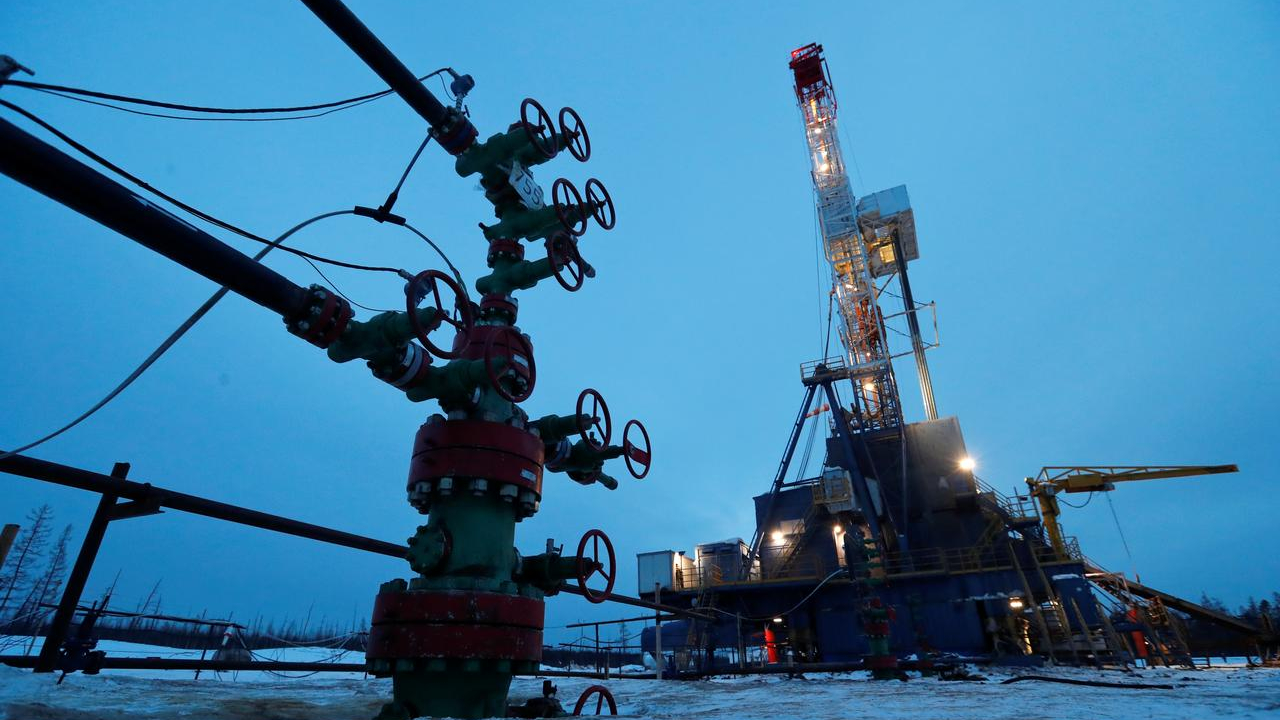

World oil price today October 1, 2025: Decreased due to pressure from increased supply

World oil prices today October 1, 2025: Oil prices continue to plummet as global supply shows signs of being more abundant, while demand has not improved much.

On October 1, world crude oil prices continued to fall due to expectations that OPEC+ will increase production at the upcoming meeting. Brent crude for November delivery fell 70 cents, or 1%, to $67.27 a barrel. US West Texas Intermediate (WTI) crude also lost 81 cents, or 1.3%, to trade at $62.64 a barrel.

Earlier in the week, both oil futures plunged more than 3%, their biggest one-day drop since August 1.

According to sources, OPEC+ is expected to approve a plan to increase production by at least 137,000 barrels per day in November. Goldman Sachs even forecast that this number could be as high as 140,000 barrels per day.

This information makes investors worry that the market will fall into a state of oversupply, especially when oil prices have just undergone a strong adjustment.

Iraq restores oil exports to Türkiye

Adding to the pressure on prices was the resumption of crude oil exports from Iraq’s autonomous Kurdistan region to Türkiye, the first time in 2.5 years that flows from the region have resumed after a temporary deal was reached.

Adding more supply at a time when the market is already worried about a glut has further depressed oil prices.

Market weighs risks and weak demand

Analysts say the market is in a delicate balance between the risk of supply shortages due to the Russia-Ukraine conflict and the oversupply from OPEC+ and Iraq. Meanwhile, oil demand remains weak, not providing enough support for prices.

In addition, the geopolitical situation in the Middle East is also being closely monitored. The fact that US President Donald Trump won the support of Israeli Prime Minister Netanyahu for a peace plan in Gaza is seen as a positive signal.

If a peace scenario materializes, trade through the Suez Canal could return to normal, meaning geopolitical risks would ease, pushing oil prices down further.

Another factor weighing on the market is the risk of a US government shutdown if the budget is not passed on time. This could impact the US economy and global energy demand, thereby putting further downward pressure on oil prices.