Kha Banh earns billions of dong online: The mystery of the source of money in gangsters' pockets

An "internet gangster" like Kha Banh has a monthly income of up to billions of dong. So, which agency manages this flow of money?

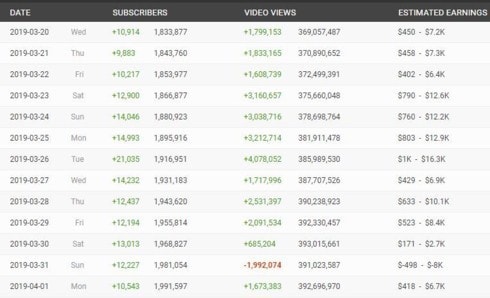

Socialblade data shows that Kha Banh's YouTube channel is ranked in group A - (almost the highest level), with nearly 2 million followers, 410 uploaded videos and nearly 400 million views.

On average, Kha Banh's channel has 11,500 subscribers and 2.17 million views every day, and more than 345,000 subscribers and 65.2 million views every month. Therefore, the amount of money that YouTube pays Ngo Ba Kha is also quite "huge", ranging from 15,300 USD - 244,700 USD, equivalent to 355 million - 5.67 billion VND/month.

|

The amount of money Kha Banh's Youtube channel earns according to SocialBlade statistics. |

If he can maintain such a large number of viewers, Ngo Ba Kha will be able to earn from 183,500 USD to 2.9 million USD per year, equivalent to 4.25 billion - 67.2 billion VND.

The content that Kha Banh group spread on social networks, although just staged videos to attract curiosity, also caused many bad consequences, especially for young people. Because, these videos always promote violent gangster lifestyle, encourage illegal behavior.

Currently, YouTube has disabled the monetization feature on Kha Banh's channel. Accordingly, all forms of advertising will be removed from videos on Ngo Ba Kha's YouTube channel by Google.

On the afternoon of April 2, the Department of Radio, Television and Electronic Information, Ministry of Information and Communications sent a document requesting YouTube to delete all video clips posted by Kha Banh group.

|

Kha Banh's daily views and passive income (in USD) from YouTube channel. |

In addition to the issue of content management on social networking platforms, the "huge" income of a group of "internet gangsters" like Kha Banh leads to the question of how the money from these violent and offensive videos will be managed?

And with the "inability" of authorities to manage these cash flows, will "internet gangsters" like Kha Banh, Phu Le or Duong Minh Tuyen... continue to spring up like "mushrooms after rain" thanks to the lenient policies of social platforms like YouTube and Facebook?

At the regular Government press conference in March 2019 held on the afternoon of April 2, Deputy Minister of Information and Communications Hoang Vinh Bao said that currently, activities and developments on social networks are very complicated, with many offensive contents that are difficult to control.

The Ministry of Information and Communications is actively working with foreign social networks, fighting with Facebook and Google to reduce offensive, negative, and obscene content...

"The Ministry is also reviewing relevant legal documents to ensure that foreign social networks are managed when providing services in Vietnam in accordance with Vietnamese law and fully comply with financial obligations," said Deputy Minister Hoang Vinh Bao.

|

The amount of money that YouTube pays Ngo Ba Kha is also quite "huge", ranging from 15,300 USD - 244,700 USD, equivalent to 355 million - 5.67 billion VND/month. |

At the recent 2019 E-commerce Forum, Mr. Nguyen Huu Tuan, representative of the Department of E-commerce and Digital Economy, Ministry of Industry and Trade, also admitted that Vietnam's current legal framework still has many shortcomings, not keeping up with the development of new types of e-business, including cross-border transactions (such as Facebook, YouTube, Google...), peer-to-peer lending...

Normally, to determine cash flow, it is necessary to go through banks or tax authorities, but these two units in Vietnam still do not have enough connection to control this issue.

Mr. Luu Duc Huy - Director of Policy Department, General Department of Taxation said, according to the provisions of the current Law on Tax Administration, commercial banks are not responsible for periodically providing information on transactions of individuals doing business online.

Therefore, individuals with income from foreign organizations and individuals are only discovered when the Tax Department requests banks to conduct screening measures.

“In Vietnam, there are over 60 commercial banks and millions of bank accounts. Account information is confidential to customers. Banks are only allowed to provide information when requested by the Tax Authority.

This is the main difficulty in tax management for individuals doing business online, especially when these individuals receive money from non-Vietnamese websites,” said Mr. Huy.