US-China trade war, Vietnam could become the focus of US attack

Mr. Nguyen Xuan Thanh, Director of Development at Fulbright University Vietnam, said that when the US-China trade war is tense, the big risk is that Chinese goods are labeled as Vietnamese to export to the US to avoid punitive tariffs. If this move is not controlled and prevented, it could also become an excuse for the US to sanction Vietnam.

The trade war between the US and China that broke out in early July is getting tense as on October 9 in the Oval Office of the White House, President Donald Trump said China is not ready to reach a trade agreement with the US. Mr. Trump affirmed that he is always ready to impose new tariffs in case China retaliates.

In addition, Mr. Donald Trump once again reiterated his threat to impose additional tariffs on $267 billion worth of imported goods from China if Beijing continues to retaliate against the tariff barriers he has erected in the escalating trade war between the two countries. This message has investors worried that the US-China trade war will become more tense.

On this issue, Mr. Nguyen Xuan Thanh, Director of Development of Fulbright University Vietnam, had the following discussions:

US-China trade war and opportunities for Vietnamese agricultural products

Sir, the US-China trade war is becoming increasingly tense. As one ofAs a country that imports a lot from China and has a large proportion of exports to the US, how will Vietnam's export turnover be affected in this war?

|

| Mr. Nguyen Xuan Thanh |

First of all, we must talk about the first two tariffs the US imposed on China.

The first round of tariffs was imposed in early July on goods worth $34 billion, a very small proportion compared to the total $505 billion the US imported from China in 2017. A closer look shows that the taxed goods are mainly intermediate goods such as mechanical machinery, electrical and electronic equipment, while consumer goods only account for about 1%. The direct impact on China's export turnover to the US is not much.

Based on US import turnover statistics, among the 818 product lines that China is subject to punitive tariffs this time, similar products exported from Vietnam to the US in 2017 were only worth 1.2 billion USD and in the first 5 months of 2018 were only 545 million USD. Therefore, the opportunity for Vietnamese enterprises to take advantage of increasing exports to the US when Chinese goods are subject to tariffs is insignificant.

Even in the second phase, when the US decided to impose a 25% tax on an additional 16 billion USD worth of imports from China, the products were similar to the first phase, namely intermediate goods and machinery and equipment. The direct impact on export turnover was still small. Statistics show that Vietnam's similar product lines, like the 279 product lines that China was subject to punitive taxes, were only worth about 3.2 billion USD in 2017.

As the US-China trade war continues to escalate, on September 24, 2018, the US government decided to impose an additional 10% tax on $200 billion worth of goods imported from China. According to the list published by the Office of the United States Trade Representative (USTR), the $200 billion worth of Chinese goods subject to a 10% tax include about 5,800 product lines with consumer goods such as furniture, suitcases - handbags, seafood and agricultural products.

Of these, the largest proportion is still electrical and electronic machinery and equipment (24.6%), mechanical machinery and equipment (19.7%). However, many consumer products are also on the list such as furniture (16.7%), chemicals (5.1%), plastic, rubber (5%) and agricultural and aquatic products (2.7%). The impact will therefore be more profound.

Including all three batches, the value of Chinese goods subject to US punitive tariffs is 250 billion USD, nearly 50% of China's total export turnover to the US.

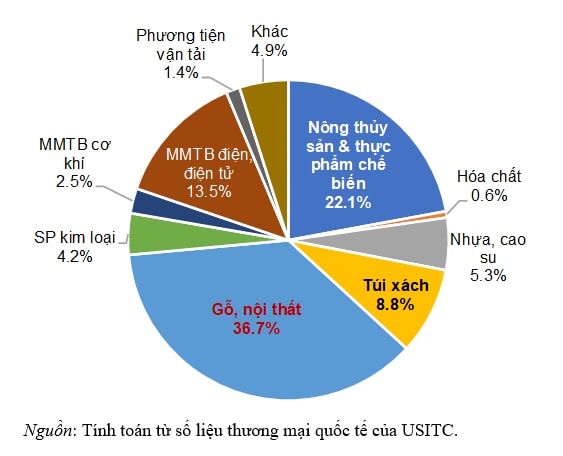

Imported goods into the US from Vietnam (similar to product lines that China is subject to an additional 10% tax rate), 2017 turnover: 13 billion USD

Compared to the 200 billion USD worth of Chinese goods, similar products that Vietnam also exports to the United States are worth about 13 billion USD, of which wooden furniture accounts for 36.7%, suitcases and handbags account for 8.8% and agricultural and aquatic products account for 22.1%. Vietnamese enterprises exporting these products to the United States will benefit; while enterprises producing goods for the domestic market will face stronger competition from imported Chinese goods.

As you mentioned, there will be products that benefit from escalating trade tensions, so are Vietnamese agricultural products among them?

In international trade, agricultural products are always a sensitive group of goods because of their impact on agriculture, farmers and rural areas. In the first and second rounds, agricultural products did not appear in the US's list of punitive tariffs. Of the 200 billion USD worth of Chinese goods that the US imposed an additional 10% tax on in the third round, agricultural products, aquatic products and processed food were only worth 5.3 billion USD, accounting for 2.7%.

However, China retaliated by focusing on US agricultural exports to this country. Soybeans were the agricultural product most affected by China's initial retaliation. Of the approximately $20 billion worth of US agricultural exports to China in 2017, soybeans accounted for $12.7 billion, or 63%.

Other agricultural products include corn, wheat, fresh fruit, nuts and some dairy products. Pork imported from the United States has also been hit by tariffs of over 70% from China.

In the third round, of the $60 billion worth of imports from the United States that China imposed tariffs of 5% to 10%, important agricultural products were cocoa powder and frozen vegetables. Combined, all three rounds mean that almost all US agricultural products exported to China are subject to retaliatory tariffs.

The US administration is now responding by launching a $12 billion aid program for US farmers affected by the trade war. The first $4.7 billion aid package is being disbursed, with $3.6 billion going to soybean farmers.

Goods imported into the United States from Vietnam (similar to product lines that China is subject to an additional 10% tax rate)

For Vietnam, when the third round of punitive tariffs takes effect, agricultural and aquatic products are an important group of products affected. Of the 13 billion USD of all products exported from Vietnam to the United States, similar to Chinese goods subject to a 10% tax, agricultural and aquatic products (including processed products) have a value of 2.9 billion USD, accounting for 22.1%, second only to furniture.

Vietnam could become the focus of US sanctions

So how are export risks perceived, sir?

A major risk is the transshipment of Chinese goods through Vietnam for export to the United States to avoid punitive tariffs. This activity can be simple import and export or more complex, with artificial processing through domestic or FDI enterprises in Vietnam. Transshipment, if not controlled and prevented, can also become an excuse for the United States to sanction Vietnam.

Vietnam currently ranks 5th among the economies with the largest trade surplus with the United States (32 billion USD according to Vietnam Customs calculations, 38 billion USD according to the US side in 2017), only behind China (376 billion USD), EU (151 billion USD), Mexico (71 billion USD) and Japan (69 billion USD). China, EU and Mexico have all been subjected to import tariffs by the US. Japan is also under pressure to negotiate trade with the US or face tariffs on cars from the US.

Vietnam is currently the 7th most open economy in the world (calculated by total import-export turnover of goods/GDP), with total import-export turnover equal to 200% of GDP. If the US imposes punitive tariffs, the impact on the Vietnamese economy will be much more negative than that of the EU, Mexico, Japan or China.

Preparing a solid foundation to prove that Vietnam does not intervene in exchange rates to improve export competitiveness, making adjustments to balance import-export relations and maintaining good diplomatic relations will help Vietnam avoid being attacked by the US protectionist policy.

As you mentioned, Vietnam may fall into the "sanctions" target of the United States, so in that case, how will Vietnam's manufacturing sector be damaged?

Transshipment, that is, Chinese goods exported to Vietnam, then labeled as Vietnamese and exported to the US to avoid taxes, if not controlled, will make Vietnam the focus of US attacks.

Recently, Vietnamese steel but originating from China is an example when the US imposed a tax of up to 450% (including 199.76% anti-dumping tax and 256.44% countervailing tax). Once the US trade agency discovered it, the businesses that were punished were in Vietnam, and not just the businesses but the entire product group. Not only the high tax but also the impact on reputation, and easily put Vietnam in the crosshairs so that the US can take action because Vietnam's trade surplus with the US is also very large.

There will certainly be negative impacts on global and regional production and supply chains. The largest proportion of goods subject to punitive tariffs is mechanical and electrical machinery and equipment, which are commercial activities, value chains, and production networks, with a large proportion belonging to multinational corporations. With a policy of diversifying production, they all have assembly plants in many places, not just concentrated in China.

The impact will not be too negative as these corporations smoothly adjust production activities between their factories globally in the short term. In the medium term, they will also have adjustments to FDI investment in new factories. This may turn out to be a positive factor for Vietnam as FDI flows shift from China to Vietnam.

Exchange rate management according to the crawling mechanism

One of the indirect factors affecting the value of import and export turnover is the exchange rate. So what is your assessment of the exchange rate as well as the exchange rate management policy of the State Bank in the US-China trade war?

In terms of policy management, the State Bank of Vietnam (SBV) still wants to stabilize the exchange rate between the VND and the USD.

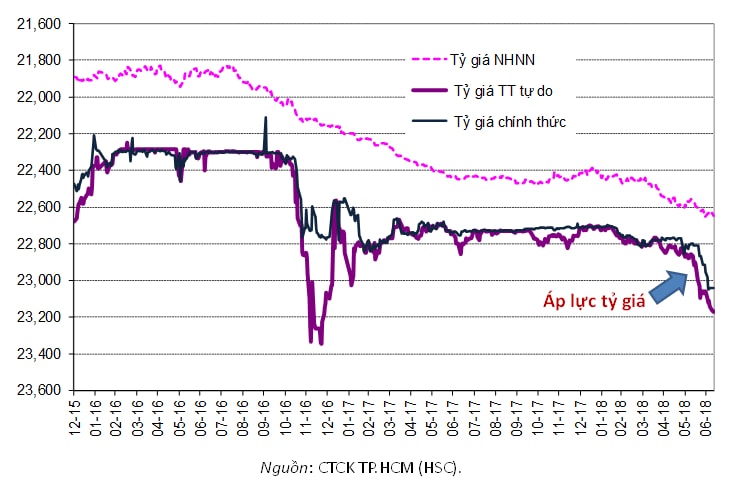

However, in recent times, the official exchange rates of commercial banks have increased in relation to the USD. The gap between the official exchange rate and the free market exchange rate has also appeared. This has occurred in the context of Vietnam's domestic macroeconomic growth figures, as well as information on the currency market, still showing positive and optimistic signs.

In the first 6 months of the year, export growth was high at 16%, the current account surplus reached 8.2 billion USD, foreign direct investment disbursement was 6.7 billion USD, foreign indirect capital inflow was 1.1 billion USD, remittances were 4.8 billion USD. It can be seen that the USD/VND exchange rate is affected by developments in the world and in the region, specifically the US-China trade war and the devaluation of the CNY.

Of course, with the current reserves of over 63 billion USD, the State Bank can completely intervene strongly to stabilize the exchange rate. But if it is too rigid and the trade war continues to escalate, when it is forced to adjust, the adjustment will be large and cause disruption in the market. It can be understood that the State Bank's recent move to adjust the USD/VND exchange rate is based on market signals and external influences.

VND/USD exchange rate fluctuations

Exchange rate policy should be directed towards not allowing VND to appreciate or depreciate too much compared to the average of 8 currencies which are important economic partners of Vietnam (USD, EUR, Chinese Yuan, Japanese Yen, Korean Won, Taiwanese Dollar, Singapore Dollar and Thai Baht).

As of the end of August 2018, compared to this basket of 8 currencies, VND has only appreciated 0.76% since the beginning of the year and 4.02% since March 31.

Thank you!