Stocks struggle at the bottom in a week full of expectations for the real estate market.

The stock market last week received a lot of supportive information such as some banks lowering interest rates, Decree 65 amendment on bond issuance being considered for approval, conference to remove difficulties for real estate... but the VN-Index only recovered slightly.

The focus is on real estate conferences.

The focus of attention of stock investors in the week of February 13-17 is the national online conference to remove obstacles and promote the healthy and sustainable development of the real estate market on February 17, chaired by Prime Minister Pham Minh Chinh.

Many investors expect the results of the conference to boost real estate stocks, thereby positively impacting stocks in other sectors.

Despite recovering in the last 3 sessions of the week, the sharp decline at the beginning of the week still caused real estate stocks to continue to have a week of decline. Vinhomes (VHM) shares of billionaire Pham Nhat Vuong decreased by 4.6%; Novaland (NVL) of Mr. Bui Thanh Nhon decreased by 15.3%; Phat Dat Real Estate (PDR) decreased by 9.1% and Dat Xanh (DXG) decreased by 3.9%...

|

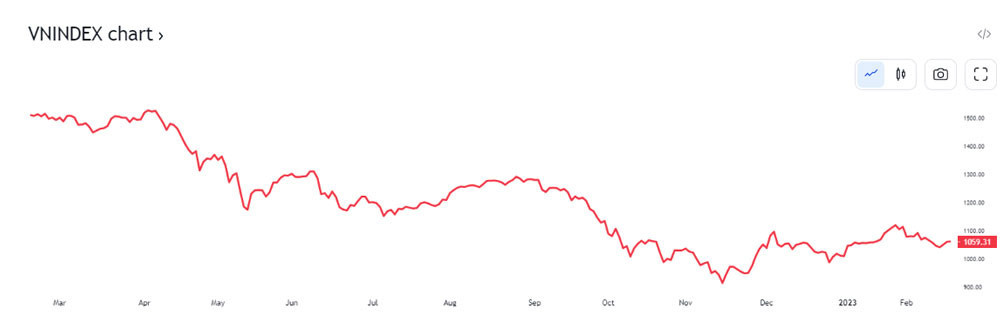

VN-Index still hovers around the bottom. Source: TV |

In the general market, the first two sessions of the week were under strong downward pressure, causing the VN-Index to hit a low of 1,031.7 points - the lowest level since the beginning of the year.

In the middle of the week, the stock market received some supportive information such as some commercial banks proactively lowering deposit and lending interest rates, Decree 65 amendment on corporate bond issuance being considered for approval... which triggered bottom-fishing cash flow and helped the market reverse and increase points in the last 3 sessions of the week, bringing the VN-Index to recover slightly by 0.4% compared to the previous week to 1,059.3 points, after 2 consecutive weeks of adjustment.

However, the overall situation remains quite bleak.

Liquidity on the three floors decreased by 9.5% to VND9,999 billion/session. Foreign investors officially net sold VND471 billion on the HOSE floor after continuously net buying in previous weeks.

Warming up with 2 large credit packages, expecting interest rate reduction

Although the policy signals are clear, real estate businesses must solve their own difficulties, but at the end of the session on February 17, some real estate stocks changed from decreasing to increasing slightly. Many investors expect interest rates to decrease, the revised Decree 65 will be passed and two large credit packages can support the real estate market to be less gloomy.

At the real estate conference on the morning of February 17, the Ministry of Construction proposed a VND110,000 billion package for social housing and worker housing.

Meanwhile, State Bank Governor Nguyen Thi Hong announced a VND120,000 billion credit package for the real estate sector (with interest rates 1.5-2% lower than the average interest rates of banks). During the implementation process, if participating banks experience liquidity shortages, the State Bank is ready to refinance for further implementation.

This is considered a source of capital to restore the real estate market.

The State Bank is also operating and regulating currency, directing credit institutions to reduce operating costs to try to reduce interest rates.

Regarding interest rates, Mr. Huynh Minh Tuan - founder of FIDT JSC said that reducing deposit and lending interest rates in the near future is feasible.

The consensus of the group of 4 largest banks (accounting for 45% of outstanding credit in the entire economy) will likely pull interest rates down.

The State Bank also injected a large amount of money through USD purchases to supplement foreign exchange reserves, thereby supporting liquidity and increasing money supply for the system.

Assessing the stock market outlook next week, Mr. Dinh Quang Hinh - Head of Macro and Market Strategy Department of VnDirect said that the cash flow in the stock market is generally still weak, reflected in low market liquidity. The market will face challenges next week when the VN-Index approaches the resistance zone of 1,065-1,080 points.

If it fails to overcome the above resistance with improved liquidity, the VN-Index will likely correct again and test the short-term bottom zone of 1,035-1,040 points once again before determining a clearer trend.