Vietcombank ATM cardholder lost money at midnight

While still keeping the ATM card of the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) in his bag, a customer continuously received text messages notifying him of cash withdrawal transactions.

Keeping ATM card at home still gets money withdrawn at midnight

The victim of the above incident was Ms. PTPU (31 years old, residing in Binh Tan District, Ho Chi Minh City). Reporting to Infonet, Ms. U. said that she was the owner of account 0251002675XXX opened at Vietcombank Binh Tay branch, District 6.

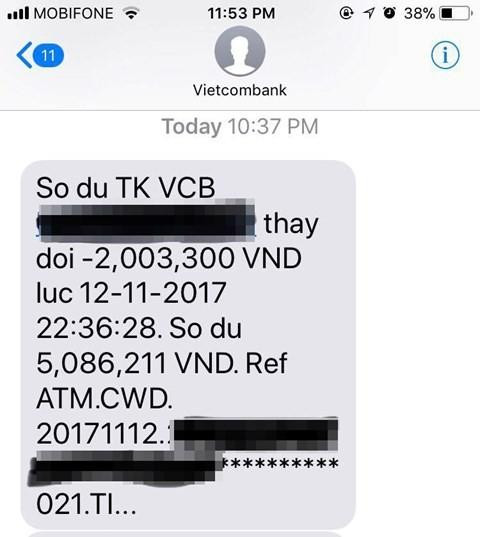

At around 10pm on November 12, Ms. U. was at home when she suddenly received 4 consecutive text messages notifying her of ATM card withdrawals. The total amount withdrawn was 7 million VND (3 withdrawals of 2 million VND and 1 withdrawal of 1 million VND).

Meanwhile, Ms. U. confirmed that her Vietcombank ATM card was still in her bag and at home. Immediately after that, Ms. U. called Vietcombank's hotline to report the incident and requested to block the card and IBanking service.

|

| 1 of 4 messages notifying Ms. U. of her ATM card withdrawal transaction on the night of November 12. |

On the morning of November 13, Ms. U. went to the place where she opened her card, Vietcombank Binh Tay branch, to report the incident. Here, the bank staff informed Ms. U. that there had been 4 withdrawal transactions with her Vietcombank ATM card information made from the ATM of another bank in Ho Chi Minh City last night.

According to Ms. U, Vietcombank staff said they would send a document to the card department of the bank that owns the ATM to retrieve images from the camera at the ATM to identify the person who made the transaction. The time to resolve the case, according to this staff, is within 1 month.

“The amount of money lost was not much, but the way the VCB staff responded made me uneasy. I wondered if the person who stole my money was masked or the camera could not identify who it was, then the staff would say the bank could not prove it,” said Ms. U.

Ms. U. also said that the stolen Vietcombank ATM card was often used by her to withdraw money from ATMs, make online payments via IBanking, and sometimes pay at stores via POS machines.

Mr. Le Tien Hung, Deputy Head of Vietcombank's Public Relations Department, said he was not aware of the incident yet. The bank will wait for a detailed report from the customer feedback department and from there will have a satisfactory solution.

How to prevent information theft?

Recently, it is not uncommon for customers using bank cards to report lost money even though they still keep the card with them and do not make transactions.

An expert in the field of information technology said that people's current habit of using bank cards, both ATM cards and credit cards, makes it easy for bad guys to steal information. Through the cases of money being stolen as mentioned above, card users need to equip themselves with some basic knowledge when making transactions.

According to this person, for credit cards, after receiving the card from the bank, the cardholder should remember the CVV number (3 numbers on the back of the card) and then cover it with tape or erase it. This way, bad guys can avoid copying the card number.

|

| It is no longer uncommon for customers using bank cards to report lost money even though they still keep the card and do not make transactions. |

As for ATM cards, this expert believes that lack of vigilance when withdrawing money at ATMs or paying by POS machine is the main reason why card information is stolen by criminals.

Accordingly, when withdrawing money at an ATM, card users need to observe whether the card reader slot on the machine has any other strange reading devices or whether the keyboard where the PIN code is entered has a hidden camera. If you want to be more careful, when entering the PIN code, users need to cover it with their hand or make a fake gesture when entering the code.

When paying via POS machines at stores, users should pay attention to see if their card has been swiped through any other skimming device before going through the POS machine. Even pay attention to whether the POS machine has any attached devices. When entering the PIN code, users should also cover their hands to avoid being secretly recorded.

According to Phuong Anh Linh/Infonet

| RELATED NEWS |

|---|