The "earthquake" caused billionaire Pham Nhat Vuong to lose $1.1 billion.

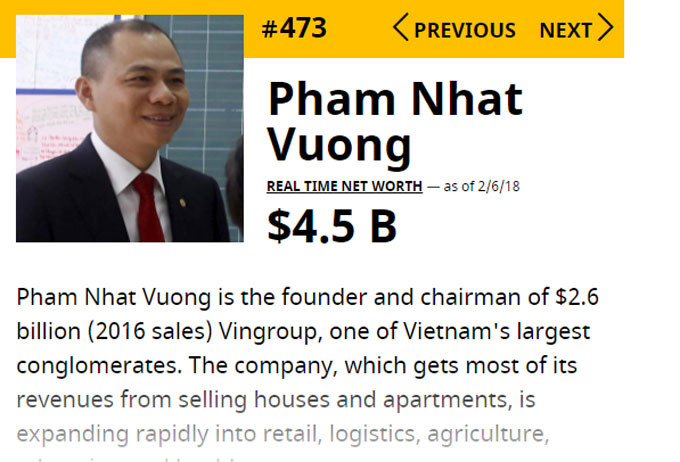

Billionaire Pham Nhat Vuong saw his fortune evaporate by $1.1 billion in a short period due to the stock market crash that swept from the US to Asia. However, Mr. Vuong still remains among the top 500 richest people and holds the number one position in Vietnam.

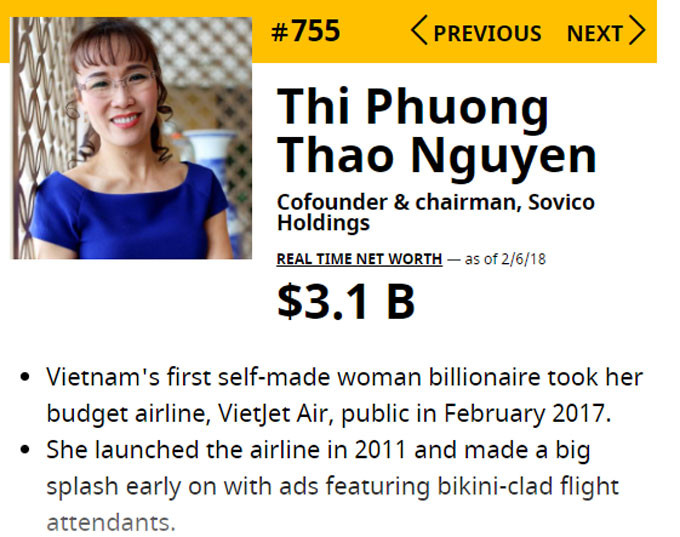

The gap between billionaire Nguyen Thi Phuong Thao and Pham Nhat Vuong narrowed quite quickly because the total assets of the only female billionaire in Southeast Asia did not decrease significantly during the recent "bloody" economic earthquake.

The trading session on February 6th continued to be a dark day for the Vietnamese stock market. After a 53-point drop, the VN-Index at one point fell by more than 63 points before closing down 37 points.

|

A series of stocks continued to hit their lower limit. Some stocks contributed to narrowing the losses in the market, such as Vingroup (VIC) of Mr. Pham Nhat Vuong, Hoa Phat (HPG) of billionaire Tran Dinh Long, Masan (MSN) of billionaire Nguyen Dang Quang… HPG increased by 1.8%, MSN increased by 1.5%, NVL increased by 0.2%, while VIC remained at its reference price.

After two panic-ridden trading sessions, the market capitalization of the Vietnamese stock market has evaporated by approximately $14 billion. According to Forbes' calculations, Mr. Pham Nhat Vuong alone lost about $1-1.1 billion, bringing his net worth down to $4.5 billion. Ms. Nguyen Thi Phuong Thao lost approximately $200 million, bringing her net worth down to $3.1 billion.

Thus, the gap between Ms. Thao and Mr. Vuong has narrowed considerably. Mr. Vuong remains the richest USD billionaire in Vietnam, while Ms. Phuong Thao is the only female billionaire in Southeast Asia.

Due to the rapid depletion of his assets, Mr. Vuong's ranking on the list of the world's richest people has plummeted from around 370 to 473. Ms. Nguyen Thi Phuong Thao has dropped from 728th place at the end of January to 755th currently.

Despite the rapid decline in assets, Vingroup (VIC) shares, owned by Mr. Pham Nhat Vuong, only experienced one consecutive day of limit-down trading and were among the rare stocks that remained stable during the dark trading session on February 6th. Vincom Retail (VRE) shares, also owned by Mr. Vuong, fell to limit-down trading for two consecutive days but saw massive trading volume. The value of these shares traded on the exchange on February 6th exceeded 450 billion VND. Foreign investors purchased 94 million shares through block trades during that session, worth 4,500 billion VND.

|

Vincom Retail Joint Stock Company (VRE) shares caused a stir even before their IPO, and after going public, they demonstrated their strength with a 54% increase compared to the initial offering price within two weeks. This is one of the rare companies on the stock market to have surpassed a market capitalization of 100,000 billion VND.

VRE is highly anticipated due to its position as a subsidiary managing and operating shopping malls within the Vingroup conglomerate, owning and operating the largest and fastest-growing shopping mall system in Vietnam.

VIC shares are also one of the rare stocks with a market capitalization exceeding $10 billion on the Vietnamese stock market (second only to Vinamilk).

Despite sharp declines over the past two sessions, the Vietnamese stock market is still attracting a very strong influx of capital. During the red session on February 6th, the total trading value surged to nearly 17,000 billion VND, an unprecedented record.

The Vietnamese stock market is currently experiencing unprecedented activity. After more than a year of almost continuous gains, the market is at its highest level in over 10 years. Profit-taking pressure could, as is often the case, pull the market down.

According to assessments from many securities companies, selling pressure will ease in the coming sessions, and the market may soon recover thanks to bargain hunting driven by the confidence of large domestic and foreign investors in the long-term prospects of the market and the economy.

SHS forecasts that, in the trading session on February 7th, increased buying pressure at the bottom could help the VN-Index recover and aim to fill the gap created between the February 5th and 6th sessions in the range of 1,026-1,048 points.

SSI Retail Research believes the market may continue to fall sharply in the next session, and the VN-Index may retest the 1030-1035 point range. At the same time, according to short-term technical indicators, SSI Retail Research assesses that a short-term rebound may occur if the VN-Index falls back to the above price range.

At the close of trading on February 6th, the VN-Index fell 37.11 points to 1,011.6 points; the HNX-Index fell 3.31 points to 115.64 points; and the Upcom-Index fell 1.98 points to 54.95 points. Trading volume reached nearly 620 million shares, with a value of 17 trillion VND, higher than the average of around 4.8 trillion VND during the active trading weeks of June and July.