How to write customer information on invoice?

Enterprises asked about instructions for recording customer information on invoices. Regarding this issue, Nghe An Tax Department would like to respond as follows:

Article 4 and Article 10 of Decree No. 123/2020/ND-CP dated October 19, 2020 of the Government regulating invoices and documents stipulate:

“Article 4. Principles of creating, managing and using invoices and documents

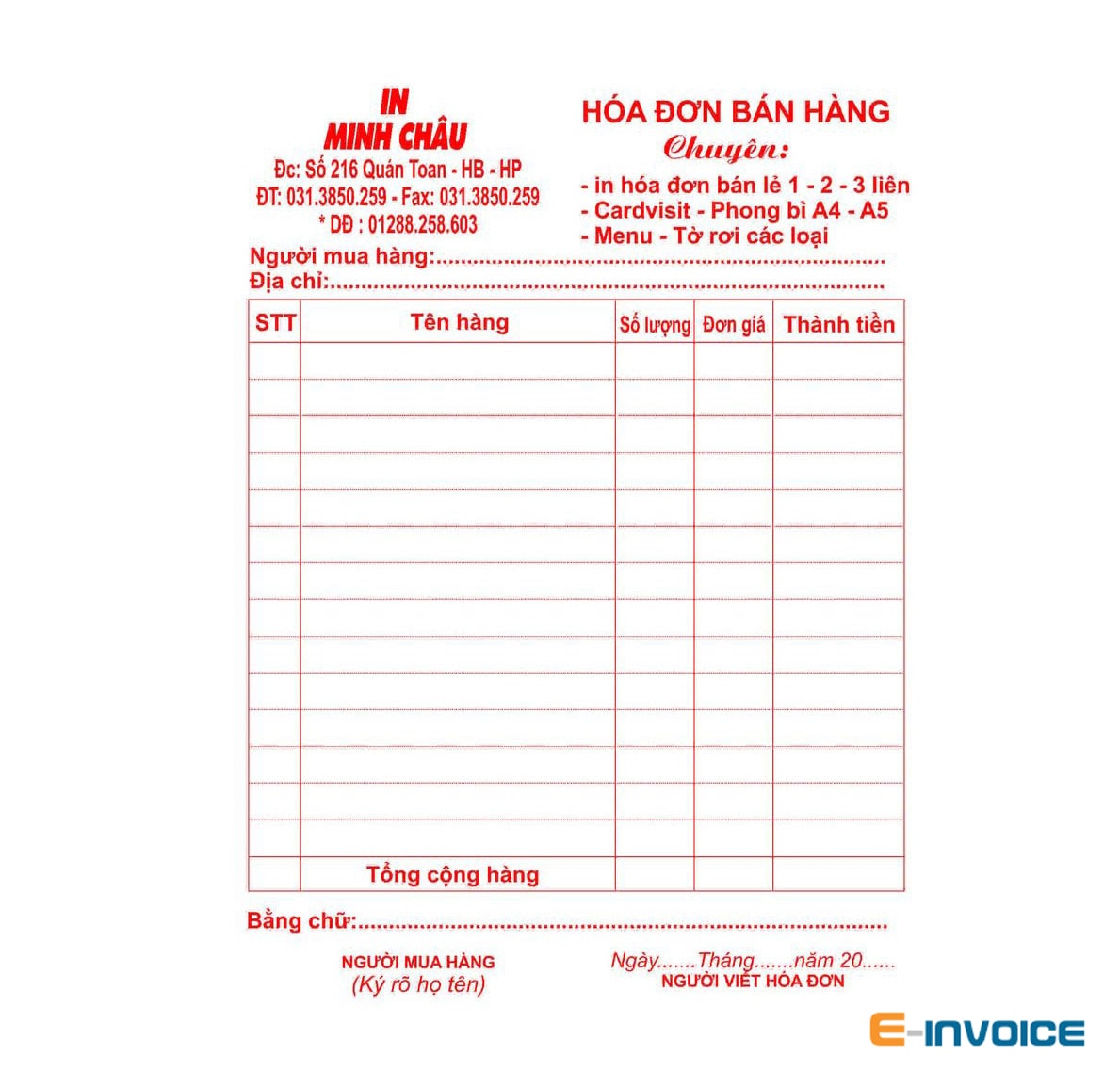

1. When selling goods or providing services, the seller must issue an invoice to the buyer (including cases of goods and services used for promotion, advertising, samples; goods and services used for giving, presenting, exchanging, paying in lieu of salary to employees and internal consumption (except for goods circulated internally to continue the production process); exporting goods in the form of loans, lending or returning goods) and must fully record the content as prescribed in Article 10 of this Decree. In case of using electronic invoices, they must follow the standard data format of the tax authority as prescribed in Article 12 of this Decree.

Article 10. Contents of invoice

5. Name, address, tax identification number of the buyer

a) In case the buyer is a business establishment with a tax code, the name, address, and tax code of the buyer shown on the invoice must be recorded in accordance with the business registration certificate, branch registration certificate, household business registration certificate, tax registration certificate, tax code notification, investment registration certificate, and cooperative registration certificate.

b) In case the buyer does not have a tax code, the invoice does not have to show the buyer's tax code. In some cases of selling goods and providing specific services to individual consumers as prescribed in Clause 14 of this Article, the invoice does not have to show the name and address of the buyer. In case of selling goods and providing services to foreign customers coming to Vietnam, the information about the buyer's address can be replaced by information about the passport number or entry and exit documents and nationality of the foreign customer.

14. In some cases, electronic invoices do not necessarily have full content.

a) The electronic invoice does not necessarily have to have the buyer's electronic signature (including the case of issuing an electronic invoice when selling goods or providing services to customers abroad). In case the buyer is a business establishment and the buyer and seller have an agreement that the buyer meets the technical conditions for digital signature and electronic signature on the electronic invoice issued by the seller, the electronic invoice has the digital signature and electronic signature of the seller and the buyer according to the agreement between the two parties.

b) For electronic invoices issued by tax authorities for each occurrence, it is not necessary to have the digital signature of the seller or buyer.

c) For electronic invoices for sales at supermarkets and shopping malls where the buyer is an individual who is not in business, the invoice does not necessarily have to include the name, address, and tax code of the buyer.

For electronic invoices for selling gasoline to individual customers who are not in business, it is not necessary to have the following indicators: invoice name, invoice model number, invoice symbol, invoice number; name, address, tax code of the buyer, electronic signature of the buyer; digital signature, electronic signature of the seller, value added tax rate.

d) For electronic invoices in the form of stamps, tickets, and cards, the invoice does not necessarily have to have the seller's digital signature (except in cases where stamps, tickets, and cards are electronic invoices with codes issued by tax authorities), buyer criteria (name, address, tax code), tax amount, and value-added tax rate. In cases where electronic stamps, tickets, and cards have available face values, it is not necessary to have criteria for unit of calculation, quantity, and unit price.

g) For the internal delivery and delivery note, the internal delivery and delivery note shows information related to the internal transfer order, the consignee, the shipper, the delivery warehouse location, the receiving location, and the means of transport. Specifically: the buyer's name shows the consignee, the buyer's address shows the receiving warehouse location; the seller's name shows the shipper, the seller's address shows the delivery warehouse location and the means of transport; the tax amount, tax rate, and total payment amount are not shown.

For the Warehouse Delivery Note for goods sent to agents for sale, the Warehouse Delivery Note for goods sent to agents for sale shows information such as the economic contract, carrier, means of transport, delivery warehouse location, receiving warehouse location, product name, unit, quantity, unit price, total amount. Specifically: record the number, date of the economic contract signed between the organization or individual; full name of the carrier, transportation contract (if any), seller's address showing the delivery warehouse location.

Based on the above regulations, when selling goods or providing services, the Company must issue an invoice to the buyer, the invoice must fully state the content as prescribed in Article 10 of Decree No. 123/2020/ND-CP. In case the buyer does not have a tax code, the invoice does not have to show the buyer's tax code. In some cases, the electronic invoice does not necessarily have the full content prescribed in Clause 14, Article 10 of Decree No. 123/2020/ND-CP.

The Company shall comply with the law based on the actual situation and the above regulations.

Nghe An Provincial Tax Department replies so that the Company can know and implement./.