Adjusting pension increase from July 1, not letting anyone suffer

It is expected that those who retire before July 1, 2024 and before 1995 will be considered for an appropriate pension increase, so that those who retire before July 1 will not be pushed further behind and disadvantaged when reforming salaries.

From July 1, 2024, cadres, civil servants, public employees and workers paying social insurance are expected to receive a new salary higher than the current one. With the current method of calculating pensions based on the last years before retirement, increasing the social insurance salary will lead to an increase in pensions.

Accordingly, the longer the period of receiving the new salary for cadres, civil servants and public employees, the higher their pension will be compared to those who retire before July 1, 2024.

Thus, those retiring after July 1, 2024 will likely receive a much higher pension than those retiring before the salary reform, which leads to a pension gap between those retiring before and after July 1, 2024, when the salary reform occurs.

According to Vietnam Social Security, to ensure the balance of benefits between retirees before and after July 1, 2024, and to ensure the balance in revenue and expenditure, the unit has proposed to adjust the pension increase from July 1 with an increase of about 8%.

Based on each specific subject, the pension level after reform will be built and adjusted so that both those who retire before or after the salary reform period will not be disadvantaged.

The Ministry of Labor, Invalids and Social Affairs said that from July 1, 2024, there will be 3 pension adjustment levels for 3 groups of subjects when reforming salaries, including:

For the group of people retiring after July 1, 2024, the current pension increase will be carefully and reasonably calculated by the Ministry and relevant agencies, in harmony between people with the same position and professional work before and after the reform period of July 1, 2024.

For those who retire before July 1, 2024, since this is the group of subjects that will be considered when implementing salary reform, the State will arrange a compensation level to reduce the salary difference between retirees before and after the salary reform period.

Those who retire before July 1, 2024, in addition to being subject to social insurance policies, will still be guaranteed full benefits like normal retirees.

The pension adjustment must not be lower than 50% of the increase after the reform to ensure balance, so that those who retire before July 1 are not disadvantaged after the salary reform.

For those who retired before 1995, the Ministry of Labor, Invalids and Social Affairs said there will be special policies to push pensions even higher for this group of people.

Waiting for instructions on how to calculate new pensions

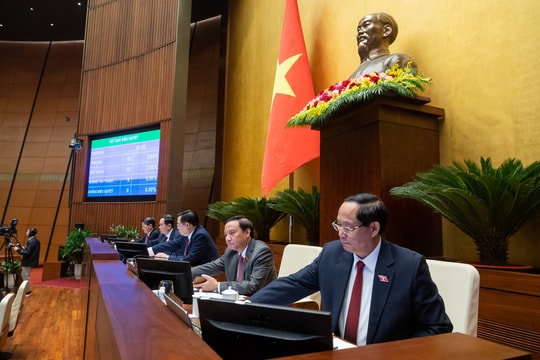

According to Ms. Duong Thi Minh Chau, Head of the Hanoi Social Insurance Communications Department, there is currently no guidance on how to calculate pensions under the new salary regime. Therefore, we need to wait for more time until the Draft Law on Social Insurance is passed by the National Assembly.

According to the representative of Hanoi Social Security, when implementing salary reform, it is expected that those who retire before July 1, 2024 and before 1995 will be considered for an appropriate pension increase to ensure harmony and balance, so that those who retire before July 1 will not be pushed further away or disadvantaged when reforming salaries.

Former Vice Chairman of the National Assembly's Committee on Social Affairs Bui Sy Loi emphasized that no matter how much the salaries of civil servants and public employees are increased, retirees must also receive a corresponding increase. If the pension and social insurance benefits are increased too low, retirees will suffer because the increased salaries and benefits cannot compensate for inflation.

According to Mr. Loi, salary reform is a process of accumulation over many years in which the previous generation accumulates for the current generation. The 560,000 billion VND fund from the Social Insurance Fund is the accumulation process of the previous generation. If the salary increase is not appropriate, it will not ensure fairness for retirees.