Proposal to adjust the price table framework for calculating resource tax in Nghe An area

(Baonghean) - Due to many shortcomings in the calculation of resource tax within the price range according to Circular 44/2017/TT-BTC, mineral enterprises in Nghe An have sent petitions to relevant ministries and branches, but up to this point, after nearly 9 months, they have not received any response documents.

|

| Stone powder products are ready to be shipped from the warehouse of Trung Hai Minerals and Trading Joint Stock Company (Quy Hop). Photo: Thu Huyen |

Inadequate policies

Due to the impact of the policy on collecting fees for granting mineral exploitation rights as well as other policy mechanisms and the consumption market, enterprises exploiting white and colored stones in the area have encountered many difficulties in the past time, many enterprises have stopped mining. March 2018 is the time when Circular 44 takes effect, so many enterprises are very worried.

According to the reflection, the approved reserves of white limestone and white marble for paving stones are not consistent with the actual minerals exploited at the mines, one of the reasons being that the criteria for assessing reserves do not include criteria for whiteness and surface uniformity. In addition, through a survey of the selling prices of some types of resources in the province, the current selling prices on the market are much lower than the price range prescribed by the Ministry of Finance. Particularly, white stone, due to its lower quality (the stone has a grayish-white, blue, black color, many stripes and cracks), the selling price of Nghe An white stone on the market is much lower than Yen Bai white stone.

Mr. Nguyen Giang Hoai - Chairman of the Association of Small and Medium Enterprises of Quy Hop district said: For white marble, this price range is too high compared to the market price. The characteristic of white marble products, both for tiling and industrial additives, is that the difference in selling price can sometimes be dozens of times higher when there is a difference in whiteness, surface decoration and sales location (because transportation costs are sometimes higher than the price of stone).

Therefore, using a price framework with a range like Circular 44/2017/TT-BTC is not appropriate. “The Ministry of Finance and relevant agencies should review and soon re-issue the price framework with appropriate grouping and a larger range, prices closer to the reality of the market. In particular, pay attention to the price to calculate the licensing fee (calculated according to the licensed reserves) and the price to calculate the resource tax (calculated for the sold goods)” - Mr. Hoai suggested.

Or for sand prices, the minimum price range for tax application is stipulated in Circular 44 as 245,000 VND/m3, while in reality in Nghe An it only fluctuates from 30,000 - 60,000 VND depending on the time and location.

Mr. Nguyen Duc Tuyen - Director of the Center for Consulting and Training of Entrepreneurs, Association of Small and Medium Enterprises, said that what businesses are upset about is that in Nghe An, the price of mining land has increased by 300% but the price of residential land is used to calculate. This is a paradox of the normative document because the 4 words "adjacent residential land" are not clearly defined, so the enforcement agencies assume that residential land is adjacent to the mine. But in reality, if it is a mine, how can there be adjacent residential land because according to regulations, the distance from the mine to the residential area is at least 300m. In reality, the vast majority of mines are very far from residential areas, so it cannot be calculated. Therefore, if understood correctly, the price of land adjacent to the mine area is taken as a unit of comparison for calculation, but the price of residential land cannot be used to calculate the price of mining land rent. Because the value of residential land is an absolute value, it has the right to buy, sell - give, so the price of residential land is too high.

Regarding the solution, Mr. Tuyen suggested: If we want to increase local revenue without having to use two sanctions on collecting mining land rent of 300% of the price of adjacent residential land and mining right fee, the Government can adjust two types of taxes and fees, resource tax and environmental fee, by 1-2 thousand VND per cubic meter. This is both reasonable and maintains a relatively stable source of revenue, while businesses can gradually adjust their production costs and maintain a stable supply rhythm for the market to develop stably.

Need to adjust soon

Discussing with reporters about this issue, according to the leader of the Department of Agriculture, the Office of the Provincial People's Committee said that the price that Nghe An province has been implementing for white stone and basic colored stone is close to the market price at the time, at the same time, the classification of stone as currently implemented is close to the actual conditions, helping the tax authorities and businesses to easily make adjustments according to Circular 44, which is beyond the tolerance of businesses.

This person also admitted that the reality of illegal mining without paying land rent or licensing fees is that the State cannot manage it, while legitimate businesses that are granted mines must pay a series of taxes and face the risk of closure. It is true that there needs to be a solution to rectify mineral exploitation activities, but it needs to be appropriate to reality and have a suitable roadmap.

|

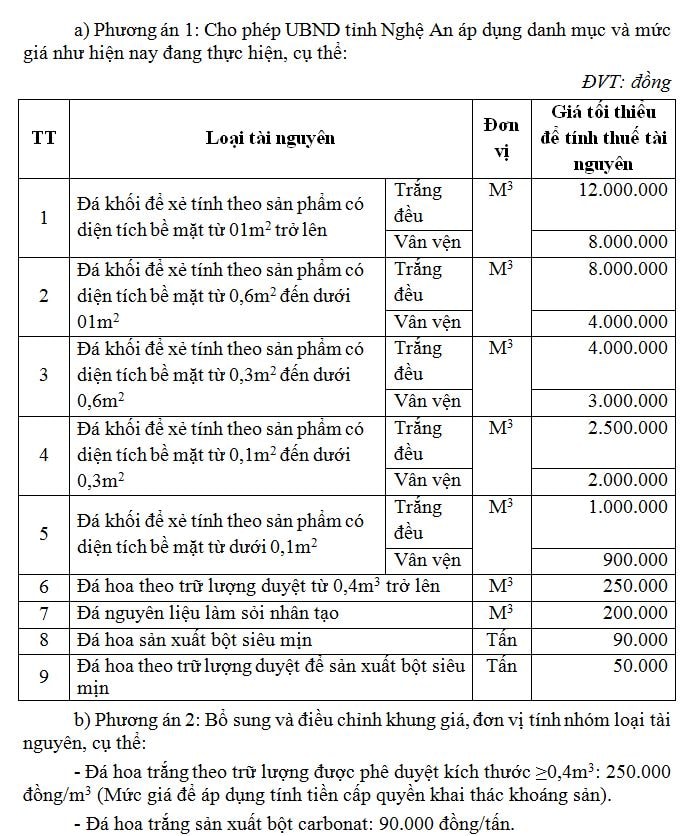

| Price framework plan that Nghe An province proposed the Ministry of Finance to allow implementation. |

To facilitate business operations, generate revenue for the local budget and at the same time meet the demand for materials for basic construction works; create jobs for workers in the province, in Official Dispatch No. 7103 dated September 15, 2017, Nghe An Provincial People's Committee requested the Ministry of Finance to allow the Provincial People's Committee to issue the price for calculating resource tax for some types of resources other than the price specified in Circular No. 44/2017/TT-BTC dated May 12, 2017 of the Ministry of Finance. Specifically: For white marble: Option 1: Allow Nghe An Provincial People's Committee to apply the list and price as currently implemented. Option 2: Supplement and adjust the price frame and unit of calculation for groups of resource types. Specifically: White marble according to approved reserves of size ≥0.4m3: 250,000 VND/m3 (price to apply for calculating mineral exploitation rights fees); White marble for carbonate powder production: 90,000 VND/ton; White marble according to approved reserves for carbonate powder production: 50,000 VND/ton (Price applied to calculate mineral exploitation rights fee).

The document also proposed specific prices for block stone for cutting; Stone according to approved reserves; Stone for common construction materials and pozzolan stone (mined minerals).

For construction sand, Nghe An proposes to apply the following prices: Leveling sand (including salty sand): 30,000 VND/m3; Black sand used in construction: 50,000 VND/m3; Yellow sand used in construction: 100,000 VND/m3.

Nghe An mineral enterprises face the risk of closure due to Circular 44

(Baonghean) - For a long time, the management of mining licenses has not been strict, white stone exports are mainly raw, creating a resource drain effect. Therefore, the State's strengthening of management of mineral exploitation activities to increase the value of goods is a correct and necessary policy. However, many policies overlap, especially Circular No. 44/2017/TT-BTC on promulgating the price framework for calculating resource tax, which lacks practicality, causing many enterprises to struggle, even go bankrupt.

29 mineral mining areas in Nghe An closed

(Baonghean.vn) - In the first 6 months of 2017, the Department of Natural Resources and Environment advised the Provincial People's Committee to issue decisions to close mines in 29 mining areas, and 8 other mining areas are being reviewed so that the Provincial People's Committee can issue decisions to close mines.

Most recently, on March 1, 2018, the Provincial People's Committee also sent a report to the Ministry of Natural Resources and Environment to request the Ministry of Finance to adjust the price list for calculating natural resource tax in Nghe An to match the actual price in the province. According to the report, many types of minerals used as common construction materials such as sand, gravel, and construction stone in Nghe An have actual selling prices much lower than the minimum price for calculating natural resource tax issued by the Ministry of Finance in Circular 44. Therefore, the price for calculating natural resource tax needs to be built on the basis of actual selling prices in localities. It is recommended that the Ministry of Natural Resources and Environment consider issuing a set of common standards to evaluate the reserves of white marble and white limestone for tiling, including criteria on whiteness and surface uniformity. At the same time, adjust the time of collecting mineral exploitation rights fees and extend the collection schedule to at least twice a year to reduce capital pressure for businesses.

In 2017, with the old resource tax rate, only about 40% of licensed units were actually operating with relatively large investment scale and advanced technology, the rest were either temporarily suspended or unable to start up.

Currently, the Vietnamese white stone industry is gradually gaining a brand name in the international market. If the tax rate according to Circular 44/2017/TT-BTC is applied, most businesses will go bankrupt and the consequences will be huge. On the other hand, if the adjustment is slow, businesses will hardly survive and foreign customers will have time to find suppliers in other countries, the risk of domestic businesses losing the market is very high.

Therefore, enterprises exploiting and processing white marble in Nghe An province request the Ministry of Finance, the General Department of Taxation and relevant agencies to soon have a specific and timely rescue plan.