Gold price this afternoon November 13, 2025: SJC PNJ ACB gold price list, BTMC gold ring, world gold

Gold price this afternoon November 13, 2025: Domestic SJC ACB PNJ gold bar price increased to 154 million. BTMC gold ring price increased to 154.3 million, world gold price increased to over 4200 USD.

Gold pricedomestic this afternoon 11/13/2025

Updated at 3:00 p.m. this afternoon, November 13, 2025, the price of gold bars skyrocketed to 154 million VND. Specifically:

DOJI Group listed the price of SJC gold bars at 152 - 154 million VND/tael (buy - sell), an increase of 2.5 million VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of gold bars was listed by Saigon Jewelry Company Limited - SJC at 152 - 154 million VND/tael (buy - sell), an increase of 2.5 million VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 152.3 - 154 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 2.3 million VND/tael for buying and 2.5 million VND/tael for selling.

The price of gold bars at Bao Tin Minh Chau Company Limited is traded by businesses at 152.5 - 154 million VND/tael (buy - sell), an increase of 2.5 million VND/tael in both buying and selling directions compared to the same period yesterday.

The price of SJC gold bars at Phu Quy is traded by businesses at 151 - 154 million VND/tael (buy - sell), the gold price increased by 2.5 million VND/tael in both buying and selling directions compared to yesterday.

The price of ACB gold bars is traded by businesses at 152 - 154 million VND/tael (buy - sell). Compared to yesterday, the gold price increased by 2 million VND/tael in the buying direction - increased by 2.5 million VND/tael in the selling direction compared to yesterday.

As of 3:00 p.m. on November 13, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 150.5 - 153.5 million VND/tael (buy - sell); an increase of 2.5 million VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 151.3 - 154.3 million VND/tael (buy - sell); an increase of 2.5 million VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list this afternoon, November 13, 2025 is as follows:

| Gold price this afternoon | November 13, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 152 | 154 | +2500 | +2500 |

| DOJI Group | 152 | 154 | +2500 | +2500 |

| Mi Hong | 152.3 | 154 | +2300 | +2500 |

| PNJ | 152 | 154 | +2500 | +2500 |

| Bao Tin Minh Chau | 152.5 | 154 | +2500 | +2500 |

| Phu Quy | 151 | 154 | +2500 | +2500 |

| ACB Gold | 152 | 154 | +2000 | +2500 |

| 1.DOJI- Updated: 11/13/2025 15:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| AVPL/SJC - RETAIL | 152,000▲2500K | 154,000▲2500K |

| 9999 ROUND RING (HUNG THINH VUONG - RETAIL) | 150,500▲2500K | 153,500▲2500K |

| 9999 JEWELRY - RETAIL | 150,300▲2500K | 153,300▲2500K |

| 999 JEWELRY - RETAIL | 150,100▲2500K | 153,100▲2500K |

| Ingredients 99.99 | 147,000▲3500K | 149,000▲3500K |

| Ingredients 99.9 | 146,800▲3500K | 148,800▲3500K |

| 2.PNJ- Updated: 11/13/2025 15:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC 999.9 gold bar | 152,000▲2500K | 154,000▲2500K |

| PNJ 999.9 Plain Ring | 150,000▲1800K | 153,000▲2000K |

| Kim Bao Gold 999.9 | 150,000▲1800K | 153,000▲2000K |

| Gold Phuc Loc Tai 999.9 | 150,000▲1800K | 153,000▲2000K |

| PNJ Gold - Phoenix | 150,000▲1800K | 153,000▲2000K |

| 999.9 gold jewelry | 149,700▲1900K | 152,700▲1900K |

| 999 gold jewelry | 149,550▲1900K | 152,550▲1900K |

| 9920 gold jewelry | 148,580▲1890K | 151,580▲1890K |

| 99 gold jewelry | 148,270▲1880K | 151,270▲1880K |

| 916 Gold (22K) | 136,970▲1740K | 139,970▲1740K |

| 750 Gold (18K) | 107,180▲1430K | 114,680▲1430K |

| 680 Gold (16.3K) | 96,490▲1300K | 103,990▲1300K |

| 650 Gold (15.6K) | 91,910▲1240K | 99,410▲1240K |

| 610 Gold (14.6K) | 85,800▲1160K | 93,300▲1160K |

| 585 Gold (14K) | 81,980▲1110K | 89,480▲1110K |

| 416 Gold (10K) | 56,170▲790K | 63,670▲790K |

| 375 Gold (9K) | 49,910▲710K | 57,410▲710K |

| 333 Gold (8K) | 43,500▲630K | 51,000▲630K |

| 3.SJC- Updated: 11/13/2025 15:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 152,000▲2500K | 154,000▲2500K |

| SJC gold 5 chi | 152,000▲2500K | 154,020▲2500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 152,000▲2500K | 154,030▲2500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 149,700▲2500K | 152,200▲2500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 149,700▲2500K | 152,300▲2500K |

| 99.99% jewelry | 148,200▲2500K | 151,200▲2500K |

| 99% Jewelry | 145,202▲2475K | 149,702▲2475K |

| Jewelry 68% | 95,476▲1700K | 102,976▲1700K |

| Jewelry 41.7% | 55,706▲1042K | 63,206▲1042K |

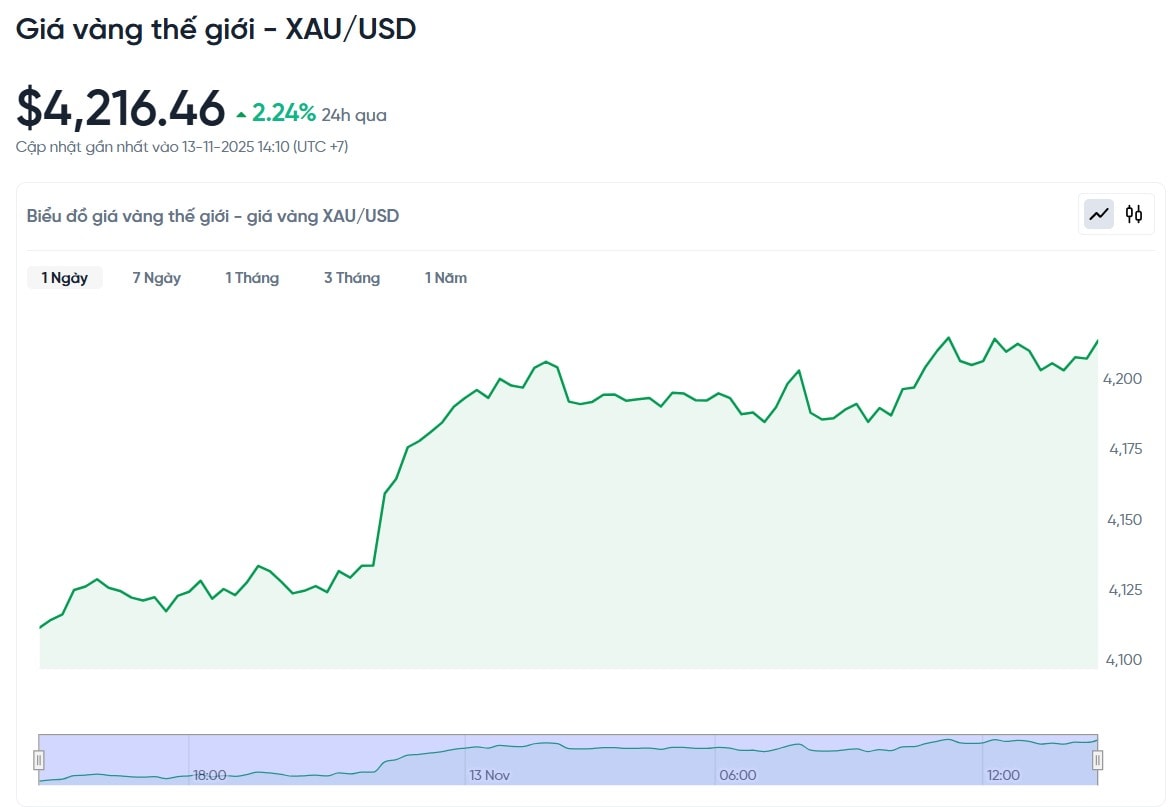

World gold price this afternoon November 13, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 3:00 p.m. on November 13, Vietnam time, was 4,216.46 USD/ounce. This afternoon's gold price increased by 92.12 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,385 VND/USD), the world gold price is about 134.2 million VND/tael (excluding taxes and fees). Thus, the gold bar price is 19.8 million VND/tael higher than the international gold price.

Although the domestic gold price has increased, the difference between buying and selling is still maintained at 2 million VND/tael for gold bars and 3 million VND/tael for gold rings. This high gap between buying and selling means that buyers still face losses if they sell immediately.

In the world, spot gold prices jumped to over 4,200 USD/ounce. Futures contracts also increased by nearly 200 USD after only three sessions, equivalent to an increase of 5%, bringing gold prices back to the important psychological zone of 4,200 USD/ounce.

Mike McGlone, senior market strategist at Bloomberg Intelligence, predicts gold will continue to hold its advantage after rising about 60% since the beginning of the year. It is worth noting that in the past, gold and stocks have often moved in opposite directions.

However, gold prices have recently surged even as US stocks hit new highs. The S&P 500, Dow Jones and Nasdaq indexes are all at record highs, but demand for gold remains strong as investors see it as a diversifier against stock market risks.

The US economy is about to release important data such as the October employment report and CPI, creating new expectations that the Fed may cut interest rates by another 0.25 percentage points at the meeting on December 9-10. According to CME FedWatch, the probability of the Fed cutting interest rates is at 63%.

Investors believe that if the Fed loosens its policy, the USD will depreciate, thereby supporting the gold price to increase further. The US government shutdown for the past 42 days has disrupted the supply of data, making it difficult for the Fed to assess the health of the economy. When the data is released again, if the US economy weakens, the gold price will benefit even more.

According to the World Gold Council, gold demand in the second quarter of 2025 reached a record 1,313 tons, with about 220 tons being net purchases by central banks. This is a major driving force for gold prices to maintain an upward trend.

ETF cash flows also continue to support gold prices. The world's largest gold ETF, SPDR Gold Shares, has added 170 tonnes since the beginning of the year, the strongest purchase in 5 years. According to InvestingLive, the dense buying pressure around the $4,100/ounce area shows that this area is a very strong technical support point for gold prices.