluctuations of world gold prices are very large, often increasing or decreasing by hundreds of dollars in a very short period of time. This shows the unstable psychology of investors and the unpredictable fluctuations in the international market.

|

| Fluctuations in world gold prices over the past year. |

The relationship between gold and oil prices has recently been inconsistent. At the end of the session on April 22, gold prices rose sharply to above $1,700/ounce despite oil prices continuing to fall sharply. Oil prices for June delivery fell from around $20/barrel in the previous session to nearly $11/barrel.

Domestically, the gold market also fluctuated strongly. Domestic gold prices were sometimes 4-5 million VND/tael higher than the converted world gold price, but there were times when domestic prices were lower than the world price, such as one or two sessions in mid-April.

Also around mid-April, the domestic gold price reached a new historical peak: 49.2 million VND/tael, higher than the peak of 49 million VND/tael at the end of 2011.

Over the past few weeks, the domestic gold price has not fluctuated much, hovering around 48 million VND/tael despite the sharp fluctuations in the world gold price. The quietness in the domestic market is due to a series of businesses temporarily closing their business to prevent the Covid-19 epidemic. Some units such as Doji, Bao Tin Minh Chau,... have closed all gold trading locations, including the location at the headquarters.

Despite the continuous increase and decrease, the general trend of world gold prices is still upward. Investors are still pushing to buy gold due to concerns that the epidemic will cause a global economic recession and financial crisis, with central banks everywhere pumping money to support the economy.

|

| Domestic gold price recently hovered around 48 million VND/tael. |

Gold is expected to continue to increase in price, although it will be under pressure to decrease in the short term when the instability is too great and many people want to hold money. Historically, the actual developments show that about 1-2 years after major crises (such as the 2008 or 1997 crisis), the price of gold always increases very strongly.

Gold will go up to 3,000 USD/ounce

According to a forecast recently released by Bank of America, the price of gold will nearly double to a record high of 3,000 USD/ounce (83 million VND/tael) within the next 18 months due to unprecedented monetary easing and money pumping by central banks of many countries, which will cause great pressure on the financial market.

Bank of America's forecast price this time is much higher than the previous forecast of 2,000 USD/ounce and much higher than the record price of gold: 1,921 USD/ounce recorded at the end of 2011.

In its report, the bank said that “the US Federal Reserve (Fed) cannot print gold” and therefore gold prices will continue to rise. Gold prices averaged $1,695 per ounce in 2020 and $2,063 in 2021.

|

| Gold price is forecast to reach 3,000 USD/ounce. |

Previously, a series of forecasts said that gold would increase sharply in the context of the world being flooded with a huge amount of cheap money. Commerzbank predicted that gold would reach 1,800 USD/ounce by the end of 2020 as investors looked for "the last resort".

Refinitiv also forecasts a similar price increase of over $1,850 an ounce this year, arguing that gold has always surged after a crisis due to its role as a safe haven asset during recessions. In the seven recessions in the US since 1969, gold has seen an average gain of about 23%.

Still, the path to higher prices won't be a straight one, Refinitiv said.

A representative of the Sprott Inc. gold fund recently predicted that gold will reach $2,000/ounce even if the world witnesses deflation or inflation after the pandemic because the global economy receives unprecedented stimulus.

Accordingly, if the economy falls into deflation, it is a sign of a major malfunction of the financial system and therefore, holding gold is a top priority. If inflation occurs, holding gold is inevitable.

Like Bank of America, WingCapital Investments said gold will rise to $3,000 an ounce within the next three years. ANZ forecasts gold prices could reach $2,000 an ounce in the second quarter of this year.

Gold prices have risen about 12% since the beginning of the year and are currently hovering around an eight-year high despite low demand due to the pandemic. According to Bank of America, there is still room for gold prices to rise as not much money is flowing into this asset.