A series of important new policies will take effect from January 2026.

Entering 2026, many major policies on taxes, wages, land, education, labor, and business officially came into effect on January 1st. These new regulations not only directly impact people's lives but also have a profound effect on the production and business activities of enterprises and business households nationwide.

One notable point is that a series of policies related to taxes, wages, and land have been adjusted to be closer to reality, while tightening management discipline in some sensitive areas.

Issuing invoices at the wrong time will be subject to fines of up to 70 million VND, effective from January 16, 2026.

According to Decree 310/2025/ND-CP amending regulations on administrative penalties for tax and invoice violations, from January 16, 2026, the act of issuing invoices at the wrong time when selling goods or providing services will be subject to higher penalties than before.

Specifically, issuing 100 or more invoices at the wrong time will result in a fine of 50 to 70 million VND. If the violation involves 50 to under 100 invoices, the fine will be 30 to 50 million VND. For minor violations, the lightest penalty is a warning.

This regulation aims to strengthen discipline in invoice management, curb tax evasion, and prevent the manipulation of revenue in a way that does not reflect reality.

Develop and implement a new land price list effective from January 1, 2026.

The 2024 Land Law stipulates that, from January 1, 2026, provincial People's Committees are responsible for developing and submitting to the People's Councils at the same level for approval the initial land price list for publication and application.

Unlike before, land price tables will be adjusted annually, instead of remaining stable for a long period. If necessary, the Provincial People's Committee can submit to the Provincial People's Council for adjustment, amendment, or supplementation of the land price table within the same year to reflect actual market fluctuations.

This regulation is expected to address the significant discrepancy between land prices in the official price list and actual transaction prices.

Increase the personal allowance to 15.5 million VND/month.

According to Resolution 110/2025/UBTVQH15, the personal allowance for calculating personal income tax will be increased and applied from the 2026 tax year.

Specifically, the personal tax deduction will be VND 15.5 million/month (VND 186 million/year), replacing the current VND 11 million/month. The deduction for each dependent will increase to VND 6.2 million/month.

This adjustment significantly reduces the tax burden for workers, especially in the context of rising living costs.

Increase the regional minimum wage for contract workers.

Decree 293/2025/ND-CP stipulates the new regional minimum wage levels, effective from January 1, 2026.

Accordingly, the highest monthly minimum wage in Region I is 5.31 million VND, and the lowest is in Region IV at 3.7 million VND. The hourly minimum wage has also been adjusted upwards correspondingly in all four regions.

The regulations apply to employees working under labor contracts and employers in all economic sectors.

Many new regulations regarding land acquisition, compensation, and resettlement.

Resolution 254/2025/QH15 of the National Assembly, effective from January 1, 2026, supplements many regulations aimed at resolving obstacles in the implementation of the 2024 Land Law.

Accordingly, the State is expanding the cases in which land can be reclaimed, including projects for the construction of drug rehabilitation centers managed by the armed forces, projects in free trade zones, and international financial centers.

Notably, it allows for land acquisition before the completion of compensation and resettlement in certain cases; the land price adjustment coefficient is issued annually by the provincial People's Committee and can be adjusted within the year if necessary.

Household businesses switching from lump-sum tax to declaration-based tax

According to Resolution 198/2025/QH15, from January 1, 2026, households and individual businesses will no longer apply the lump-sum tax method but must pay taxes using the declaration method.

When filing tax returns, business households are required to have complete and valid invoices and documents for goods and services purchased and sold. At the same time, the revenue threshold for tax exemption has been raised from 200 million VND to 500 million VND per year, and this amount can be deducted before calculating tax.

Exemption from business license fees, extension of exemption from agricultural land use tax.

From January 1, 2026, businesses and household businesses will be exempt from business license fees as stipulated in Resolution 198/2025/QH15.

In addition, Decree 292/2025/ND-CP extends the exemption from agricultural land use tax until December 31, 2030, for many types of land and land users in the agricultural sector.

Teachers are given the highest salary priority within the public administration sector.

The 2025 Teacher Law for the first time clearly stipulates that teachers in public educational institutions will be paid at the highest level in the administrative and public service salary scale system.

In addition to their salaries, teachers also receive professional incentive allowances and other allowances depending on their working conditions, region, and the nature of their work.

Businesses must delete data of employees who have left the company.

The Personal Data Protection Law of 2025 stipulates that when an employee is no longer employed or when a labor contract is terminated, the employer must delete or destroy the employee's personal data, unless otherwise agreed upon or stipulated by law.

This regulation aims to ensure privacy and security of personal data in labor relations.

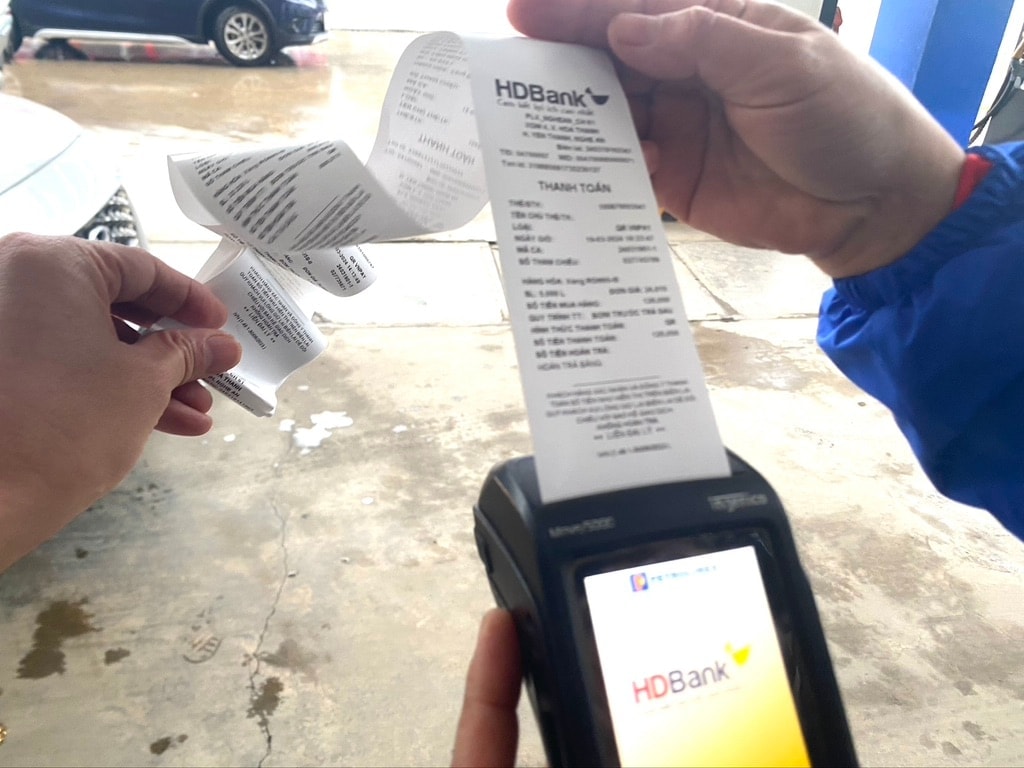

Reduce environmental protection tax on gasoline and diesel by 50% in 2026.

According to Resolution 109/2025/UBTVQH15, the environmental protection tax on gasoline, diesel, and lubricants will continue to be reduced by 50% in 2026, similar to the rate applied in 2025 (excluding aviation fuel).

This tax rate will be adjusted back to the old regulations from 2027 unless a resolution is passed to extend it further.