Proposal to reduce the contribution rate of 2 insurance funds

If approved, reducing the contribution rate to the Occupational Accident and Disease Insurance Fund and the Unemployment Insurance Fund by 1% will help employers save VND5,400 billion per year.

The Ministry of Labor, War Invalids and Social Affairs proposed that the Government reduce the contribution rate to the Unemployment Insurance Fund and the Occupational Accident and Disease Insurance Fund by 1%. Specifically, each fund will reduce its contribution by 0.5%, equivalent to saving businesses about VND5,400 billion in annual insurance contributions.

|

Each fund type with a 0.5% reduction in contribution will help businesses save about VND5,400 billion. Illustration photo: Ngoc Thanh. |

According to the roadmap, in the next 2-3 years, businesses will be able to reduce their contribution rates as proposed. In the long term, the Ministry will study and regulate the contribution rates to the Occupational Accident and Disease Insurance Fund by industry and sector, and flexibly change them depending on the level of risk and risk of occupational accidents and diseases. For the Unemployment Insurance Fund, the Government will base on the fund's balance capacity to regulate the contribution rates for each period.

"If applied, the above amount is a necessary support for the business community when pressure on labor costs, production and domestic and foreign environmental competition is increasing," said Minister Dao Ngoc Dung.

According to statistics, the expenditure ratio of these two insurance funds in recent years has been much lower than the revenue, and the fund balance is large. In the past 8 years, the Labor Accident and Occupational Disease Insurance Fund had the highest expenditure level of 11%, and in 2015 the expenditure level was only about 8%. Currently, the unemployment insurance fund balance is large, nearly 49,000 billion VND. In 2015, the revenue of this fund was 9,470 billion VND but only more than 50% was spent, about 4,800 billion VND.

Based on the above figures, the Ministry of Labor affirms that there is sufficient basis to reduce the contribution rates of these two funds. With the Labor Accident and Occupational Disease Fund regulated by the Government, a 0.5% reduction in the contribution rate can be applied immediately. However, the Unemployment Insurance Fund is approved by the National Assembly, so it needs to be submitted to the National Assembly Standing Committee for consideration and comment.

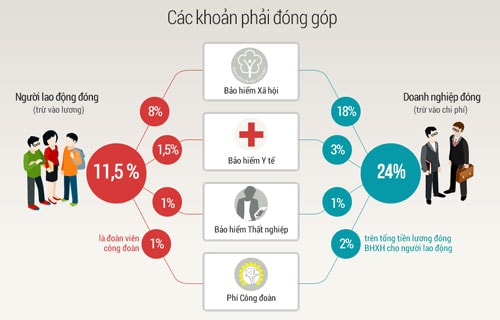

|

Amounts that employees must contribute in their salary (see details). Graphics: Tien Thanh - Hoang Phuong. |

According to current regulations, the rate of insurance contributions based on employees' salaries is 32.5%, including social insurance, health insurance, unemployment insurance, not including 2% union fees. Of which, the enterprise contributes 22% and the employee contributes 10.5%.

The contribution rate to the Occupational Accident and Disease Insurance Fund is 1% paid by the employer. This fund is used to pay for medical examination and assessment of injuries and illnesses, health rehabilitation, and support for occupational accidents and diseases for employees...

The rate of contribution to the Unemployment Insurance Fund is 2%, of which the employer contributes 1% and the employee contributes 1%. The State supports the maintenance of the fund balance annually. The fund is used to pay unemployment benefits and support vocational training to maintain employment for employees.

According to VNE

.jpg)