Online personal income tax refund with results in just 3 days

Personal Income Tax refund in just 3 days is the content stated in the decision of the General Department of Taxation on the automatic personal income tax refund process.

According to the General Department of Taxation, from 2025, the tax authority will automatically refund personal income tax. In just 3 days, taxpayers will know the results of their tax refund application.

Automatically generate tax settlement records

Recently, the General Director of the General Department of Taxation issued Decision 108/QD-TCT on the automatic personal income tax (PIT) refund process. This process stipulates the order and procedures for the Tax authority to process PIT refund dossiers for individuals who directly settle taxes and request refunds on the tax settlement declaration.

The automatic personal income tax refund process includes three main steps:

- Create and receive suggested Personal Income Tax Finalization Declaration with tax refund request from taxpayers.

- Automatically resolve personal income tax refunds based on declared information.

- Post-refund control to ensure the accuracy of tax refunds.

Based on the declaration database from the income-paying organization and individuals, along with tax registration data, dependent registration data and general information on tax obligations, the information technology (IT) system of the Tax sector will automatically synthesize data. This system will compare the indicators on the personal income tax finalization declaration to determine the taxpayer's declaration obligations and create a suggested tax finalization declaration for individuals to directly finalize taxes.

The data synthesis and creation of the Suggested Declaration are performed by the Tax sector's IT system immediately after the deadline for submitting the personal income tax finalization declaration of the income-paying organization.

Taxpayers can useeTax Mobile applicationor the General Department of Taxation's Personal Electronic Tax application to check the information on the suggested Tax Finalization Declaration.

- If agreeing with the suggested information, the taxpayer confirms and submits the settlement documents on the application as prescribed.

- If disagreeing, taxpayers can edit information in the corresponding indicators, add reasons for differences compared to the data suggested by the tax authority and submit the settlement dossier with supporting documents.

Automatically resolve personal income tax refunds

The administrative procedure settlement information system will automatically create and send:

Notice on receiving electronic tax declaration dossiers

Notice on receiving tax refund application

These notifications will be sent immediately after the system receives the tax settlement file with the indicator "Tax refund to taxpayer".

Then, the automatic tax refund subsystem will continue to create a tax refund request file and perform the next processing steps according to regulations.

Prepare in advance for personal income tax refund

To make a refund of paid personal income tax, taxpayers must have an account at the General Department of Taxation Portal.

To do your own personal income tax refund online, you need to have complete electronic personal income tax deduction documents from companies that pay income in the tax settlement year.

How to submit personal income tax refund application online in detail

Method 1: Refund personal income tax on the General Department of Taxation's Information Portal

The personal income tax refund you receive is the amount of overpayment after tax settlement. Specifically, the steps are as follows:

Step 1: Access the Vietnam Tax website and select "Individual"

Step 2: Select a login account and fill in all required information

Step 3: Select “Tax settlement” >> Select “Online declaration”

Step 4: Enter the declaration information displayed on the system

Step 5: Submit the declaration

Step 6: Send documents and attached personal income tax deduction certificates

Method 2: Personal income tax refund on eTax Mobile

To make a personal income tax refund on eTax Mobile, follow these steps:

Step 1: Open the app and log in to your eTax Mobile account

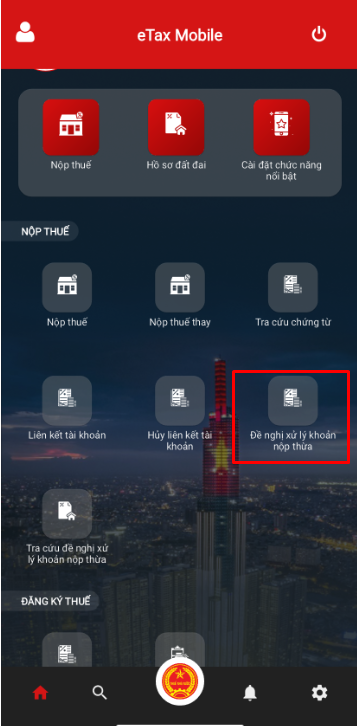

Step 2: Select “Request to process overpayment”

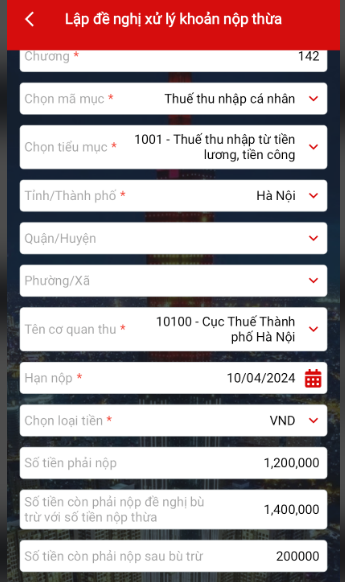

Step 3: Submit a tax refund request

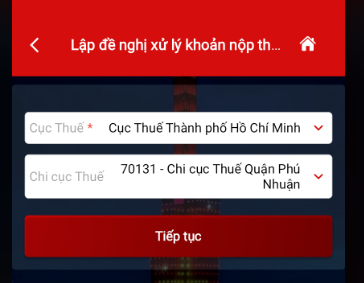

Select the Tax Department and Tax Branch (if any) and Select “Continue“

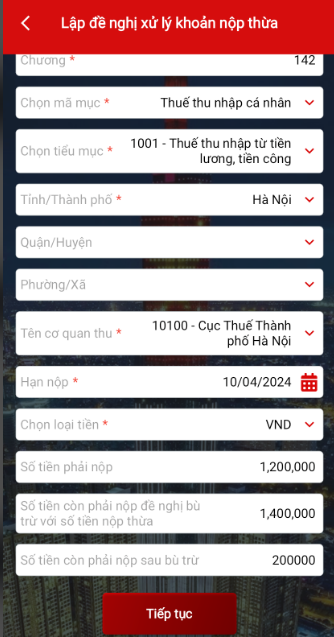

Step 4: Enter the information of the person requesting to handle the overpaid tax >> Select “Continue”

Note: Items marked with * are required.

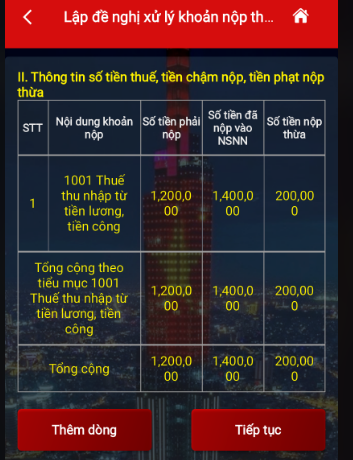

Step 5: Check the information of tax amount, late payment, overpayment penalty >> Select "Continue"

Step 6: Enter the amount payable, the remaining amount to be offset with the overpaid amount, the remaining amount to be paid after offset as well as the required information >> Select "Continue"

Note: Items marked with * are required.

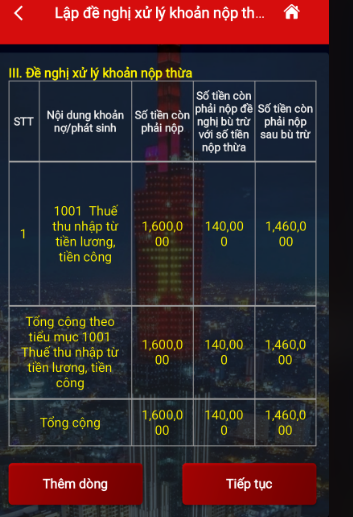

Step 7: Check the information of the amount of money requested to process the overpayment >> Select "Continue"

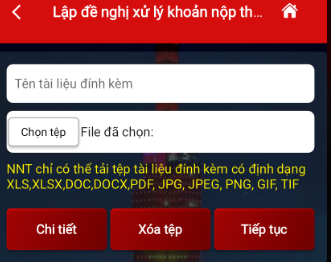

Step 8: Name the attached document and select the tax refund request >> Select “Continue”

Select declaration: 02/QTT-TNCN – Personal income tax finalization declaration (TT80/2021)

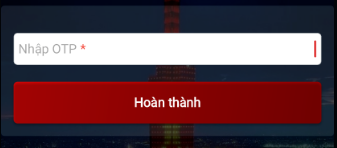

Step 9: Enter the OTP code sent to the taxpayer's phone number >> Select "Complete"

.jpeg)