Young Vietnamese people have an easier time owning a home than those in developed countries.

Young people's incomes in Vietnam have not caught up with housing prices in Ho Chi Minh City and Hanoi, but they receive inheritance or financial support.

In many parts of the world, Generation Y (also known as Millennials, born between 1981 and 1991) is having difficulty owning real estate. However, in Ho Chi Minh City and Hanoi, the opposite is true. Although young people’s income is not enough to buy a house, they still own residential real estate due to financial support from their families, or even inheritance.

Savills Hanoi Residential Sales Director Duong Duc Hien said that according to the results of the mid-term Population and Housing Census as of April 1, 2014, the rate of home ownership was 90.8%, a slight decrease compared to the rate in 2009 of 92.8%. However, if analyzed more deeply, this rate is the result of the younger generation inheriting residential real estate from the previous generation or receiving significant support when buying a house.

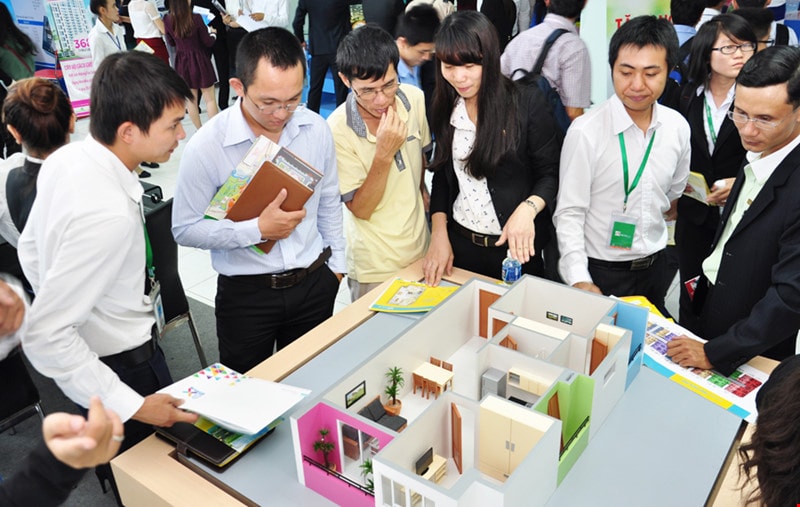

|

| Young people's income is not enough to buy a house, but they still own residential real estate due to financial support from their families or inheritance. |

Mr. Hien said that without this assistance, home ownership for customers under 35 years old in big cities in Vietnam would be very difficult. Because the income of young customers cannot afford the housing prices in big cities like Hanoi and Ho Chi Minh City.

The price of a mid-range 2-bedroom apartment in Hanoi ranges from 3-6 billion VND, equivalent to 140,000 - 200,000 USD. Housing prices in Ho Chi Minh City are a little more competitive than in Hanoi but not too different. With current high housing prices, the income of young people in Vietnam cannot keep up and family support is currently contributing significantly to the financial potential of young buyers.

According to a survey on the ability of young people to buy a house in developed markets, the situation is somewhat more difficult than in Vietnam. Specifically, in Australia, the number of people aged 25-34 only accounts for 45% of the total number of home owners (this rate used to be 58% in 1986). This shows that the rate of young people buying a house is decreasing quite a lot.

In the US, the figure is 31% for those under 35, down from 39% in 1995. The under-35 group owns just 5% of all homes owned in the UK and they pay rents 4.5 times higher than mortgage rates.

|

A high-rise housing project in Ho Chi Minh City. Photo:Vu Le |

Savills Sydney Head of Residential Research Sophie Chick believes the impact on younger buyers is due to the fact that home ownership is increasingly concentrated among older generations, who have had access to home ownership before, are well-served by mortgages and have not faced the recent surge in house prices.

As a result, the younger generation with limited financial resources is increasingly finding it difficult to buy a home in a context where larger financial resources are needed to meet higher housing prices and larger deposits. Generation Y (also known as the renter generation) has had to postpone major events such as marriage and children, and one of the requirements for home ownership today is having two income earners, despite the low interest rates in the post-global financial crisis period.

One option for millennials in other parts of the world is the private rental sector. Around a third of the population in Anglophone countries still rents. On the other hand, in owner-occupier markets, rents are very high (e.g. 50% in Germany). Home ownership in these countries will also become more concentrated among older groups.