Hoang Anh Gia Lai is facing cash flow difficulties.

Sharing with reporters, Mr. Doan Nguyen Duc admitted to having difficulties with cash flow, but with the group's strong restructuring, he believes Hoang Anh Gia Lai will operate well again.

Immediately after Hoang Anh Gia Lai Group (Stock code: HAG) announced its audited consolidated report with poor business results, the company's shares were sold heavily on the stock exchange today. The two codes HAG and HNG (shares of the subsidiary specializing in agriculture) dropped to 6,900 VND per share - the lowest in history.

Talk toreporteramid auditors questioning the company's ability to continue operating as a going concern,Chairman of Hoang Anh Gia Lai - Doan Nguyen Duc affirmed that the company is still operating normally and is in the restructuring phase.

|

Mr. Duc said that business has its ups and downs and he is very sad when shareholders suffer losses due to falling stock prices. |

Regarding the mortgage of assets such as cows, stocks, football academies, etc. to borrow capital, Mr. Duc admitted but said that this is a normal practice in business investment."No corporation in the world or in Vietnam can borrow money without collateral. Banks also have to look at the ability to repay debt before lending. These are all assets of Hoang Anh Gia Lai. Investors can look at the debt to total assets to see clearly," said Mr. Duc.

Regarding outstanding debt of nearly 27,100 billion VND, an increase of 49.5% compared to the end of 2014 with major creditors being BIDV Bank, BIDV Securities Company, Eximbank, Asia Commercial Bank (ACB), Lao Viet Joint Venture Bank, Sacombank, VPbank... Mr. Duc said that he is negotiating for restructuring. When there are results, the company will notify shareholders and the public.

However, he noted that for banks, businesses must be trustworthy to be able to borrow capital. Regarding ACB selling off more than 28 million HNG shares to recover debt, Mr. Duc said that it was the bank's business, which had been carefully calculated, so he did not comment.

Sharing more about the difficulties being encountered, this leader said that they mainly come from the rubber sector. "LBusiness has its ups and downs. Just like 10 years ago, no one thought the oil price would drop below 30 USD per barrel," he commented. Accordingly, when Hoang Anh Gia Lai invested in rubber, with a capital of 1,300 USD, it could sell for 5,500 USD per ton. However, there are times when the price drops to 1,100 USD, so Mr. Duc said that it is normal for businesses to face difficulties, even though other sectors are operating well.

"What I find most painful and worrying is that investors are suffering losses when the stock price falls. When the stock price falls, the company cannot say anything good. However, as the head of the group, I hope investors should stay calm at this time, look at the effective projects of Hoang Anh Gia Lai to avoid regrets later," he shared.

In addition, Mr. Duc said that he himself is also a shareholder, if the stock price falls, the biggest loss will be to him personally.This person also affirmed that after strong restructuring, Hoang Anh Gia Lai will operate better. "I affirm and believe that it is so," he emphasized.

|

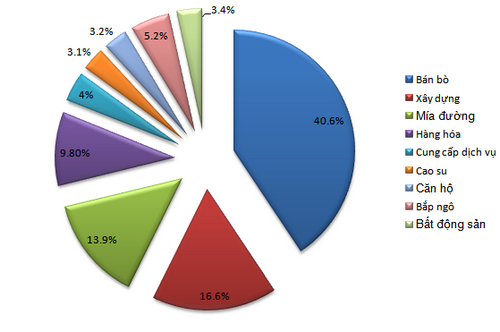

Hoang Anh Gia Lai's revenue structure in 2015. |

Previously, General Director Vo Truong Son also said that in the coming time, Hoang Anh Gia Lai will focus on its main business areas, including cattle breeding, planting an additional 6,000 hectares of sugarcane in Laos and 30,000 hectares of palm oil. In the palm oil sector, the group has built a factory, tested operations and achieved good results. At the same time, it will plant an additional 30,000 hectares of rubber and invest in a real estate project complex in Myanmar.

Yesterday (April 11), Hoang Anh Gia Lai Group officially announced its 2015 audited report. Accordingly, the company's revenue reached over 6,200 billion VND, but due to high interest costs, profits decreased to only 602 billion VND. The group's largest revenue comes from raising cows and building...

According to VNE

| RELATED NEWS |

|---|