How to know if your bank card information is stolen on ATM?

In the context of increasingly complex high-tech crimes with many sophisticated tricks, to make safe card transactions, you need to equip yourself with basic knowledge such as how to recognize the risk of card information being stolen, how to use cards safely and how to lock cards in emergency situations.

How to recognize the risks of card insecurity on ATMs

When making card transactions on an ATM, you should observe carefully: Card reader slot; the area above - opposite the keyboard; the position above the ATM screen; inside the device covering the keyboard or ATM keyboard because these are the locations at risk of having a device installed to steal card information.

Be alert and careful if you find one of the following situations: The PIN keypad is abnormally high; when entering the PIN, it feels like there is a space below.

In addition, you also need to be vigilant if there are suspicious signs in the area where card information stealing devices are often installed, such as: Double-sided tape/glue around the card reader, or small holes in areas where the keyboard can be seen, such as the top of the ATM, the side of the ATM screen. PIN stealing cameras can also be hidden in nearby receipt boxes.

Some illustrations of card information stealing devices:

|

| The card skimming device covers the entire outside of the card reader slot. |

|

| The card skimming device covers the outer part of the card reader slot. |

|

| Card skimming device inside the card reader slot. |

|

| Secret camera to record PIN entry. |

|

| Fake keyboard steals cardholder's PIN (installed over real keyboard). |

How to use card safely at ATM?

You should check the ATM before making a transaction to promptly detect any unusual signs and do not make a transaction if you suspect the ATM has strange or unusual equipment.

Remember to always cover the keypad when entering your PIN to avoid exposing your PIN during transactions. In case of unsuccessful ATM withdrawal, you should check your account balance or call the bank hotline for check and support before leaving the ATM.

Customers are advised to use the automatic balance notification service via SMS and should regularly check messages to promptly and proactively detect unusual transactions.

Immediately contact the bank to block the card if you suspect that your card information has been leaked or if you suspect that your ATM has a device installed to steal card information.

How to lock your card quickly and safely

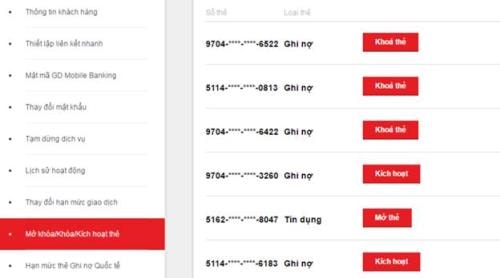

A representative of Vietnam Maritime Commercial Joint Stock Bank (Maritime Bank) said that in emergency cases, customers can proactively lock their cards by accessing Mobile banking or Internet banking to lock the card (domestic ATM card, international debit card and credit card).

The method is very simple, you just need to access Mobile banking or Internet banking, select the "Settings" function. Next, select "Activate card/Open card/Lock card" and select the type of card you want to lock and follow the instructions.

Alternatively, you can call Maritime Bank's automated voice system at hotline 1800 59 9999 (free) or (024) 39 44 55 66; press 1 to select Vietnamese, then press 1 to select the card lock function and follow the instructions.

Customers do not need to meet the operator directly, do not worry about the phone being busy, can still lock the card in time.