5G mobile connections in Asia-Pacific to increase 10-fold by 2030

(Baonghean.vn) - According to the latest report on the Asia-Pacific (APAC) Mobile Economy 2023 by the Global Mobile Suppliers Association (GSMA), 5G mobile connections are expected to increase 10 times, from 4% in 2022 to more than 41% in 2030.

By the end of 2030, the APAC region is expected to have around 1.4 billion 5G connections, an increase driven by factors such as falling prices of 5G-enabled terminals; countries in the region accelerating the expansion of 5G coverage; and concerted efforts by governments to integrate mobile-enabled technologies into many aspects of society.

However, the GSMA report also revealed that while developed mobile markets such as Australia, Japan, Singapore and South Korea are at the forefront of pushing 5G technology, there are still many barriers affecting overall mobile access and usage in some other APAC countries.

To maximize the region’s growth and innovation potential, policymakers can act to rebalance the digital ecosystem and create fairer business conditions for mobile operators, the GSMA report argues, creating incentives for mobile operators to continue investing in building existing 4G infrastructure, promoting investment in the deployment of 5G networks and introducing new services that meet the demands of the digital economy in the coming decades.

Key findings from the APAC Mobile Economy 2023 report include:

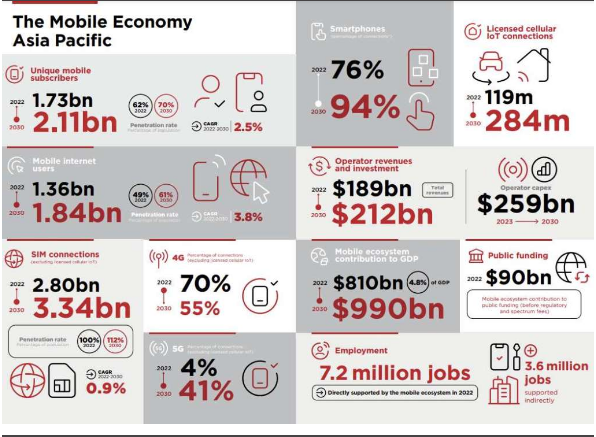

The number of mobile subscriptions in the APAC region will increase from 1.73 billion in 2022 to 2.11 billion in 2030

During the period from 2022 to 2030, the number of mobile subscribers in the APAC region is expected to increase by about 380 million, i.e. from 1.73 billion in 2022 to 2.11 billion in 2030, with South Asia accounting for about two-thirds of the total mobile subscribers in the APAC region.

Mobile penetration in the APAC region is expected to increase from 62% in 2022 to 70% in 2030, at a compound annual growth rate (CAGR) of 2.5%. However, it is still expected to be lower than the global average of 73%. Mobile penetration is highest in Northeast Asia and Oceania at 82% and 79%, respectively.

APAC region to have 1.36 billion mobile internet subscriptions by 2022

During the period from 2022 to 2030, the number of mobile internet users in the APAC region is expected to increase by about 480 million, i.e. from 1.36 billion in 2022 to 1.84 billion in 2030.

Mobile internet penetration in the APAC region will increase from 49% in 2022 to 61% in 2030, at a compound annual growth rate (CAGR) of 3.8%.

Despite significant improvements over time, the study also found that just under half (47%) of the population in APAC has access to mobile internet, and the region still lags behind other regions in the world. The main reasons for this lag include a lack of digital skills, especially among older populations; a lack of financial capacity to afford devices and services; and concerns about online safety.

The mobile internet landscape in the APAC region is quite diverse, with mature markets such as Australia, South Korea and New Zealand having penetration levels above 80%, while barriers continue to impact accessibility and usage in other markets.

5G to account for 41% of total APAC mobile connections by 2030

5G is gaining momentum in many markets across APAC, driven by a combination of factors including rapid expansion of 5G coverage in many markets (such as India), falling average selling prices of 5G-enabled devices, and aggressive marketing efforts by mobile operators to promote 5G. By 2030, 5G is forecast to account for around 41% of the region’s mobile connections, up from 4% in 2022.

Despite the growth of 5G in mature markets, 4G will remain the dominant technology at the regional level for the foreseeable future, accounting for around 55% of total connections in 2030, down from 70% in 2022. Meanwhile, 2G and 3G-based connections are on track to decline, to just 2% and 3% respectively in 2030. Many operators in countries across the APAC region have recently announced plans to switch off their 2G and 3G networks in the coming years.

Countries in the APAC region are among the world leaders in 5G adoption.

The first wave of 5G growth is dominated by pioneering markets in North America, Western Europe, Northeast Asia and the Gulf region. By the end of 2023, 5G adoption will be widespread in mass markets such as Australia (42%), Japan (47%) and South Korea (53%), on par with other global markets such as China (45%), Germany (35%) and the US (59%).

The second wave of 5G growth is now underway and is being driven by 5G network deployments in large emerging markets such as India. While the share of 5G mobile connections will remain high in the first wave markets in 2030, the second wave markets will see much higher numbers of new 5G connections, accounting for around 5 billion 5G connections globally by 2030.

Smartphone usage will increase by double digits on average in the period to 2030

There are forecast to be more than 3 billion smartphone connections in the APAC region by 2030, accounting for around 94% of mobile connections, up 18% from 2022; compared to the global average of 92%. The increase in smartphone connections is fairly consistent across the region, with both mature and emerging markets.

Availability of affordable smartphones and improved digital literacy are two factors that have played a significant role in driving the increased adoption and usage of smartphones in the region. Several countries in the APAC region have taken initiatives to improve digital skills among vulnerable groups such as women and the elderly. In the 2023 budget, the Indian government reduced customs duties on imports of certain inputs for phone manufacturing, which is seen as a positive step towards making phones more affordable.

GSMA Intelligence forecasts show that the top three markets with the most smartphone connections in the APAC region include India with around 1.3 billion, followed by Indonesia with 381 million and Japan with 168 million.

APAC is the region with the highest concentration of mobile data traffic markets.

Mobile data traffic will more than double in APAC countries between 2019 and 2030, with 5G being a major driver of mobile data traffic growth. In the region, online gaming and gaming are among the top services and content consumed by 5G users.

Licensed cellular IoT connections will more than double by 2030

There are expected to be more than 280 million cellular IoT connections in the APPAC region by 2030, with Japan, South Korea, and India accounting for approximately 71% of these connections, 41%, 19%, and 11%, respectively. There will be an explosion of IoT applications as 5G networks expand across the region, as 5G enables new IoT use cases based on the low latency and high capacity of 5G technology.

IoT will be crucial in realizing the digital transformation ambitions of countries across the APAC region, as it will enable a range of initiatives such as smart manufacturing, smart factories, smart cities, etc.

Mobile operators will spend $259 billion on network development between 2023 and 2030, mostly on 5G.

GSMA's report shows that 5G telecom infrastructure spending in the APAC region is expected to reach $259 billion during 2023-2030, with investments going towards expanding connectivity areas and mainly implementing full-scale 5G deployments.

According to analysts, after the widespread construction of 5G networks in the past few years in pioneering 5G markets, leading to record investment intensity in some markets, capital expenditures (CAPEX) in these markets will start to decline.

Instead, mobile operators will shift their focus to monetizing 5G services after already investing heavily in them. While pioneering markets in the region will ramp up 5G investment in 2023, the pace of 5G deployment will not be enough to prevent an overall decline in investment. This is because previous generations of networks, such as 3G and 4G, will remain integral to the connectivity landscape for the foreseeable future.

The mobile sector contributed about $810 billion to the APAC economy in 2022

The mobile sector plays a vital role in the APAC economy, contributing $810 billion in economic value by 2022, accounting for nearly 4.8% of the region's Gross Domestic Product (GDP).

By 2030, the mobile sector's contribution will reach around US$990 billion in the APAC region, driven largely by improvements in productivity and efficiency brought about by the increased use of mobile services.

APAC mobile ecosystem to support around 11 million jobs by 2022

Mobile operators and the mobile ecosystem directly employed approximately 7 million jobs across the APAC region in 2022. In addition, economic activity in the mobile ecosystem also created approximately 4 million jobs in other sectors, meaning nearly 11 million jobs were directly or indirectly supported through the mobile ecosystem.

By 2022, the financial contribution of the mobile ecosystem will reach 90 billion USD

In 2022, the mobile sector contributed significantly to public sector finances, with about $90 billion collected through taxes in the sector. Accordingly, revenue from value-added tax (VAT) on services, sales tax and special consumption tax was $30 billion, followed by VAT on phones; corporate profit tax and social security tax, each collected $20 billion.

5G will add about $133 billion to the APAC economy by 2030

5G is expected to benefit the APAC economy by an additional US$133 billion by 2030, accounting for more than 13% of the overall economic impact of the mobile sector. The majority of 5G benefits will be realized in the period up to 2030, with some countries in the early stages of deployment, and the economic benefits of 5G will increase as 5G technology begins to reach scale and widespread adoption in the region.

The benefits of 5G in 2030 will be concentrated in the service and manufacturing industries

5G is expected to benefit most sectors across the APAC economy, depending on how well it incorporates 5G business use cases. In 2030, 42% of the benefits from 5G are expected to come from the services sector (public administration, finance, healthcare, education); 34% from manufacturing, driven by applications including smart factories, smart cities and smart grids; 11% from utilities management, construction, oil and gas and agriculture; 8% from ICT; 4% from retail and 1% from other sectors.

Other trends in the regional mobile industry

Data traffic over telecommunications networks is growing exponentially as more people take advantage of broadband connections and demand for data-intensive digital content increases.

To accommodate growing digital traffic and maintain service performance, mobile operators must continuously invest to expand network capacity, close coverage gaps and deploy new technologies, according to GSMA research.

The report notes that as 5G adoption increases, the need to monetize will increase, along with the need to attract new customers and encourage existing ones to spend more. Virtual reality (VR) and augmented reality (AR) are expected to play a key role in creating new consumer experiences by leveraging 5G’s speed, latency, and capacity. 5G fixed wireless access offers additional revenue opportunities, especially in areas with low fixed broadband penetration.

The report also shows that the fintech industry is growing rapidly in the APAC region, from large mature markets such as India to emerging markets such as Vietnam and Indonesia. In particular, the fintech sector has continued to grow since the COVID-19 pandemic and financial inclusion in the APAC region is improving, such as the increase in mobile money.

To realise these ambitions and maximise the region’s growth and innovation potential, policymakers can act to rebalance the digital ecosystem and create fairer business conditions for mobile operators. This includes introducing appropriate tax policies, flexible licensing regimes and comprehensive legal frameworks to bridge the digital divide and safeguard cyberspace.

In addition, spectrum availability and efficient licensing continue to be critical to enabling the investment needed to expand mobile access, meet growing demand for data services, and improve the quality and range of services offered. The upcoming World Radiocommunication Conference 2023 (WRC-23) will provide policymakers with an opportunity to secure critical spectrum resources for 5G expansion and develop a long-term spectrum roadmap to 2030 and beyond.

Regarding this issue, Mr. Julian Gorman, Head of APAC, GSMA said: “As the world's largest geographically spread mobile market, the APAC connectivity ecosystem is diverse and includes both pioneering mobile innovators and emerging markets.”

“The region has some of the fastest-growing 5G markets in the world today, particularly India, which will add tens of millions of 5G connections in 2023. However, across APAC, we are also seeing a huge disparity in mobile internet usage,” added Julian Gorman.

To help people in the APAC region fully access mobile connectivity, the head of APAC at GSMA said that government agencies need to establish a flexible, forward-looking policy and regulatory regime to support the deployment and operation of mobile networks. This includes greater efforts to close the digital divide, especially for women and vulnerable groups such as the working poor, migrant workers, child workers, people with disabilities, ethnic minorities, reintegrated people, etc.

Meanwhile, Mr. Yuen Kuan Moon, CEO of Singtel Group (Singapore), said: “Our experience in Singapore has taught us that early adoption of emerging technologies is critical to facilitating the country’s economic development. This is why Singtel is rolling out nationwide 5G Standalone coverage three years ahead of regulatory targets, making Singapore a testbed for the world to explore new solutions and applications.”