Gold prices continue to rise next week

The impact of the Fed keeping interest rates unchanged and profit-taking activities at the end of September has led many to predict that gold prices will increase next week.

After the US Federal Open Market Committee's policy meeting in the middle of last week with the decision not to raise interest rates, gold prices have tended to increase again. At many times, gold prices reached their highest peak in the past 2 weeks. At the end of the trading session of the week (September 23), gold prices were pinned at a high of 1,337 USD/oz. It can be said that the gold market experienced a trading week with the highest price increase in nearly 2 months.

Many investors have already concluded that the gold market seems to be moving with the assumption that there will be no Fed rate hikes from now until the end of the year. Therefore, the factors that will affect the gold price next week that many people are interested in are only the gold selling activities to take profits before the end of September, which is also the end of the third quarter of 2016. In addition, the political factor is also taken into account by the market as the two US presidential candidates are preparing to enter the first round of debates.

|

| A Kitco News survey shows that the rate of predicting gold prices to increase is at a very high level. (Photo: Kitco News) |

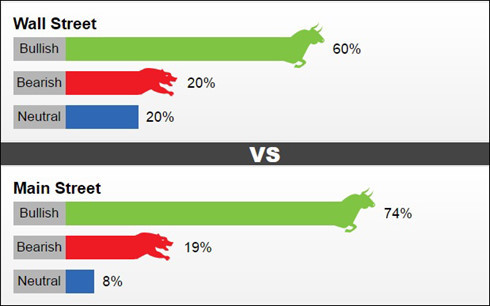

Meanwhile, the results of the survey on gold price forecasts for next week conducted by Kitco News also show that both forecast channels (Wall Street and Main Street) share many optimistic opinions, predicting that gold prices will continue to increase from last week, right after the Fed decided not to raise interest rates soon.

Specifically, 12/20 gold market analysts and traders (60%) believe that gold prices will continue to rise next week. Along with 596/809 participants in Kitco News' online survey (74%) also believe that gold prices will rise higher than current levels, it is also possible that gold prices will increase in the long term.

Phil Flynn, senior market and price analyst at Futures Group, said that gold prices will continue to rise since the Fed decided to keep interest rates steady. Meanwhile, there is no sign that the agency will show a tightening monetary policy, at least in the near future.

“Even if the Fed raises rates in December, I’m afraid that won’t have much impact on the gold market, because interest rates have been low for a long time,” Flynn said. “Many people like me feel that way, because if you look at the odds of a Fed rate hike in December, which are only at 60% and are trending down, people will have the feeling that even if the Fed does raise rates in December, it won’t easily lead to a series of rate hikes, which alone will be enough to support gold prices.”

Similarly, Charlie Nedoss, senior market strategist at LaSalle Futures Group, through technical analysis of the gold price path chart, said that the 100-day average of the gold price is showing a major support level. Tested earlier this week, the gold price will have a surge likened to the launch of a rocket.

More cautious about the gold price increase, Kevin Grady, President of Phoenix Futures and Options LLC, said that it is likely that gold prices may stagnate or decline due to profit-taking activities at the end of September and the end of the third quarter. He also pointed out that there were about 5,000 new futures contracts signed last week, so gold prices may fall, but it is unlikely that gold prices will fall significantly.

According to VOV

| RELATED NEWS |

|---|