What conditions do businesses and workers facing difficulties due to the epidemic need to get loans?

(Baonghean.vn) - Nghe An Newspaper reporter had an interview with Mr. Tran Khac Hung - Director of the Provincial Social Policy Bank about the policy to support employees and employers facing difficulties due to the Covid-19 pandemic.

On July 1, 2021, the Prime Minister issued Resolution No. 68/NQ-CP on a number of policies to support employees and employers facing difficulties due to the Covid-19 pandemic and Decision No. 23/2021/QD-TTg dated July 7, 2021 stipulating the implementation of a number of policies to support employees and employers facing difficulties due to the Covid-19 pandemic; in which the Vietnam Bank for Social Policies is assigned to provide loans to employers to pay for work suspension and production recovery wages for employees.

PROCEDURAL REVOLUTION

PV:Could you tell us what is new in Resolution 68/NQ-CP, which has just been issued by the Government, compared to previous support packages?

Mr. Tran Khac Hung:After Resolution 68 was issued, Decision 23 of the Prime Minister regulating the implementation of a number of policies to support employees and employers facing difficulties due to the Covid-19 pandemic was a procedural revolution, with a breakthrough for employers to access the fastest. Previously, employers borrowing to pay salaries for employees who stopped working had to access within 1 month and 10 days and with 4 different types of documents. This policy has shortened the entire time and process, to only 4 days to process documents, and the Bank disburses to customers within 2 working days from the date of receiving capital notification.

|

| Mr. Tran Khac Hung - Director of the People's Credit Fund, Nghe An branch. Photo by Thu Huyen |

Employers are allowed to borrow capital atVietnam Bank for Social Policiesi with 0% interest rate, no need to take measures to secure loans to pay for suspension of work for employees participating in compulsory social insurance who must stop working for 15 consecutive days or more during the period from May 1, 2021 to March 31, 2022. Employers are exempted from the requirement to prove the business's revenue or finances.

Another new point of this support is that in addition to the loan objects to pay salaries for workers who have stopped working, this time it adds loans for employers to pay salaries to restore production, with 2 groups including: Employers who have to temporarily suspend operations due to requests from competent state agencies to prevent and fight the Covid-19 epidemic and employers operating in the fields of transportation, aviation, tourism, accommodation services, sending workers abroad under contracts to restore production and business.

|

| Notice of salary loan. Photo: PV |

Mr. Tran Khac Hung:To promptly bring the policy into life, on July 8, 2021, the Vietnam Bank for Social Policies organized a national online conference with delegates at its headquarters and branches in provinces and cities on policies to support employers in borrowing capital to pay wages for work suspension and production recovery according to Resolution No. 68 and Decision No. 23 of the Prime Minister.

In Nghe An, the Bank for Social Policies, Nghe An branch, organized professional training, thoroughly grasped the tasks of loan implementation to all officers and employees of the branch; advised the Provincial People's Committee to issue an official dispatch directing departments, branches and sectors to strengthen direction and coordination with the Bank for Social Policies to implement policies accurately, promptly and effectively. On July 13, the Bank for Social Policies, Nghe An branch, also issued Notice No. 700/TB - NHCS on the implementation of the loan policy for employers to pay wages for work suspension and wages for production recovery due to the impact of the pandemic to all district and town transaction offices; press agencies in the area...

We consider the implementation of the policy to support employers in borrowing capital to pay for work stoppages and pay for production recovery for employees as a top priority task in the coming time; strengthen and promote the publicity of the policy to all levels, sectors and beneficiaries, with the motto "each cadre is a propagandist" to propagate the policy to all businesses and people in the area.

|

| Enterprises borrow capital to pay salary suspension for employees affected by the epidemic from the Vietnam Bank for Social Policies in November 2020. Photo: Thu Huyen |

PRACTICAL SUPPORT FOR AFFECTED WORKERS

PV:Can you be more specific about the conditions for businesses to borrow capital to pay salaries to employees to restore production and business?

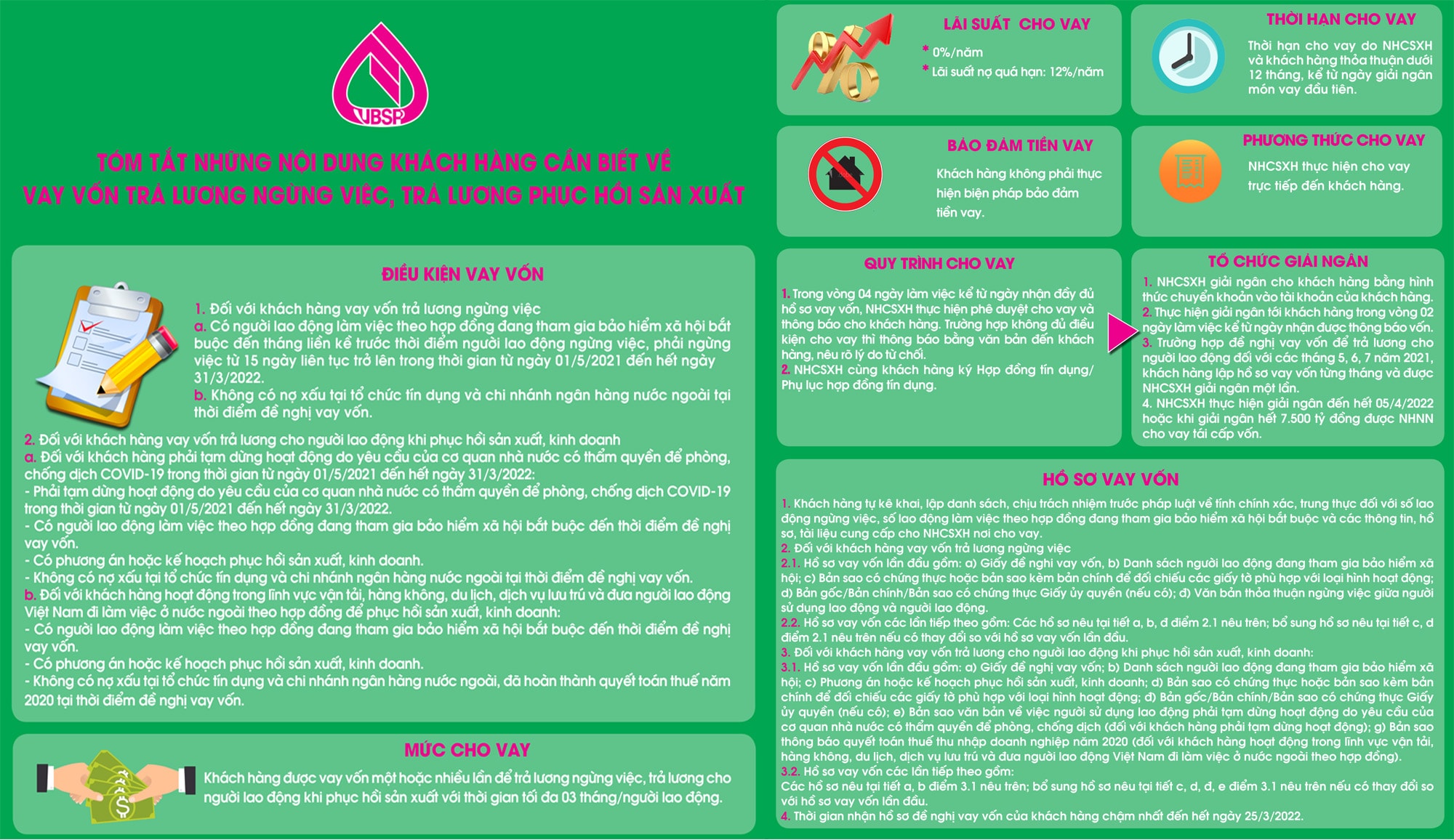

Accordingly, employers are allowed to borrow capital to pay for suspension of work and pay salaries to employees when resuming production and business when meeting the following conditions:

1. For customers borrowing capital to pay for unemployment benefits

a. There are employees working under a contract participating in compulsory social insurance until the month immediately preceding the time the employee stops working, and must stop working for 15 consecutive days or more during the period from May 1, 2021 to March 31, 2022.

b. No bad debt at credit institutions and foreign bank branches at the time of loan application.

2. For customers borrowing capital to pay salaries to employees when restoring production and business

a. For customers who must temporarily suspend operations due to requests from competent state agencies to prevent and fight the Covid-19 epidemic from May 1, 2021 to March 31, 2022:

- Must temporarily suspend operations due to the request of competent state agencies to prevent and control the Covid-19 epidemic from May 1, 2021 to March 31, 2022.

- There are employees working under contract participating in compulsory social insurance at the time of loan application.

- Have a plan or strategy to restore production and business.

- No bad debt at credit institutions and foreign bank branches at the time of loan application.

b. For customers operating in the fields of transportation, aviation, tourism, accommodation services and sending Vietnamese workers to work abroad under contracts to restore production and business:

- There are employees working under contract participating in compulsory social insurance at the time of loan application.

- Have a plan or strategy to restore production and business.

- No bad debt at credit institutions and foreign bank branches, completed tax settlement for 2020 at the time of loan application.

Regarding the loan amount for paying salaries to workers when restoring production: The maximum loan amount is equal to the regional minimum wage for workers working under labor contracts. The maximum support policy period is 3 months; the loan term is less than 12 months.

The disbursement of the Vietnam Bank for Social Policies to employers for the months of May, June and July 2021 is made once; the disbursement deadline is April 5, 2022 or when the full disbursement of VND 7,500 billion is refinanced by the State Bank of Vietnam, whichever comes first.

|

| What customers need to know about loans to pay for unemployment and production recovery. Photo: PV |

PV:Thank you very much!

Loan application documents include:

- Loan application form.

- List of employees participating in social insurance;

- Certified copy or copy with original for comparison of one of the following documents: Certificate of Business Registration/Certificate of Cooperative/Business Household Registration; Decision on establishment by competent state agency (if any); Business License/Operating License/Practice Certificate (for conditional business lines or those prescribed by law); Investment License/Investment Certificate (for enterprises established by foreign investors); Authorization Letter (if any).

- A copy of the document stating that the employer must temporarily suspend operations due to the request of a competent state agency to prevent and control the Covid-19 epidemic during the period from May 1, 2021 to March 31, 2022 (for loans to pay salaries to restore production and business).

- Plan or project to restore production and business.

- Copy of 2020 corporate income tax settlement notice from tax authority for employer.