Gold price today December 19, 2024: Domestic and international gold prices suddenly increased

Gold price today December 19: World gold price increased slightly while waiting for the Fed's interest rate decision. Domestic gold price jumped to the highest level of half a million VND per tael.

Domestic gold price today December 19, 2024

At the time of survey at 4:30 a.m. on December 19, 2024, the gold price on the trading floors of some companies was as follows:

The price of 9999 gold today is listed by DOJI at 83.7 million VND/tael for buying and 84.7 million VND/tael for selling.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 84.3-85.1 million VND/tael for buying and selling. Compared to yesterday, the price of SJC gold bars increased by 200 thousand VND/tael for buying and keeping the selling price unchanged.

SJC gold price at Bao Tin Minh Chau Company Limited was also traded by the enterprise at 83.1-85.1 million VND/tael (buying - selling). Compared to yesterday, the gold price increased sharply by 500 thousand VND/tael in the buying direction.

At Bao Tin Manh Hai, it is also being traded at 82.6-85.1 million VND/tael (buy - sell).

The latest gold price list today, December 19, 2024 is as follows:

| Gold price today | December 19, 2024 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 83.1 | 85.1 | +500 | - |

| DOJI Group | 82.6 | 85.1 | - | - |

| Mi Hong | 84.3 | 85.1 | +200 | - |

| PNJ | 83.1 | 85.1 | +500 | - |

| Vietinbank Gold | 85.1 | - | ||

| Bao Tin Minh Chau | 83.1 | 85.1 | +500 | - |

| Bao Tin Manh Hai | 82.6 | 85.1 | - | - |

| 1.DOJI- Updated: 19/12/2024 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 82,600 | 85,100 |

| AVPL/SJC HCM | 82,600 | 85,100 |

| AVPL/SJC DN | 82,600 | 85,100 |

| Raw material 9999 - HN | 83,600 | 83,800 |

| Raw materials 999 - HN | 83,500 | 83,700 |

| AVPL/SJC Can Tho | 82,600 | 85,100 |

| 2.PNJ- Updated: 19/12/2024 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 83,600 | 84,700 |

| HCMC - SJC | 83,100▲500K | 85,100 |

| Hanoi - PNJ | 83,600 | 84,700 |

| Hanoi - SJC | 83,100▲500K | 85,100 |

| Da Nang - PNJ | 83,600 | 84,700 |

| Da Nang - SJC | 83,100▲500K | 85,100 |

| Western Region - PNJ | 83,600 | 84,700 |

| Western Region - SJC | 83,100▲500K | 85,100 |

| Jewelry gold price - PNJ | 83,600 | 84,700 |

| Jewelry gold price - SJC | 83,100▲500K | 85,100 |

| Jewelry gold price - Southeast | PNJ | 83,600 |

| Jewelry gold price - SJC | 83,100▲500K | 85,100 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 83,600 |

| Jewelry gold price - Jewelry gold 999.9 | 83,500 | 84,300 |

| Jewelry gold price - 999 jewelry gold | 83,420 | 84,220 |

| Jewelry gold price - 99 jewelry gold | 82,560 | 83,560 |

| Jewelry gold price - 916 gold (22K) | 76,320▼500K | 77,320 |

| Jewelry gold price - 750 gold (18K) | 61,980 | 63,380 |

| Jewelry gold price - 680 gold (16.3K) | 56,070 | 57,470 |

| Jewelry gold price - 650 gold (15.6K) | 53,550 | 54,950 |

| Jewelry gold price - 610 gold (14.6K) | 50,170 | 51,570 |

| Jewelry gold price - 585 gold (14K) | 48,070 | 49,470 |

| Jewelry gold price - 416 gold (10K) | 33,820 | 35,220 |

| Jewelry gold price - 375 gold (9K) | 30,360 | 31,760 |

| Jewelry gold price - 333 gold (8K) | 26,570 | 27,970 |

| 3. SJC - Updated: 12/19/2024 04:30 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 83,100▲500K | 85,100 |

| SJC 5c | 83,100▲500K | 85,120 |

| SJC 2c, 1C, 5 phan | 83,100▲500K | 85,130 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 83,000▲400K | 84,500▲200K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 83,000▲400K | 84,600▲200K |

| 99.99% Jewelry | 82,900▲400K | 84,100▲200K |

| 99% Jewelry | 80,267▲198K | 83,267▲198K |

| Jewelry 68% | 54,343▲136K | 57,343▲136K |

| Jewelry 41.7% | 32,223▲84K | 35,223▲84K |

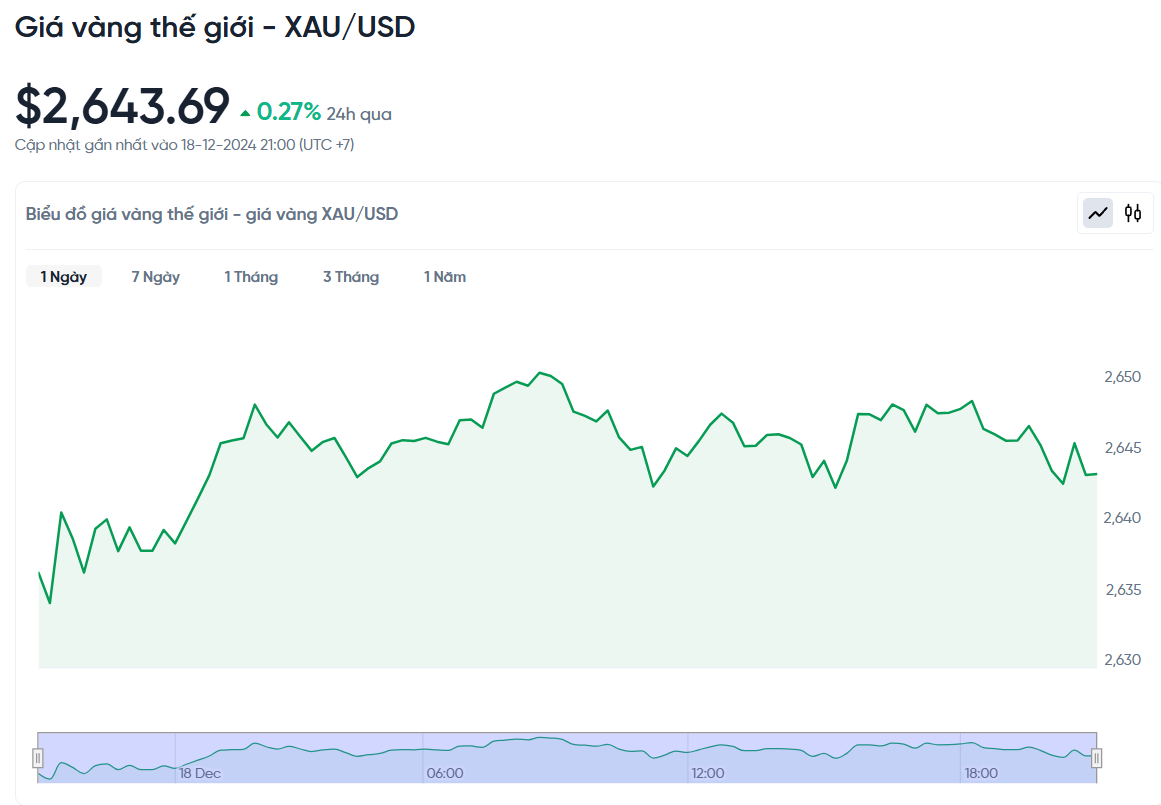

World gold price today December 19, 2024 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 5:00 a.m. today, Vietnam time, was 2,643.69 USD/Ounce. Today's gold price increased by 7 USD/Ounce compared to yesterday. Converted according to the USD exchange rate, on the free market (25,720 VND/USD), the world gold price is about 82.89 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 2.21 million VND/tael higher than the international gold price.

According to the latest report from the US Department of Commerce, retail sales data last month showed that American consumers maintained quite stable purchasing power, but there were signs of slowing down.

Specifically, retail sales in November increased 0.7%, higher than the forecast of 0.6%. At the same time, the data for October was also adjusted up 0.5%. Over the past 12 months, US retail sales have increased 3.8%.

However, excluding autos (the "core" retail sales), the figure rose just 0.2%, below expectations of 0.4%.

The price of gold in the world market is currently quite quiet, which also affects the price of gold in the country, causing the domestic gold market to not fluctuate much. According to experts, the main reason for this situation is that many investors are on holiday and they are waiting for the economic forecasts that will be announced by the US Federal Reserve (Fed). Therefore, they limit their gold buying and selling activities during this time.

Currently, investors' attention is focused on the economic forecasts that the Fed will announce, as this information will greatly influence decisions to adjust US monetary policy in 2025 and 2026.

“Gold could see a further boost later in the day following the Fed announcement,” said Matt Simpson, senior analyst at City Index. “The market may have been over-expecting rate cuts next year, so if the Fed hints at two cuts, that could push gold higher.”

Additionally, the central banks of Japan, Britain, Sweden and Norway will also make policy decisions this week.

Chile's central bank cut its key interest rate by 0.25 percentage point to 5.00% on Tuesday, continuing an easing cycle that began last year.

Gold does not offer yield so it typically performs well in low interest rate environments.

Traders are also closely watching US GDP and inflation data due out this week for further insights into the economic situation.

China is buying gold at a rate 10 times faster than publicly acknowledged, according to a new report from Goldman Sachs. Central banks bought a total of 64 tonnes of gold in October, three times the average before 2022. Of that, China bought 55 tonnes, but the official figure from the People's Bank of China (PBoC) was only 5 tonnes. This shows that China is trying to increase its gold reserves to reduce its dependence on the US dollar and protect the value of national assets in the context of global economic and political instability.

According to Goldman Sachs, the increase in gold purchases by central banks, especially in emerging countries, reflects the need to protect assets from financial and geopolitical risks.

Goldman Sachs believes that demand for gold will remain strong as central banks seek to diversify their reserves, especially after Russia's assets are frozen in 2022.

Gold price forecast

Increased gold buying by central banks, especially China, has fueled forecasts that gold prices could hit $3,000 an ounce by the end of 2025.

A World Gold Council survey found that 81% of central banks expect global gold reserves to continue to rise next year, and none predict a decline.

Analysts remain bullish on gold prices over the next 12 months, predicting prices will reach $2,900 an ounce by the end of next year. They also recommend investors, especially those with dollar-denominated assets, allocate 5% of their portfolios to gold as a means of diversification.

In addition to gold, there is also optimism about long-term investment opportunities in copper and other transition metals. Demand for these metals is expected to increase sharply thanks to increased investment in future power generation, energy storage and electric transport.