EU oil ban unlikely to hit Russia

The EU's partial oil ban will reduce Russia's exports to Europe, but Moscow can offset the loss with rising oil prices.

The EU's partial oil ban will reduce Russia's exports to Europe, but Moscow can offset the loss with rising oil prices.

The European Union (EU) on May 30 agreed to a partial ban on Russian oil, after tense negotiations late into the night at a summit in Brussels, Belgium.

With this decision, all Russian oil imports to the EU by sea will be banned immediately, while oil transported via the Druzhba pipeline system will be exempted. Two-thirds of Russia's oil exports to the EU are transported by ship.

When Poland and Germany fulfill their commitment to stop importing Russian oil via the Druzhba pipeline by the end of this year, the proportion of banned Russian oil entering the EU will rise to 90%.

|

The Druzhba oil pipeline connecting Hungary and Russia at the MOL Group's Danube refinery in Szazhalombatta, Hungary, in May. Photo:Reuters. |

Europe is Russia’s biggest energy customer. According to Eurostat, Russian crude accounted for 27% of the bloc’s total imports in 2021. Data from the International Energy Agency (IEA) shows that this equates to about 2.4 million barrels per day, 35% of which is transported via the Druzhba pipeline.

But Russian oil transported by pipeline accounts for a much larger share for Hungary (86%), the Czech Republic (97%) and Slovakia (100%).

Hungarian Prime Minister Viktor Orban said the new EU ban, which exempts oil imports via pipeline, was a "good approach", but warned that contingency plans were needed in case oil deliveries were disrupted by incidents.

According to veteran commentator Stanley Reed ofNY TimesThe EU's ban on Russian oil imports will affect the country's crude oil exports, but not enough to deal a heavy blow to Moscow as EU leaders expect.

For now, analysts say Russia's oil production remains largely unaffected, with European and other buyers snapping up the opportunity to buy crude at a discount of about $30 a barrel compared to Brent crude.

Kpler, a company that tracks oil shipments by sea, estimates that Russian oil production actually rose by about 200,000 barrels a day in May, to 10.2 million barrels a day. However, that is about 800,000 barrels a day lower than February levels.

Kpler estimates that the EU ban, when effective, will reduce Russia's oil production by one million barrels per day, about 10% of total production.

Analysts say the decline will have a widespread impact on Russia's energy sector for years to come, as major oil companies leave the country and sanctions prevent Russia from importing technology from the West.

But for now, the Russian oil industry appears resilient. The current uptick in production comes as Russian refineries ramp up production after scheduled maintenance and as non-Western buyers become less wary of buying Russian oil.

“Many other customers have now gotten used to buying Russian oil amid Western sanctions,” said Viktor Katona, an analyst at Kpler.

Russian seaborne oil exports to the EU fell by about 440,000 barrels a day between February and March, but have since remained relatively stable at around 1.2 million barrels a day. Italy is a major customer, importing about 400,000 barrels a day, although nearly a quarter of that oil is shipped to central Europe via the port of Trieste.

Kpler estimates that an average of 600,000 barrels of oil per day were shipped by pipeline from Russia to countries such as Hungary, Slovakia, Poland and Germany in May.

Hungarian oil company MOL said earlier this month that its refining profits had “skyrocketed” thanks to lower prices for Russian Urals crude. Hungary’s government has been adamant against sanctions on Russian oil, saying it is a landlocked country with no choice but to rely on pipeline imports from Russia.

Meanwhile, many customers around the world appear to be stockpiling cheap Russian oil. India is one of them, buying more than 700,000 barrels a day from Russia in May.

According to the Wednesday Group, a think tank that tracks Russia’s energy sales, Russia’s oil and gas revenues are now the same as they were before the military campaign in Ukraine, about $1 billion a day.

The EU's refusal to immediately ban all Russian oil will give Moscow valuable time to find alternative customers, with Asia being the most promising market, according to commentators Emily Rauhala and Quentin Aries fromWashington Post.However, it is unlikely that Russia will find customers with demand commensurate with the EU market in the short term. Moreover, re-establishing the energy export system will take a lot of time and money.

Edward Gardner, an economist at Capital Economics, an independent research and consulting firm based in London, predicts that Russian oil exports will fall by about 20% this year. He notes that the EU can cope “fairly well” by finding new suppliers, but oil prices will remain high in Europe and elsewhere.

|

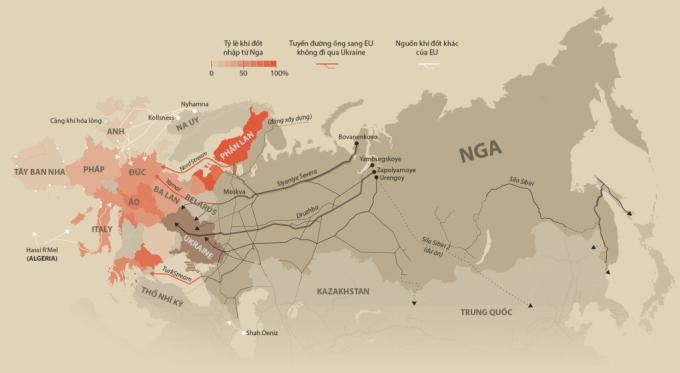

Pipelines transporting Russian gas to Europe. |

“The global impact of the reduction of Russian oil entering the market is that it will cause oil prices to continue to rise,” he said. Even if Russia’s oil exports fall due to the EU ban, the high prices will help Moscow to significantly offset the loss, experts said.