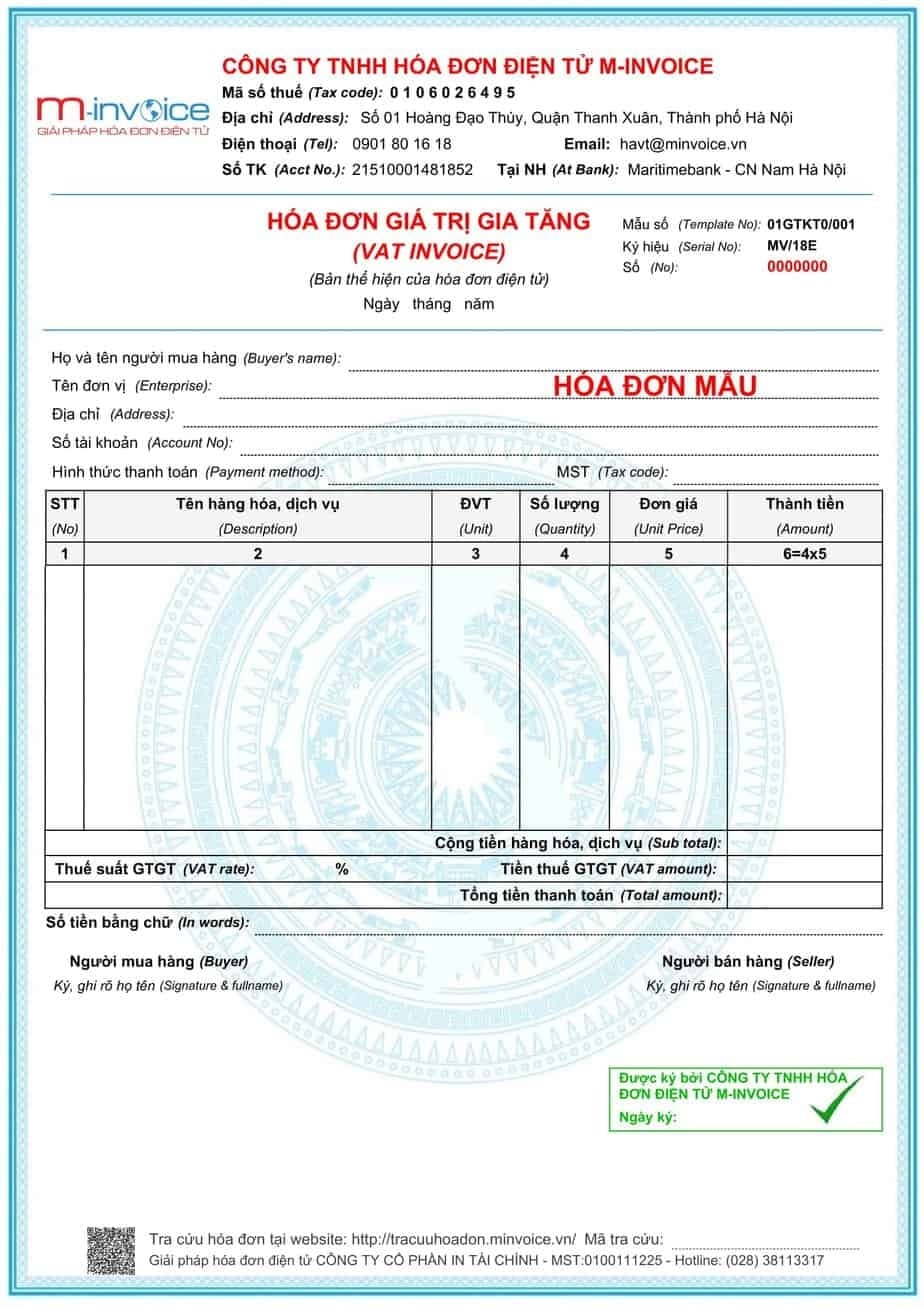

Tax policy Q&A: Cases of stopping the use of electronic invoices

Enterprises asked about cases of stopping using electronic invoices, the Tax Department responded as follows:

According to the provisions of Article 9 and Article 15 of Circular No. 68/2019/TT-BTC, cases of stopping the use of electronic invoices with tax authority codes and electronic invoices without tax authority codes include:

- Cases specified in points a, b, c, d, clause 1, Article 15 of Decree No. 119/2018/ND-CP, specifically:

+ Enterprises, economic organizations, other organizations, households, and business individuals whose tax codes have expired;

+ Enterprises, economic organizations, other organizations, households, and business individuals that are subject to verification and notification by the tax authority that they are not operating at the registered address;

+ Enterprises, economic organizations, other organizations, households and business individuals notify the competent state management agency to temporarily suspend business;

+ Enterprises, economic organizations, other organizations, households and business individuals have received notice from the tax authority about stopping the use of electronic invoices to enforce tax debt collection;

- Other cases are guided in Circular No. 68/2019/TT-BTC as follows:

+ In case of using electronic invoices to sell smuggled goods, prohibited goods, counterfeit goods, goods that infringe intellectual property rights, which are detected by competent authorities and reported to the tax authority;

+ In case of the act of creating electronic invoices for the purpose of short-selling goods or providing services to appropriate money from organizations or individuals, it is detected by the authorities and reported to the tax authorities;

+ In case the business registration authority or competent state agency requests an enterprise to temporarily suspend its business in a conditional business line or profession when it discovers that the enterprise does not meet the business conditions prescribed by law.