E-commerce transactions subject to 10% tax is fake information

Information related to e-commerce transactions being taxed at 10% that appears a lot on social networks today is incorrect.

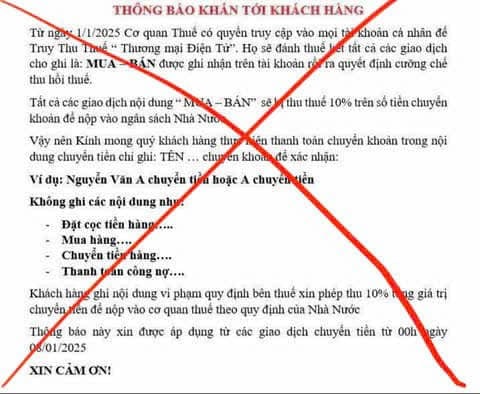

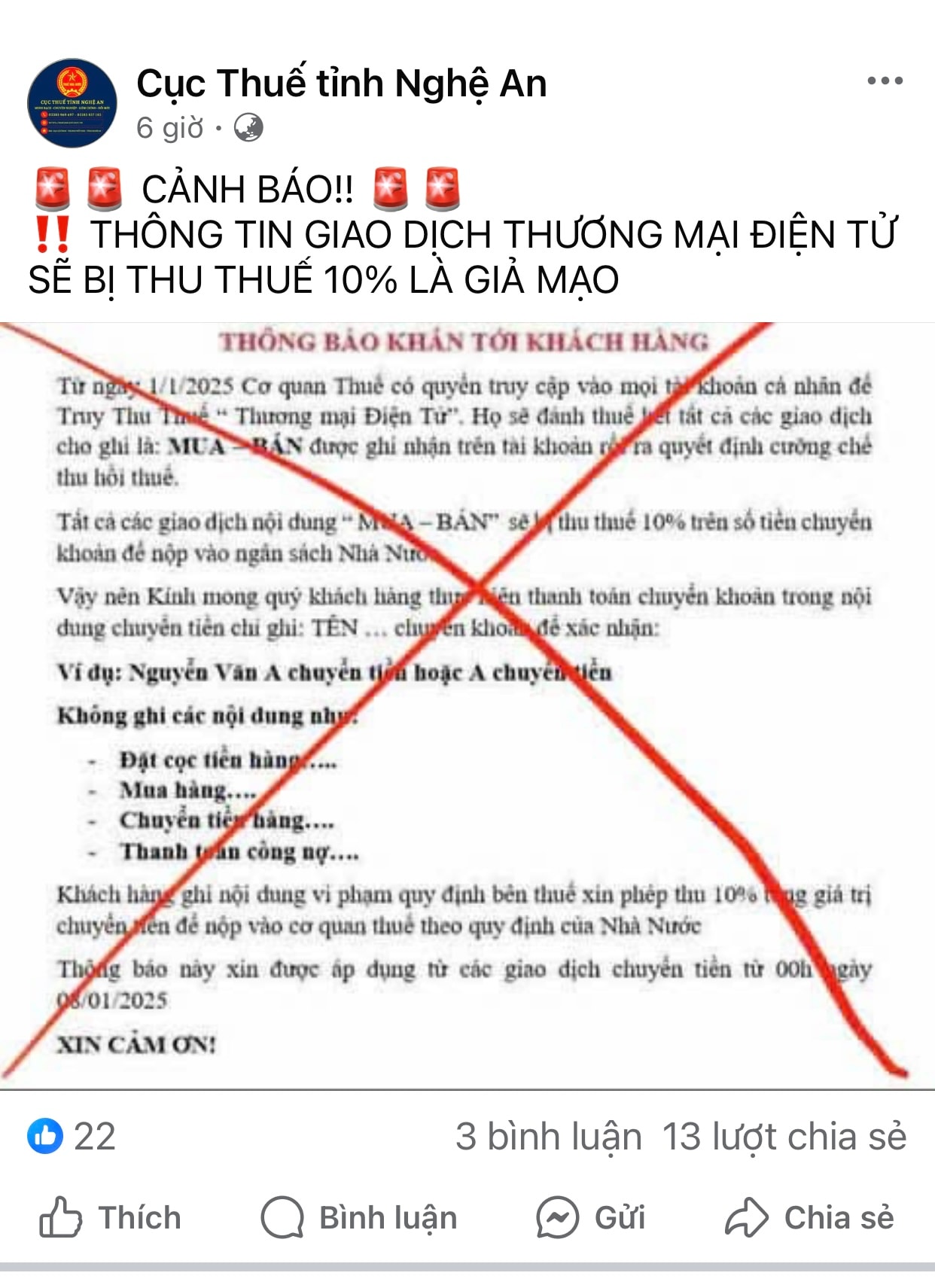

In recent days, a notice appeared on social networks with the following content: "From January 1, 2025, tax authorities have the right to access all personal accounts to collect e-commerce transactions. Specifically, all transactions with the content of Buy - Sell will be taxed 10% on the transferred amount."

Many e-commerce businesses through livestream and social networking platforms such as Facebook, TikTok, YouTube... notify buyers about the content of the message when paying for goods. If the buyer transfers money and writes the purchase content, the seller will collect 10% of the total transfer value to pay to the tax authority.

This information makes online businesses and shoppers confused.

Regarding this issue, Ms. Nguyen Thi Lan Anh - Director of the Department of Tax Management for Small and Medium Enterprises, Business Households and Individuals (General Department of Taxation) said that the information about e-commerce transactions being taxed at 10% spreading on social networks is incorrect.

According to current regulations in Circular 40 of the Ministry of Finance guiding on value added tax, personal income tax and tax management for business households and individual businesses, the tax rate for e-commerce business is 1.5% of revenue, including 1% value added tax and 0.5% personal income tax. These tax rates apply to sellers through e-commerce.

Buyers of goods and services do not have to pay additional tax because the 1% value added tax has been added to the price of the goods by the seller.

For online sellers who have not declared and paid taxes, tax authorities always track down to determine revenue to collect taxes and impose fines for late tax payment.

Currently, the Nghe An Provincial Tax Department has also announced and propagated to people to be vigilant, select information, and not share false information that causes public confusion.

.jpg)

.jpg)