Nearly 75,000 poor households and policy beneficiaries in Nghe An receive preferential loans.

(Baonghean.vn) - In 2020, 74,981 poor households and other policy beneficiaries received preferential loans from policy credit sources.

|

| On the morning of January 20, the Board of Directors of the Provincial Branch of the Vietnam Bank for Social Policies held the 66th regular meeting to evaluate the performance results in 2020 and deploy tasks for 2021. Comrade Nguyen Thi Thu Thu - Director of the State Bank of Vietnam, Nghe An branch chaired the meeting. Photo: Thu Huyen |

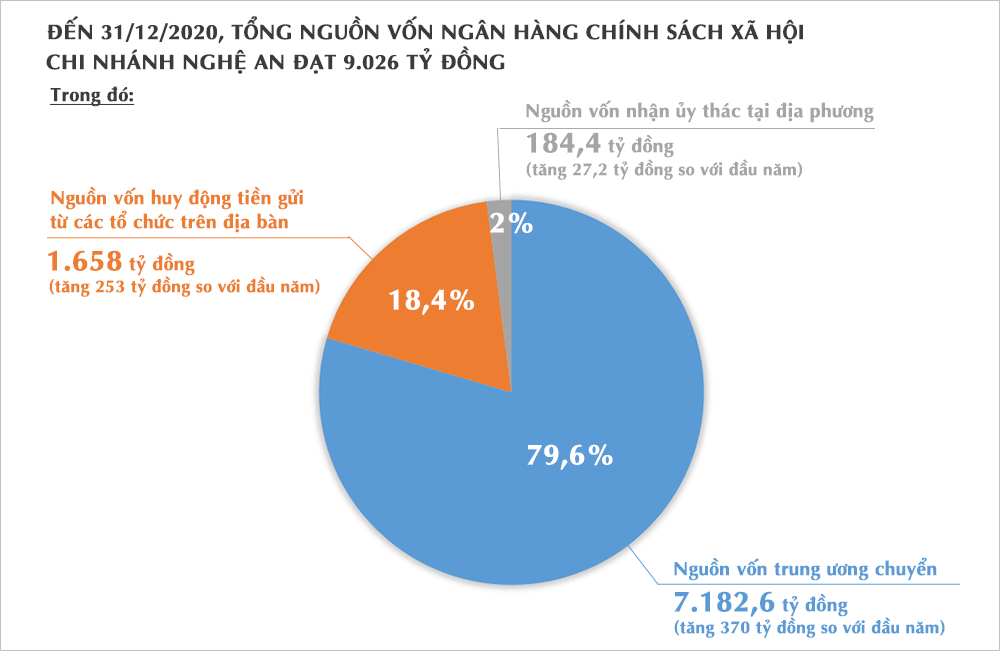

According to the report of the Nghe An Provincial Social Policy Bank, in 2020, 74,981 poor households and other policy beneficiaries in the area received preferential loans from policy credit capital. According to statistics from localities, policy credit capital contributed to helping 39,473 poor and near-poor households escape poverty in 2020. By December 31, 2020, the total capital reached VND 9,026 billion, an increase of VND 650 billion compared to 2019, achieving a growth rate of 7.76%.

Loan turnover in 2020 reached 3,033 billion VND, an increase of 9.6% over the previous year. Notably, during the year the unit has implementedcapital disbursementfor a number of businesses to pay salaries to employees who have stopped working due to the impact of the Covid-19 epidemic with an amount of 745 million VND/7 businesses/160 employees supported.

|

| Deputy Director of the Provincial Social Policy Bank Nguyen Van Vinh presented a report on the results of operations in 2020 and deployed tasks for 2021. Photo: Thu Huyen |

As of December 31, 2020, total outstanding debt reached VND 9,008 billion/20 programspolicy credit(increased by 1 program compared to 2019), increased by 647 billion VND compared to the beginning of the year, achieving a growth rate of 7.74%, completing the growth target set by the Representative Board in 2020. In the first months of the year, despite being negatively affected by the epidemic, starting from the second quarter, the Branch has taken advantage of capital from the Central Government, accelerated the disbursement of programs to meet capital needs for poor households and policy beneficiaries to restore production, creating conditions for people to soon stabilize their lives.

|

| Graphics: Lam Tung |

Of the 20 programs under management, 11/20 programs have increased outstanding loans compared to the beginning of the year. Some programs have increased significantly, such as: Loans for near-poor households, households that have just escaped poverty, clean water and rural environmental sanitation, loans for production and business households in difficult areas, loans for job creation, loans for labor export, loans to support production for ethnic minority households in difficult areas according to Decision No. 2085/QD-TTg of the Prime Minister...

The branch has implemented many solutions to handle and collect due and overdue debts. Thanks to that, credit quality continues to improve, overdue debts and frozen debts have decreased sharply compared to the beginning of the year.

In 2021, the Vietnam Bank for Social Policies sets the following targets: Capital growth and outstanding loans reaching at least 7%; Completing 100% of the plan to receive entrusted capital from local budget sources according to the Central target assigned in 2021 (25 billion VND); Completing 100% of the plan to increase capital mobilized from the market according to the Central target assigned.

At the meeting, members of the Board of Directors gave their opinions on the ratio of the balance entrusted through the organizations; whether there are instructions for extending the loan program when it expires; and the need to promote the role of the commune chairman in policy credit activities...

Concluding the meeting, Ms. Nguyen Thi Thu Thu - Director of the State Bank of Vietnam, Nghe An branch, emphasized that despite the epidemic, the activities of the Board of Directors of the Provincial Social Policy Bank achieved many good results; policy credit growth was good, reaching 7.74%. Policy credit continues to make important contributions to the socio-economic development achievements of the province and the implementation of the goals of poverty reduction and social security.new rural constructionin localities in the province.

|

| The delegation of the Vietnam Bank for Social Policies gave gifts to policy families in Ta Ca commune (Ky Son). Photo: Thu Huyen |

Regarding the implementation of tasks in the coming time, it is recommended that the Board of Directors at the provincial and district levels continue to effectively direct the implementation of the contents of Directive No. 29 of the Provincial Party Committee and Official Dispatch No. 463 of the Provincial People's Committee, in order to increase resources and mobilize the entire political system to actively participate in policy credit activities. Actively advise the People's Committees at all levels to allocate and transfer the budget source of VND 25 billion to the Vietnam Bank for Social Policies to promptly deploy loans in the first quarter of 2021. Review and approve the plan to allocate capital for credit programs to localities in a timely manner when the Central Government assigns targets, ensuring quick disbursement of capital sources.

For the provincial and district-level Social Policy Banks, Director of the State Bank of Vietnam Nguyen Thi Thu Thu suggested continuing to advise on the good implementation of Directive 40 of the Secretariat; and the directive documents of the Provincial People's Committee on policy credit activities in the area.Promote the mobilization of capital sources to best meet the borrowing needs of poor households and policy beneficiaries, striving to complete the target of increasing outstanding loans of policy credit programs by September 30, 2021. Coordinate with members of the Department of Labor, Invalids and Social Affairs to complete the Project on lending to workers from newly escaped poverty households to work abroad using local budget capital; Continue to improve the quality of policy credit activities...