ESG Investing: The world is boiling, how much do Vietnamese investors understand?

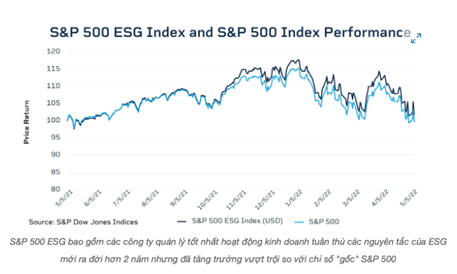

(Baonghean.vn) - In January, Bloomberg Intelligence predicted that global ESG assets could surpass $41 trillion this year and reach $50 trillion by 2025. Much of this growth has occurred in the US, with an increase of 40% over the past two years. The S&P 500 ESG Index (which includes S&P 500 companies that adhere to the best ESG principles) has also outperformed the S&P 500 in recent months, demonstrating the importance of this index in meeting the needs of global investors.

What is ESG that global investors are excited to invest in?

ESG is an acronym for E-Environmental; S-Social and G-Governance, a set of standards to measure factors related to sustainable development and the impact of businesses on the community. The higher the ESG score of a business, the better its ESG practice capacity.

In fact, the term ESG has been around for a long time, but investing in ESG-compliant businesses has always received mixed opinions over the years. Economic benefits are weighed against environmental - social - governance benefits, making investing in ESG - a value investment standard not highly valued in the past. It was not until the Covid-19 pandemic broke out at the end of 2019 that sustainable business development according to ESG criteria was no longer an option but became a vital decision for businesses.

|

| Since 2019, the topic of ESG has been mentioned more in corporate earnings calls. Source: Pimco |

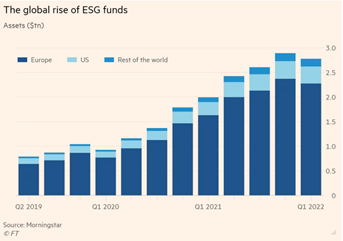

The Covid-19 pandemic over the past two years has even accelerated this trend, causing investment strategies to shift more towards ESG factors than traditional financial indicators. According to the Financial Times, despite many people still being "half-believing, half-doubting" about ESG, the flow of money into ESG-compliant businesses has been stronger than ever. Mr. Carsten Stendevad - Investment Director of Sustainable Development at Bridgewater Associates Fund also told the Financial Times: "For Europe in particular, green ambitions are now synchronized with national security ambitions and ensuring energy sovereignty and this momentum will promote the transition to renewable energy because countries do not want to depend on another country for energy."

|

Assets of ESG investment funds globally are increasing. Source: Morningstar |

According to CME Group, as the ESG ecosystem develops and the number of investors increases, ESG investments must keep pace. Although the S&P 500 ESG index has been around for just over two years, it has grown significantly compared to the "original" S&P 500 index. This shows that businesses that take ESG standards as core values in their business operations are receiving a lot of investment from investors, pushing their stock prices up faster than other companies.

|

Also according to CME Group statistics, the average daily trading volume in the E-mini S&P 500 ESG futures contract in the first quarter of 2022 increased by more than 100% compared to the same period last year and has increased steadily since the contract launched in November 2019.

|

ESG futures open interest and trading volume have grown rapidly in recent years. Source: CME Group |

How do Vietnamese investors "identify" ESG investments? /The shift towards ESG investment strategy

In Vietnam, since 2017, the Ho Chi Minh City Stock Exchange (HoSE) has launched the Vietnam Sustainability Index (VNSI) which includes 20 companies with the highest sustainability scores listed on the HoSE. However, the VNSI index and the ESG concept are still quite unfamiliar to Vietnamese investors.

Talking to us, Mr. Nguyen Van Dung, an investor and broker with 16 years of experience, said that he sees that most investors have not seen the opportunity. In fact, many Vietnamese enterprises have done very well in ESG standards, but the cash flow seems to be absorbed in short-term "games". He gave the example of VNM (Vinamilk) stock.

Vinamilk is one of the very few Vietnamese enterprises that have been interested in and invested in ESG for many years. Since 2012, this enterprise has published an annual sustainability report, transparently presenting the ESG standards that the company has applied and measuring results according to the United Nations Sustainable Development Goals model and reporting according to GRI - Global Standards for Sustainable Development Reporting. Since 2017, VNM has been continuously rated in the top 20 green stocks VNSI, with a total ESG score of 90%.

|

| Vinamilk was awarded First Prize in Sustainable Development Report - Listed Company Selection Program 2021 |

Vinamilk is now starting to reap many results from its continuous ESG investment process. Many years ago, Vinamilk invested in farms according to many high international standards such as European Organic, GlobalG.AP (Global Good Agricultural Practices)... These standards often require a large amount of investment capital, a methodical and long-term implementation process, however, the green and sustainable values brought about afterwards are enormous. Up to now, Vinamilk has hundreds of hectares of land meeting European Organic standards, this farming method helps protect land resources, which are the most valuable resources of agriculture. Or the application of modern production technology, combined with green energy such as solar energy, Biomass, CNG... in the farm and factory system helps to significantly save fuel costs.

|

The solar power system has covered 13/13 farms and 10/13 factories of Vinamilk. |

Vinamilk's integration of ESG into its strategic plan also helps manage risks better. The G (Governance) factor is rated very strongly, the 3-line defense model according to Vinamilk's Risk Management and Internal Control practices ensures objectivity and independence in assessing governance processes. The company also continuously updates its corporate governance regulations to protect shareholders' rights and establish operating standards for the Board of Directors and Executive Board, in which, typically, it maintains at least 3 independent members of the Board of Directors to ensure objectivity in important decisions.

Sharing more about ESG investment trends in the stock market, Ms. An Nguyen - analyst at Rong Viet Securities Company (VDSC): “The ESG factor of a business is increasingly being considered in investment analysis decisions in the Vietnamese market, with the aim of providing a broader perspective on the risks and opportunities of investing in a company's stocks. In addition, ESG practices are one of the plus points that help a company gain an advantage in attracting large foreign investment capital with preferential interest rates and other terms such as loans from the Asian Development Bank (ADB) or issuing green bonds.”

Ms. An Nguyen said that in the current context of inflationary tension, attracting cheap capital is an advantage to help businesses expand production and business.

The current erratic fluctuations in the stock market have caused many investors to reconsider their investment strategies. The trend of investing in businesses with good governance, environmental and social responsibility with the goal of sustainable development is expected to become more evident in the coming time.