Thai, Korean, Japanese tycoons: A bustling race in Vietnam

A series of famous retailers from Japan, Thailand, Korea and France have flocked to Vietnam, hoping to quickly capture a large part of the lucrative pie. The whirlwind of penetration by foreign retail giants has made competition in the Vietnamese retail market increasingly fierce.

Flooding into Vietnam

In late 2014, Berli Jucker Plc (BJC) acquired Metro Cash & Carry Vietnam for 655 million Euros - the largest merger and acquisition deal at that time - signaled the entry into the Vietnamese retail market from Thailand. Shortly after, another giant from Thailand, Central Group, also acquired Nguyen Kim - one of the largest electronics retailers in Vietnam, followed by Big C.

In October 2015, leading retailer Emart (Korea) also officially entered the North Saigon area when launching a $60 million shopping center. "Compatriot", Lotte Mart has been quite successful here with 11 supermarkets and expects to increase its market share with 60 stores by 2020.

|

| Retailers compete to expand their sales networks. |

Most Japanese investors see Aeon’s success in Vietnam as a positive sign. Aeon has opened four shopping malls in Vietnam and has ambitions to increase this number to 20 by 2020. Also from the land of cherry blossoms, Saigon Centre in Ho Chi Minh City welcomed its anchor tenant, Takashimaya, last July.

Launching three more Simply Mart stores in Ho Chi Minh City, AuchanSuper - a retail brand from France - also plans to launch 17 more supermarket chains by the end of next year in Ho Chi Minh City and 20 stores by 2020 in the northern provinces.

Major fashion brands such as Gap, Mango, and Topshop have become the top choices of young Vietnamese people. In early September this year, Zara opened its first flagship store in Ho Chi Minh City. H&M is also completing procedures to enter Vietnam early next year.

Vietnam's retail market is like a lucrative cake. Ms. Trang Le, Head of Market Research and Development Consulting, JLL Vietnam, commented that increasing disposable income, urbanization rate and increasingly high living standards make Vietnam one of the most dynamic emerging economies in Southeast Asia.

According to Boston Consulting Group, the middle and upper class in Vietnam is growing the fastest in the region, doubling in number from 12 million (2014) to 33 million (2020), with an income of over 15 million VND/month. These are potential customers for retailers.

In addition, e-commerce has exploded thanks to the increase in the number of consumers using the online network. According to a Nielsen report, 9/10 consumers in Vietnam (91%) own smartphones, compared to 82% in 2014 and the rapid rise of connected devices, especially smartphones and tablets, are particularly important factors in the trend of shifting demand for goods consumption online.

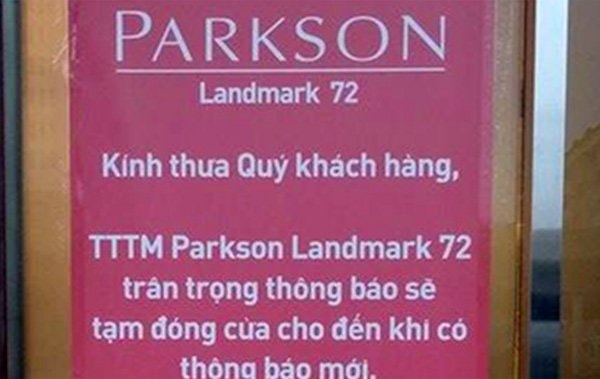

However, not all shopping malls or modern retail stores are equally successful. Metro and Big C have changed owners despite having been operating in Vietnam for many years. Parkson had to suddenly close its high-end shopping mall in Keangnam and recently a shopping mall in Ho Chi Minh City.

The domestic and foreign competition

Domestic retailers, typically Vingroup and Coop.Mart, are also actively expanding their business operations to maintain their domestic retail market share. In this race for market share, many people are worried about the "weakness" of domestic investors in the face of the increasingly rapid penetration of foreign giants.

|

| Parkson had to close due to years of losses. |

Mr. Vo Hoang Anh, Marketing Director of Saigon Co.op, believes that domestic enterprises need to be more proactive and serious in building and adjusting strategies to adapt. This enterprise is promoting its brand and retail store network, having close relationships with customers, manufacturers and service providers.

Economist Nguyen Minh Phong commented that the Vietnamese retail market is no longer a playground for domestic enterprises but has become an attractive "land" for foreign retail "giants", especially multinational corporations. To be able to win, it is not only about price and quality but also about good service attitude and after-sales service.

According to Ms. Nguyen Ngoc Tram, JLL Vietnam, the concern is inevitable because modern consumers have smart shopping habits, quality and diverse designs will be the priority criteria for selection, and these two criteria are completely advantages of foreign retailers, while this is a limitation of many domestic retailers.

Ms. Tram believes that retailers still have many opportunities to promote their competitiveness, but they need to seriously consider their strengths and weaknesses to come up with the most appropriate business strategy.

Domestic retailers have the advantage of understanding regional culture as well as Vietnamese consumer habits better than foreign retailers, so they should focus on promoting this advantage.

According to the planning for the development of supermarket and commercial center networks of the Ministry of Industry and Trade until 2020 and vision to 2030, the proportion of retail sales of goods through supermarket and commercial center networks by 2015 will account for only 30% and reach 45% by 2020.

“Development opportunities still exist for all domestic retailers, it is just a matter of the ability to grasp and take advantage of the opportunities,” Ms. Tram commented.

According to Vietnamnet

| RELATED NEWS |

|---|