Strange story of Agribank: Suddenly "a lump of money falls on your head" is real

The case of customers losing money in their accounts is not uncommon at many banks, but the case of a woman in Hanoi suddenly being informed by the bank that her account had increased by tens of millions of dong is real, even though she did not open an account at Agribank.

That was the case of Ms. BHD (Cau Giay, Hanoi) when on November 6, she received a series of messages from the Bank for Agriculture and Rural Development (Agribank), including a message informing her that her account balance had increased by 50 million VND.

It is worth mentioning that Ms. BHD has never opened an account at Agribank, and the phone number she is using is the one she has owned for nearly 20 years.

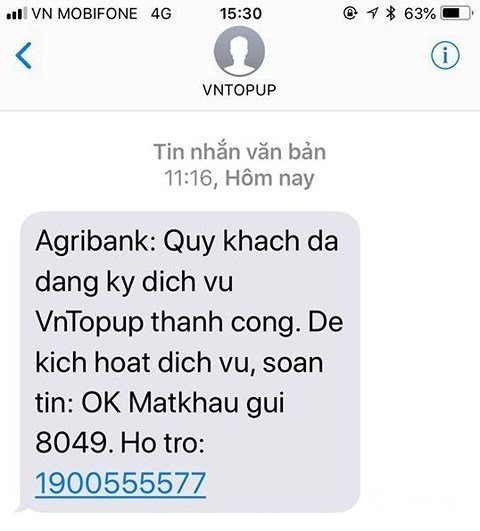

One of the messages sent to her phone came from the VnTopup switchboard (a service to top up prepaid and postpaid mobile phone accounts via SMS from mobile phones or via Mobile Banking, the amount is deducted directly from the customer's personal account at Agribank) with the content: "Agribank: You have successfully registered for the VnTopup service. To activate the service, text: OK Matkhau to 8049. Support: 1900555577".

|

| A message notifying of successful activation of VnTopup service was sent to Ms. D's phone. |

“When I suddenly received this message, I was skeptical, but I was even more surprised when a few hours later I received a message from Agribank informing me that my account had increased by 50 million VND sent by an individual,” said Ms. BHD.

According to the information displayed on the screen, this message did not come from the VnTopup switchboard but from Agribank itself with the content that account 150605378… increased by 50 million VND. The content of the money transfer was from an individual named NTAT depositing money.

“I confirm that I have never opened an account at Agribank, and my phone number has not changed for nearly 20 years. Is it possible that someone stole my personal information to open an account? Will I receive a message at some point saying that I owe the bank money?”, Ms. BHD expressed concern.

Ms. Vu Pham Thao Ly, in charge of communications at Agribank, after checking, confirmed that the above account number belonged to a customer opened at Agribank Tay Ho branch (Hanoi), the hotline number for texting also belongs to Agribank, and the text message notifying the balance was also sent to the customer by Agribank.

However, Ms. Ly affirmed that it is impossible for someone to steal personal information or borrow someone else's name to open a bank account, because in addition to a phone number, customers must also present their ID card to open an account.

“No one can steal information or borrow someone else's name to open an account because you still need an ID card.

|

| A series of messages from Agribank were sent to Ms. D's phone, including a message informing that her account balance had increased by 50 million VND. |

In this case, it is possible that the customer is the cardholder who registered the wrong phone number with the bank, or the bank employee misread the customer's phone number, so it accidentally matched Ms. BHD's phone number.

We have contacted Ms. D to apologize and requested Agribank Tay Ho Branch to remove that phone number from the system," said Ms. Vu Pham Thao Ly.

According to a survey by the auditing firm EY, responding to cybersecurity issues became the top priority for large global banks (89%) in 2018, instead of being more concerned with reputational and cultural risk management as in 2017.

In Vietnam, although banks have made many efforts to ensure information security as well as invest in solutions and tools to detect and prevent risks and losses in electronic payments. However, there are still complaints from customers about issues related to unusual transactions that customers did not directly perform, leading to loss of money in the account.