Motivation from credit policy for ethnic minority areas

(Baonghean) - Along with the implementation of mechanisms and policies of the Central and the province, the mountainous districts in Nghe An have had many positive changes in socio-economic development.

|

| A working delegation from the Vietnam Bank for Social Policies visited economic models in Ky Son district. Photo: Thu Huyen |

Previously, Mr. Vi Van Dung's family in Hoa Son village, Ta Ca commune, Ky Son district was very poor, one of the poorest households in the village. In March 2008, Mr. Dung was able to borrow 10 million VND from the poor household loan program. With the money, he bought a breeding cow to develop the economy; thanks to effective breeding, the mother cow gave birth to a calf, so in 2013, the family escaped poverty.

In 2014, his family continued to be granted 4 hectares of forest land by the State to protect and preserve the forest. At the same time, his family was lent 20 million VND by the Social Policy Bank, Nghe An branch, from the job creation program to develop a herd of cows, raise goats and grow fruit trees.Mr. Dung said: “Thanks to the loan from the Social Policy Bank, my family has stabilized our lives, had a source of income, and escaped poverty. My family currently has 19 cows, 10 goats, more than 100 chickens, and grows various fruit trees. In addition to having money for my children to go to school, I have also built a spacious house, with a TV, refrigerator, motorbike, and invested in 2 more rice milling machines to serve the people in the village.”

Currently, the economic development model of Mr. Vi Van Dung's family has become a typical example of Ky Son district.

|

| Thanks to a loan from the Bank for Social Policies, Mr. Vy Van Dung's family in Ta Ca, Ky Son has effectively developed their farm economy. Photo: Thu Huyen |

In Anh Son district, policy credit capital has helped thousands of poor households buy buffaloes and cows, build new ones, repair and renovate thousands of square meters of houses.2Livestock barns, purchase additional materials, machinery, production and business tools...

Most poor households use loans for the right purposes, have good repayment capacity, and many households have escaped poverty. From 2015 to now, there have been 16,856 loans from the Vietnam Bank for Social Policies. During the period 2015-2017, 2,940 households escaped poverty thanks to policy credit loans, reducing the annual poverty rate.

As of September 30, 2018, there were 19 policy credit programs being implemented in the province with a total capital of VND 7,710 billion, an increase of VND 498 billion compared to the beginning of the year; the growth rate reached 6.92%.

Nghe An ethnic minority region has 11 districts and towns, accounting for 41% of the population and 83% of the natural area of the whole province. Of which, 3 districts benefit from Resolution 30a of the Government; the whole region has 205 communes and towns, of which 99 are extremely disadvantaged communes, border communes, safe zone communes and 184/270 extremely disadvantaged villages in 61 communes of region II are eligible for investment under Program 135 phase 2.

Closely following the growth target of outstanding loans of credit programs assigned by the Central Government during the year, the Provincial Branch of the Social Policy Bank has coordinated with entrusted organizations to organize timely disbursement with loan turnover in 9 months reaching 2,102 billion VND, up 7% over the same period. The total outstanding loan balance of the Social Policy Bank through 4 political organizations and unions in the whole province reached over 7,616 billion VND. Of which, in mountainous districts and ethnic minority areas, the total outstanding loan balance is nearly 4,000 billion VND, accounting for 52.12% of outstanding loans with 157,515 customers with outstanding loans.

The disbursement of capital for annual credit programs by the Provincial Bank for Social Policies basically completed the assigned plan, lending was done promptly, ensuring the right subjects. Loan turnover from 2015 to August 2018 reached more than 4,260 billion VND, with 160,877 households receiving loans. The average capital growth rate reached 6.5 - 7.5%/district.

Currently, the overdue debt of 11 mountainous districts is 7,448 million VND, accounting for 0.19%. Some localities have fully implemented the notification of debt cancellation for debts at risk due to objective reasons, and extended the debt repayment period for households in temporary difficulty who have not been able to pay their debts to support the people.

|

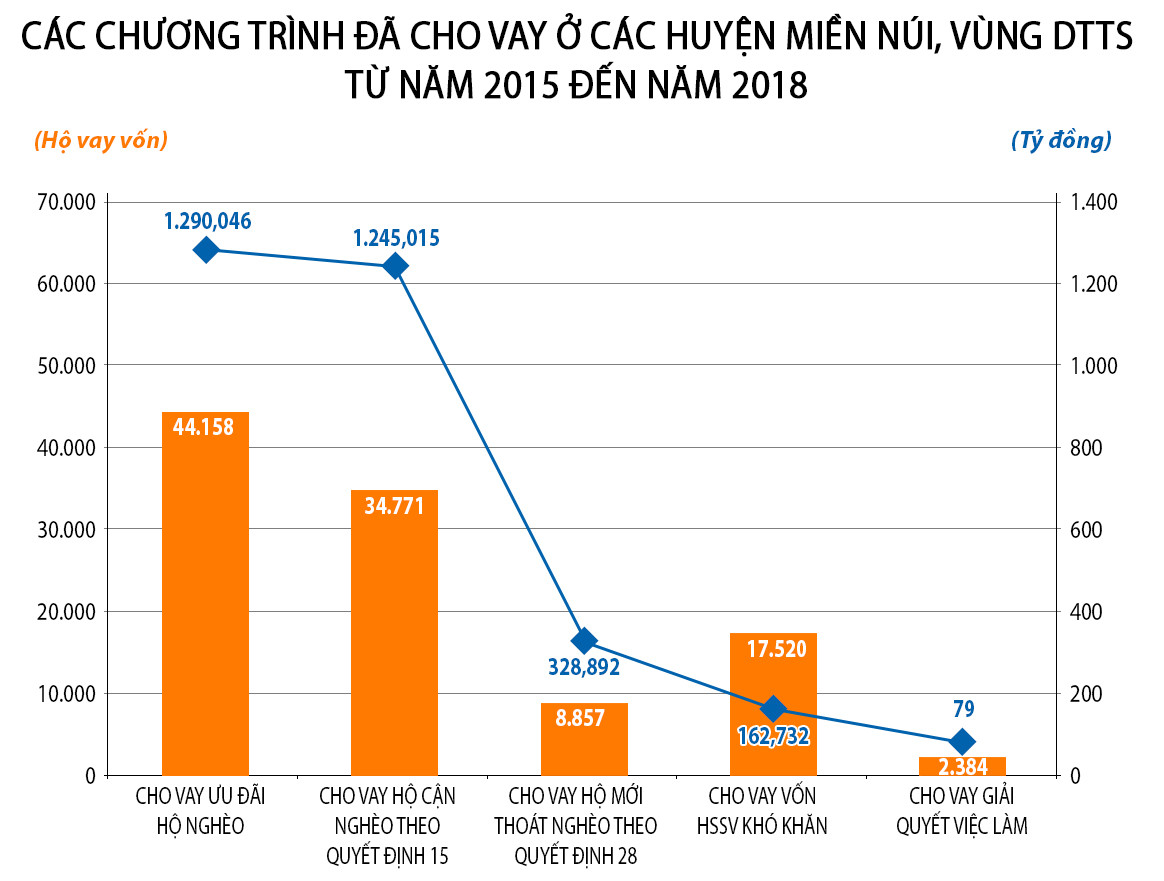

| Loan programs in mountainous areas. Graphics: Huu Quan |

Through the policy credit capital of the Social Policy Bank, it has helped thousands of poor households have capital to develop large livestock farming such as buffalo, cows, goats, build new, repair, renovate thousands of square meters of livestock barns, invest in purchasing materials, machinery, production tools, develop service businesses, build houses, clean water works, environmental sanitation... Many effective models such as supporting student loans, borrowing capital for production and business, building houses in Quy Hop, Con Cuong, Que Phong districts.

More practical and effective solutions are needed.

The results of the programs have contributed to reducing the poverty rate in the 30a districts by an average of 6-7% per year; in 2 years (2016-2017), 17,214 poor households were reduced; contributing to reducing from 24.04% to 17.04% of poor households in the whole province. Through preferential credit activities, poor ethnic minority households have received support, advice, and shared production and business experiences from members of the savings and loan groups, and are subject to regular inspection and supervision by the group management board and staff of the entrusted association.

Loan programs from the Bank for Social Policies have helped poor households and policy beneficiaries in mountainous areas gradually change their awareness of production, business and economic development methods, form savings habits and enhance community responsibility in the production organization process, actively strive to eliminate hunger, reduce poverty, and increasingly stabilize their lives.

|

| Mr. Luong Huu Phuong in Tan Tho hamlet, Nghia Tho commune (Nghia Dan) escaped poverty with a loan from the Social Policy Bank. Photo: Thu Huyen |

In order to effectively implement Directive No. 40-CT/TW of the Secretariat and Directive No. 29-CT/TU of the Provincial Party Committee Standing Committee, Mr. Tran Khac Hung - Director of the Provincial Social Policy Bank proposed that the province arrange additional loan capital for the poor and other policy beneficiaries through the Social Policy Bank in the area, in accordance with the actual conditions of the locality. At the same time, strengthen coordination and connection of agricultural and forestry extension activities, application of science and technology in production with the implementation of credit policies in mountainous areas, ethnic minority areas...

To further promote the effectiveness of policy credit for ethnic minorities, according to Ms. Lo Thi Kim Ngan - Head of the Ethnic Minority Committee - Provincial People's Council, in the coming time, the Provincial and District Social Policy Bank needs to promote the dissemination of policy credit to all classes of people in mountainous areas and ethnic minority areas; effectively implement preferential credit programs; conduct reviews, recommendations, and proposals for competent authorities to consider amending and supplementing guiding documents in accordance with the practical implementation of social policy credit activities in mountainous areas, especially the mobilization of additional capital from the annual local budget.

In the period 2015-2018, 160,877 poor and near-poor households who have just escaped poverty and other policy beneficiaries in mountainous areas and ethnic minority areas in Nghe An province have been able to borrow capital with an amount of 4,260,144 billion VND. Of which, ethnic minorities account for 94,450 households, with an amount of 1,768 billion VND. Currently, the number of households with outstanding debt is 79,113 households, with an outstanding debt of 1,755.6 billion VND, accounting for 50.2%.