Directive 40 creates a boost in policy credit in Nghe An

(Baonghean.vn) - Implementing Directive No. 40-CT/TW dated November 22, 2014 of the Party Central Committee Secretariat, social policy credit activities in Nghe An have had many positive changes. Directive 40 is considered a breakthrough in policy credit in localities.

POSITIVE MOVEMENT

Dien Chau is considered one of the localities that has well implemented Directive 40 on strengthening the leadership and direction of Party committees and authorities at all levels in social policy credit activities.

Every year, the People's Committee of the district and communes and towns have paid attention to allocating budget sources to entrustSocial Policy Bank(NHCSXH) provides loans to poor households and policy beneficiaries, supports funding, facilities, arranges commune transaction points, removes difficulties, creates favorable conditions for banks to operate effectively, and successfully completes assigned tasks. During the district budget year, the commune budget allocated 750 million VND, completing 107% of the 2021 plan.

|

| Mr. Nguyen Van Truong's family in Bac Tien Tien hamlet, Dien Kim commune borrowed 50 million VND from the Employment Program from the local budget. Photo: Thu Huyen |

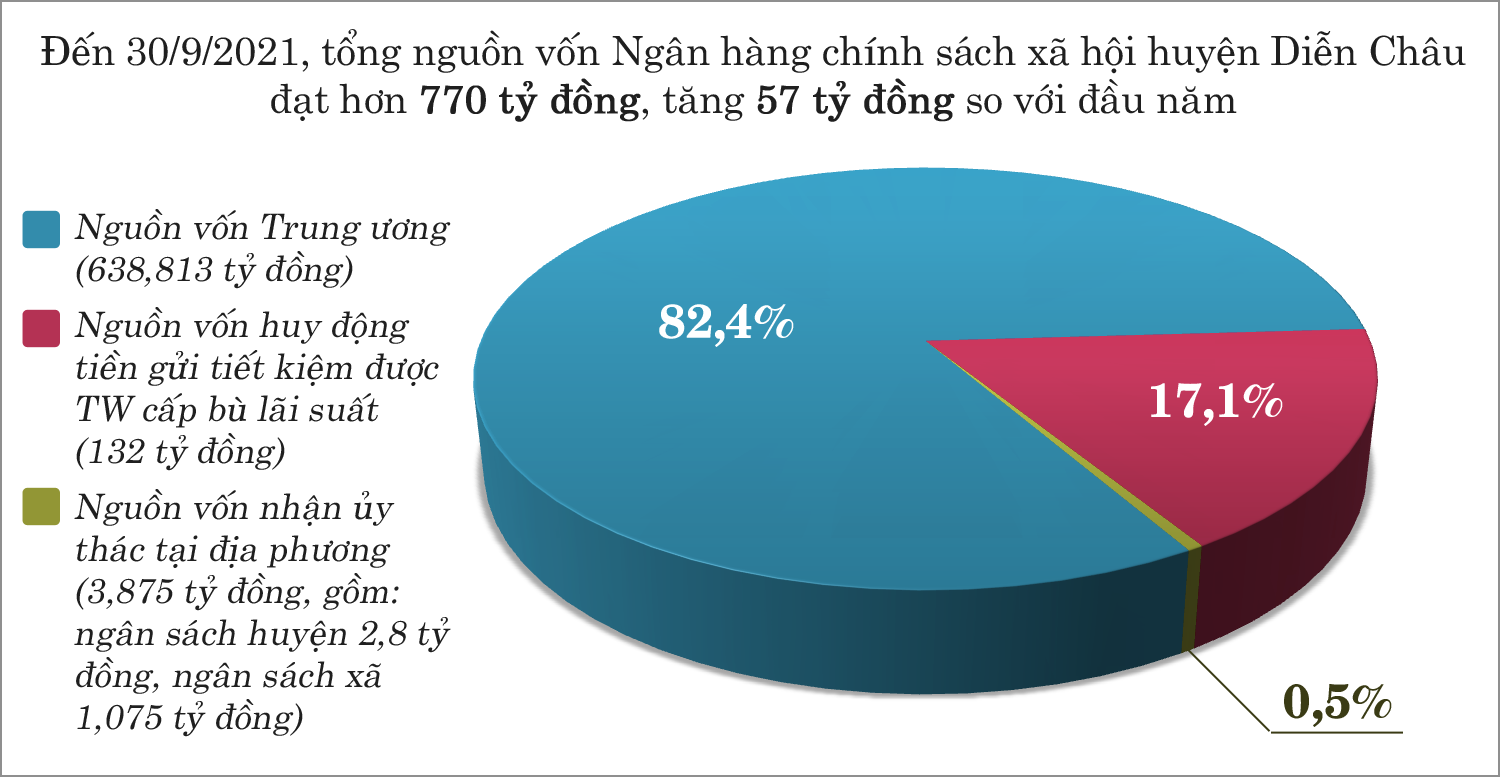

By September 30, 2021, the capital balance from the district budget and the commune budget reached nearly 4 billion VND, contributing significantly to creating a stable capital source for lending to poor households and policy beneficiaries in the district. Some communes have performed well such as: Town, Dien Hong, Dien Thanh, Dien Kim, Dien Nguyen, Dien Hoa...

|

| Graphics: Huu Quan |

Mr. Nguyen Van Tuan - Director of the Social Policy Bank of Dien Chau district said: Along with abundant capital, good debt collection turnover has contributed significantly to creating a stable and proactive revolving loan source in the district, meeting the borrowing needs of poor households and policy beneficiaries in the context of difficulties in capital provided by the central government. Total outstanding debtpolicy creditin the area reached over 732 billion VND.

The loans have helped 9,970 poor households, near-poor households and households that have just escaped poverty have capital to produce and do business, stabilize their lives and gradually escape poverty sustainably. In addition, capital sources serving the goals of social security and new rural construction continue to receive attention, with outstanding loans reaching 275 billion VND.

|

| Representatives of the Bank for Social Policies of Dien Chau district visited the shrimp farming model on sand of Mr. Nguyen Tien Cuong in hamlet 2, Dien Trung, Dien Chau. Photo: Thu Huyen |

Mr. Pham Xuan Sanh - Vice Chairman of the District People's Committee, Head of the Board of Directors of the District Social Policy Bank, said: DeploymentDirective 40and Decision 401 of the Prime Minister, Party committees and authorities at all levels have clearly recognized the role and position of social policy credit in implementing the goals of poverty reduction, job creation, new rural construction and ensuring social security of the locality. In many localities, Party committees and local authorities at all levels have led, directed, inspected and supervised policy credit activities in the area, relevant agencies, departments, and socio-political organizations have actively participated in the activities; policy credit activities have accelerated the socialization process; transparency, publicity, democracy and fairness have been enhanced; capital needs for poor households, near-poor households, newly escaped poverty households and other policy subjects have been basically met; credit quality has been ensured to be stable and sustainable.

In Nam Dan, the capital plan management is always of interest to the District Social Policy Bank Representative Board. Mr. Nguyen Sy Hai - Director of the District Social Policy Bank said: The development of annual credit plans is carried out in accordance with regulations. Every year, the Board of Directors' Representative Board directs the development of plans from villages and hamlets; Advises on timely allocation of new capital sources. For revolving capital sources, the Head of the Board of Directors' Representative Board authorizes the Director of the District Social Policy Bank to make adjustments in accordance with regulations.

|

| Mr. Nguyen Van Hung's livestock farm in Nam Giang commune, Nam Dan borrowed 100 million VND from the program for newly escaped poverty households to invest in effective livestock farming. Photo: Thu Huyen |

Specifically, in terms of mobilizing resources from the local budget, in 2020, 600 million VND was mobilized/plan of 500 million VND (of which NSH 300 million VND, Trung Duc Company 300 million VND), in the first 10 months of 2021, the Transaction Office advised the District People's Committee to allocate the budget for the district to transfer 500 million VND, completing 100% of the assigned plan. By October 31, 2021, the total budget source reached 3,040 billion VND. Capital mobilization achieved good growth.

FOCUS ON DISBURSEMENT TO MEET LOAN NEEDS

After more than 5 years of implementing Directive No. 40, social policy credit activities in the province have achieved many important results. The total policy credit capital reached nearly 9,700 billion VND, of which the resources mobilized from the local budget and organizations and enterprises in the area reached 214 billion VND.

Tens of thousands of policy beneficiaries have received preferential loans to invest in production, create jobs, export labor, renovate and build houses, and students have expenses for studying and building clean water and environmental sanitation works in rural areas. People's lives, especially the poor and policy beneficiaries, have improved significantly, contributing significantly to the implementation of the national target of sustainable poverty reduction and new rural construction. In the first 9 months of 2021, policy credit capital has provided capital to 56,891 poor households and other policy beneficiaries.

|

| Ms. Le Thi Hang's household in loan group 4B, hamlet 13, Nam Giang commune, Nam Dan borrowed 100 million VND from the job creation fund to invest in grocery business. Photo: Thu Huyen |

However, Nghe An is a province with difficulties; budget revenue has not met spending needs, local capital for entrusted lending is limited. In the process of implementing Directive 40, some Party committees and authorities have not paid due attention, have not provided timely leadership and direction, and have not enhanced their role and responsibility in inspecting and supervising the implementation of policy credit. The allocation of district-level budgets to entrust the VBSP to implement lending is still limited, in some places the targets assigned by the Provincial People's Committee have not been met and have not been completed each year. The integration of socio-economic development programs, agricultural, forestry and fishery extension work, transfer and guidance of production techniques, and orientation of product consumption markets with policy credit has not been synchronized...

In order to further improve the effectiveness of policy credit activities to contribute to the socio-economic development process, on August 24, 2021, the Provincial People's Committee issued an official dispatch on the implementation of Conclusion No. 06-KL/TW dated June 10, 2021 of the Party Central Committee Secretariat on continuing to implement Directive 40. Accordingly, the Provincial People's Committee requested the Vietnam Fatherland Front Committee, mass organizations at all levels, provincial departments and branches, People's Committees of districts, cities and towns to perform many tasks, in which policy credit work is identified as one of the key tasks to deploy socio-economic development in the period of 2021-2025, contributing significantly to the successful implementation of the Resolution of the 19th Provincial Party Congress.

|

| Policy Bank staff guide people through loan procedures. Photo: Thu Huyen |

Currently, the demand for loans to create jobs for workers in the province is still very large, especially the labor force returning from the southern provinces due to the impact of the Covid-19 pandemic (estimated at about 80 billion VND), but the capital provided by the central government is very limited (the central government provides this capital in a counterpart method compared to the capital entrusted from the local budget: 50% local budget, 50% central source).

So, tomeet the loan needs of workers, at the recent meeting of the Provincial People's Credit Fund Board of Directors, Vice Chairman of the Provincial People's Committee Le Hong Vinh assigned members of the Provincial People's Committee and the Finance Department to advise the People's Committee at the same level to arrange the 2022 budget source to entrust the Social Policy Fund to lend to poor households and other policy beneficiaries in the area, specifically: Provincial budget of 20 billion VND, district-level budget according to the targets assigned by the Provincial People's Committee.

The representative boards of the Social Policy Bank in the districts focus on allocating capital in a timely manner when there is a notice of capital allocation from the Social Policy Bank to quickly disburse capital for programs, meeting the needs of production and social security loans for poor households and policy beneficiaries. For the district policy bank, take advantage of capital from higher levels, actively and effectively mobilize deposit capital and revolving debt collection capital to focus on disbursing to meet the needs of loans for poor households and other policy beneficiaries, especially loans to restore production after the pandemic.