Former General Director of Dong A Bank accused of causing losses of more than 5,500 billion VND

Mr. Tran Phuong Binh - former General Director of Dong A Bank (DAB) was accused of causing losses of more than 5,500 billion VND in the fourth case of legal trouble.

Mr. Binh, 64 years old, was proposed by the Ministry of Public Security's Investigation Police Agency (C03) to be prosecuted for the crime.Violation of regulations on banking activities and other activities related to banking activities,according to Article 206 of the Penal Code, January 6.

This is the fourth case involving Mr. Binh. In the three previous cases (all related to violations leading to loss of DAB's money), Mr. Binh is serving a combined sentence oflife imprisonment.

7 people were identified as accomplices with Mr. Binh in this case, prosecuted for the same crime: Nguyen Duc Tai (former Director of DAB Transaction Office), Nguyen Thi Ngoc Van (former Deputy General Director of DAB), Vu Thi Thanh Hoa (former Head of DAB Corporate Customer Credit Department), Nguyen Van Thuan (former Deputy Director of DAB Transaction Office), Phung Ngoc Khanh (former Chairman and General Director of M&C Joint Stock Company), Chau Thi An Binh (former Deputy Director of Product and Service Department, DAB Headquarters).

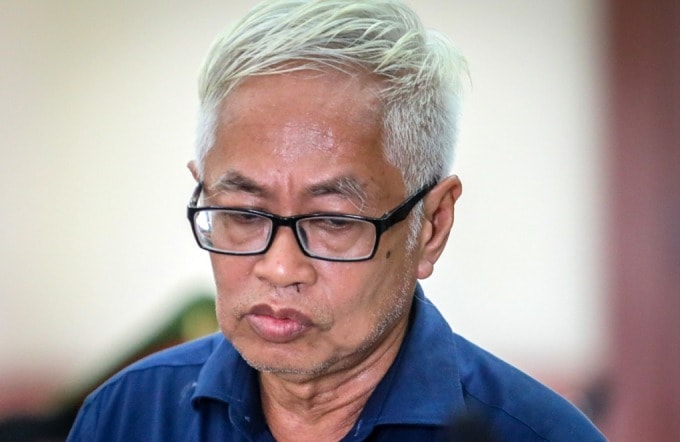

|

| Mr. Tran Phuong Binh in court in mid-2020. Photo:Quynh Tran |

According to the conclusion, Mr. Binh held the position of General Director of DAB for 17 years (1998-2015). In the last four months of 2012, under the organization and direction of Mr. Binh, DAB Transaction Office lent 5 loans to 5 companies: Ngoi Sao, Lien Phat, Phat Van Hung, Bien Bac and Minh Quan, totaling 1,680 billion VND.

The common collateral for the above 5 loans is a part of the land use rights, an area of more than 62,000 m2 belonging to the 7.6 ha project in An Phu ward, District 2, Ho Chi Minh City, worth 2,100 billion VND.

According to the authorities, the loans of the above companies were not used for the right purpose but mainly used to pay debts or transferred to some other units. To date, 5 companies have stopped operating, leading to the inability to repay DAB more than 5,500 billion VND, of which nearly 3,700 billion VND is interest. The assets mortgaged for these loans were valued at only nearly 185 billion VND at the time of prosecution (May 24, 2022).

The investigation agency assessed that the actions of Mr. Binh and his accomplices were one of the reasons why DAB had an accumulated loss of more than 31,000 billion VND at the end of 2015, negative equity of more than 25,000 billion VND and total real assets of only 47,000 billion VND.

Mr. Binh stated that in 2008, the General Director of M&C Company was in great financial difficulty and did not have the money to pay the principal and interest on the loans due. In order for DAB to avoid a high overdue debt ratio, Mr. Binh requested the General Director of M&C to continue borrowing to have money to pay the principal and interest on the loans due.

Mr. Binh admitted that, in his role as General Director of DAB, he had committed illegal acts in agreeing with M&C on borrowing money for the wrong purpose. Furthermore, Mr. Binh also directed his subordinates to prepare and sign loan documents and directly approved credit for companies in the M&C group.

C03 concluded that the actions of the 8 defendants caused damage to DAB of more than 5,500 billion VND.