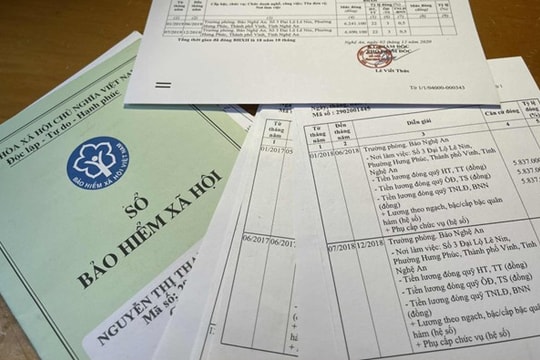

Instructions for calculating interest on late payment and evasion of social insurance, health insurance, and unemployment insurance

(Baonghean) - This is one of the contents of Circular 20/2016/TT-BTC guiding the implementation of financial management mechanisms on social insurance (SI), health insurance (HI), unemployment insurance (UI) and management costs of SI, HI, and UI.

The Circular stipulates that in cases of evasion; failure to pay enough for the number of people required to participate, failure to pay enough amount as prescribed, payment lower than the amount of people required to participate; appropriation of social insurance, health insurance, unemployment insurance premiums discovered by the social insurance agency or competent authority from January 1, 2016, in addition to collecting the amount required to pay as prescribed, the insurance agency will collect the interest calculated on the amount, the period of evasion and the late payment interest.

In which, the entire period of evasion before January 1, 2016 is calculated according to the late payment interest rate applicable to 2016. For the period of evasion from January 1, 2016 onwards, it is calculated according to the late payment interest rate applicable to each year.

|

| One-time social insurance benefits are calculated based on the number of years of social insurance contributions. |

The amount of late payment interest for social insurance, health insurance, and unemployment insurance receivable in a month includes the accumulated late payment interest up to the end of the previous month and the late payment interest calculated on the late payment amount arising in the month.

Every month, the Social Insurance agency is responsible for sending notices of social insurance, health insurance, and unemployment insurance payment results to employers according to the instructions of Vietnam Social Insurance, clearly stating the amount of late social insurance, health insurance, unemployment insurance payment and late payment interest (if any).

Also according to this Circular, for late unemployment insurance payments by employers up to the end of 2014 (if any), the Social Insurance agency requires enterprises to pay in full according to regulations; the State budget does not support the Unemployment Insurance Fund in this case.

This Circular takes effect from March 20, 2016.

Nghe An Provincial Social Insurance

| RELATED NEWS |

|---|

.jpg)