Stocks to watch on April 22: Prioritize ACB, HPG, HDG, MBB and VCI

Stocks to watch on April 22 include ACB, HPG, MBB, HDG, VCI... with good recovery potential thanks to accumulated price base and improved cash flow.

Agriseco Securities Company (AGR):

Agriseco recommends a list of potential stocks in the last week of April 2025, with the common point being that they are all in a narrow accumulation zone and have short-term recovery potential.

- ACB: After a strong fluctuation, the stock is consolidating tightly around the price range of 24,000 VND/share. Cash flow is still present and shows no signs of withdrawal. Recommended buying range: below 24,000 VND, expected return of 9-10%, cut loss of 5%.

- HPG: Accumulating near the 20-day MA and showing signs of surpassing the 20-hour MA. Recommended to buy below 25,000 VND/share, target recovery to the 200-day MA, expected profit 9-10%.

- HDG: Recovering from short-term bottom with improved liquidity and MACD divergence supporting price increase. Recommended to buy below 23,000 VND, expect to recover to 26,000 VND, profit 8-15%, cut loss 5%.

- MBB: Exceed MA200 and accumulate at the price range of 23,000 VND/share. Expected to continue increasing if liquidity improves. Target price: 26,000 VND/share, expected profit 12%, cut loss 5%.

- VCI: After the correction, the stock maintained the MA20 and MA50 support zones. Recommended to buy below VND 36,500, target VND 40,000, expected profit of 10%, cut loss of 5%.

Vietcombank Securities Company (VCBS):

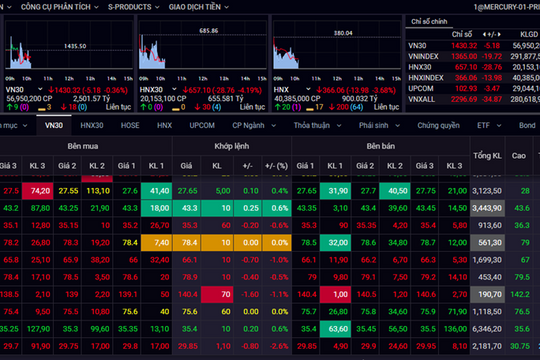

VCBS assesses that VN-Index is testing the 1,200-1,220 point range. Cash flow is forecast to continue to differentiate according to business results in the first quarter of 2025.

VCBS recommends:

- Investors shouldTake profits on stocks under strong selling pressure.

- Portfolio structure toStocks with signals to attract cash flow and strengthen price foundationsin recent sessions.

- Pay special attention to the group with positive prospects thanks to good business results.

Dragon Capital Securities Company (VDSC):

Rong Viet believes that although the market is supported at the 1,200 point level, the recovery effort is still weak. Investors need to closely monitor the supply and demand of each code.

- RecommendationsTake advantage of the recovery to take profits or restructure the portfolio, avoid holding large proportions in stocks with unclear trends.

Market context on April 21:

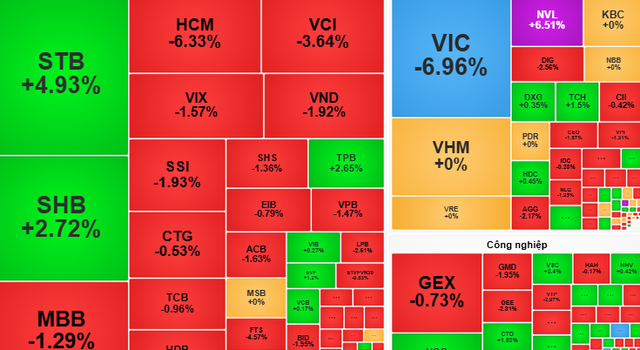

VN-Index ended the session down more than 12 points, closing at 1,207 points. Although red dominated, cash flow still appeared in some individual stocks such asSTB, FRT, REEwith an increase of 3-5%. In particular, STB increased strongly thanks to dividend expectations, showing thatStocks with separate supporting information still attract cash flowmid-adjustment phase

Summary:

The trading session on April 22 is expected to continue to present opportunities for surfing in stocks with good accumulation price bases, improved liquidity and positive business prospects. Investors should closely follow recommendations from securities companies and prioritize a reasonably structured portfolio during the period when the market has not yet established a clear trend.