Gold price today October 23, 2024: World gold price approaches record peak of 2740 USD/ounce

Gold price today October 23, 2024: The price of 9999 gold rings continued to increase by nearly 1 million to a new milestone of 87.6 million VND/tael. In addition, SJC gold also increased sharply by 1 million VND/tael. World gold advanced to a record peak of 2740 USD/ounce

Domestic gold price today October 23, 2024

At the time of survey at 5:00 a.m. on October 23, 2024, the gold price on the trading floors of some companies was as follows:

The price of 9999 gold today is listed by DOJI at 86.6 million VND/tael for buying and 87.6 million VND/tael for selling. Compared to yesterday, the price of DOJI gold rings continued to increase sharply by 800 thousand VND/tael in both buying and selling directions.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 88.3-89 million VND/tael (buy in - sell out). The price of Mi Hong gold increased sharply by 1 million VND/tael in both buying and selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is also traded by the enterprise at 87-89 million VND/tael (buy in - sell out). Meanwhile, at Bao Tin Manh Hai, it is being traded at 87-89 million VND/tael (buy in - sell out).

Gold price increased sharply by 1 million VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, October 23, 2024 is as follows:

| Gold price today | October 23, 2024 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 87 | 89 | +1,000 | +1,000 |

| DOJI Group | 87 | 89 | +1,000 | +1,000 |

| Mi Hong | 88.3 | 89 | +1,000 | +1,000 |

| PNJ | 87 | 89 | +1,000 | +1,000 |

| Vietinbank Gold | 89 | - | +1,000 | |

| Bao Tin Minh Chau | 87 | 89 | +1,000 | +1,000 |

| Bao Tin Manh Hai | 87 | 89 | +1,000 | +1,000 |

| 1.DOJI- Updated: 10/23/2024 05:10 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 87,000▲1000K | 89,000▲1000K |

| AVPL/SJC HCM | 87,000▲1000K | 89,000▲1000K |

| AVPL/SJC DN | 87,000▲1000K | 89,000▲1000K |

| Raw material 9999 - HN | 86,500▲600K | 86,900▲600K |

| Raw materials 999 - HN | 86,400▲600K | 86,800▲600K |

| AVPL/SJC Can Tho | 87,000▲1000K | 89,000▲1000K |

| 2.PNJ- Updated: 10/23/2024 05:10 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 86,300▲500K | 87,600▲850K |

| HCMC - SJC | 87,000▲1000K | 89,000▲1000K |

| Hanoi - PNJ | 86,300▲500K | 87,600▲850K |

| Hanoi - SJC | 87,000▲1000K | 89,000▲1000K |

| Da Nang - PNJ | 86,300▲500K | 87,600▲850K |

| Da Nang - SJC | 87,000▲1000K | 89,000▲1000K |

| Western Region - PNJ | 86,300▲500K | 87,600▲850K |

| Western Region - SJC | 87,000▲1000K | 89,000▲1000K |

| Jewelry gold price - PNJ | 86,300▲500K | 87,600▲850K |

| Jewelry gold price - SJC | 87,000▲1000K | 89,000▲1000K |

| Jewelry gold price - Southeast | PNJ | 86,300▲500K |

| Jewelry gold price - SJC | 87,000▲1000K | 89,000▲1000K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 86,300▲500K |

| Jewelry gold price - Jewelry gold 999.9 | 86,200▲600K | 87,000▲600K |

| Jewelry gold price - 999 jewelry gold | 86,110▲600K | 86,910▲600K |

| Jewelry gold price - 99 jewelry gold | 85,230▲590K | 86,230▲590K |

| Jewelry gold price - 916 gold (22K) | 79,290▲550K | 79,790▲550K |

| Jewelry gold price - 750 gold (18K) | 64,000▲450K | 65,400▲450K |

| Jewelry gold price - 680 gold (16.3K) | 57,910▲410K | 59,310▲410K |

| Jewelry gold price - 650 gold (15.6K) | 55,300▲390K | 56,700▲390K |

| Jewelry gold price - 610 gold (14.6K) | 51,820▲370K | 53,220▲370K |

| Jewelry gold price - 585 gold (14K) | 49,650▲360K | 51,050▲360K |

| Jewelry gold price - 416 gold (10K) | 34,940▲250K | 36,340▲250K |

| Jewelry gold price - 375 gold (9K) | 31,380▲230K | 32,780▲230K |

| Jewelry gold price - 333 gold (8K) | 27,460▲200K | 28,860▲200K |

| 3. SJC - Updated: October 23, 2024 05:10 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 87,000▲1000K | 89,000▲1000K |

| SJC 5c | 87,000▲1000K | 89,020▲1000K |

| SJC 2c, 1C, 5 phan | 87,000▲1000K | 89,030▲1000K |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 86,000▲1100K | 87,300▲1100K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 86,000▲1100K | 87,400▲1100K |

| 99.99% Jewelry | 85,900▲1100K | 87,000▲1100K |

| 99% Jewelry | 84,138▲1089K | 86,138▲1089K |

| Jewelry 68% | 56,815▲748K | 59,315▲748K |

| Jewelry 41.7% | 33,932▲459K | 36,432▲459K |

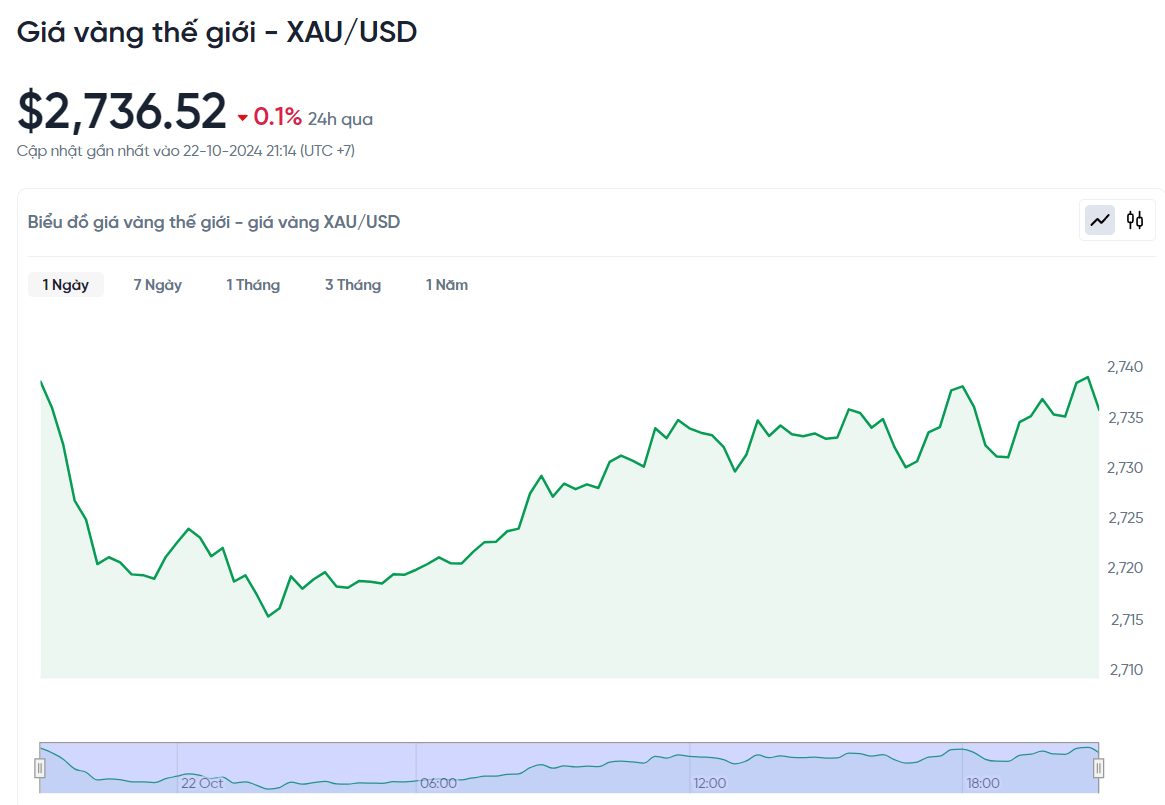

World gold price today October 23, 2024 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 5:00 a.m. today, Vietnam time, was 2,736.52 USD/Ounce. Today's gold price increased by 2.82 USD/Ounce compared to yesterday. Converted according to the USD exchange rate, on the free market (25,360 VND/USD), the world gold price is about 85.26 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 3.73 million VND/tael higher than the international gold price.

Since the beginning of June, those who bought gold to stabilize the price have made a profit of 8 million VND per tael, an increase of 7.5%. The State Bank has sold gold through 4 commercial banks and SJC company.

SJC gold initially sold for VND78.98 million/tael and was sold for VND79.98 million/tael. People lined up to buy gold, then gold sales moved online. SJC gold has increased by VND18 million/tael since the beginning of the year, an increase of 25.3%. SJC gold is approaching the record price of VND92.4 million/tael, reached in May.

Last week, the price of each tael of plain rings increased by 3.5 million VND and gold bars increased by 4 million VND. Compared to the beginning of the year, the price of plain rings increased by 23.5 million VND per tael, an increase of 37%; gold bars increased by 20 million VND per tael, an increase of 20%.

Despite the price increase, domestic gold bar and plain ring trading remains weak due to limited supply. Many people have difficulty buying gold and major brands are often out of stock.

Marc Chandler, CEO of Bannockburn Global Forex, stressed that demand for gold will continue to increase due to tensions in the Middle East and the BRICS meetings.

Experts expect the BRICS Summit to be a short-term gold price driver, given its impact on the US dollar and interest in gold.

At the BRICS Summit, announcements on new members and new payment systems are expected, which could positively affect gold prices.

The BRICS group of emerging economies (Brazil, Russia, India, China and South Africa) currently holds more than 20% of the world's gold, a significant figure that reflects the growing economic power and influence of these countries.

According to the World Gold Council report, Russia leads the group with 2,340 tons of gold (accounting for 8.1% of global gold reserves), while China has 2,260 tons. Russia and China account for 74% of BRICS gold, while India owns 840 tons, leading the remaining countries.

The BRICS gold holdings have important economic implications. Gold is considered a safe haven asset, helping to reduce economic risk and protect against inflation. This reinforces the BRICS’ role as major economic powers. At the same time, the potential creation of a BRICS common currency, possibly backed by gold, could challenge the dominance of the US dollar and alter the global balance of power.

Rising demand for gold, fueled by central bank buying and economic uncertainty, also presents a great investment opportunity. The upcoming BRICS summit in Kazan, Russia, will provide more details on plans to launch a common currency, which could accelerate the de-dollarization process.

The BRICS gold reserves and the possibility of a new currency could have a profound impact on the global financial system. Investors and governments should closely monitor these developments to seize opportunities and respond to possible changes in the world market.

Gold price forecast

Darin Newsom, a senior market analyst at Barchart.com, is bullish on the future of gold and other precious metals.

Mr. Newsom predicted that world gold prices will increase due to investor demand seeking safety amid uncertainties related to the upcoming US presidential election.

Kevin Grady, president of Phoenix Futures and Options, said that with interest rates falling, gold has the potential to reach new highs. Grady also predicted that gold prices could reach $3,000 an ounce in the first quarter of 2025.

Major banks predict that precious metals prices could rise to $3,000 an ounce next year. Investors are advised to have a small portion of their portfolios in precious metals, especially given the recent price increase.

Many analysts believe that gold prices will continue to rise, possibly reaching $3,000 an ounce.

Michael Widmer from Bank of America believes that gold prices are in a favorable period, possibly exceeding $3,000 due to rising public debt and geopolitical instability.

Experts from Citi also believe that gold prices could reach $3,000 in the next 6 to 9 months, and could rise further if oil prices rise due to tensions in the Middle East.

Commonwealth Bank of Australia forecasts gold prices could remain at $3,000 in the fourth quarter of next year due to a weak US dollar. However, current gold prices are expected to average $2,800.