Practical benefits of receiving pension when participating in Social Insurance

(Baonghean.vn) - Retirement is the core of the Social Insurance policy, ensuring long-term social security for workers when they reach retirement age. Pensions are extremely important, helping workers ensure that when they retire, they have the money to pay for basic living needs and have an additional Health Insurance card (issued free of charge) for health care.

Many optimal benefits

Ms. Ly Hoang Minh - Deputy Head of the Retirement Department, Social Insurance Policy Implementation Department, Vietnam Social Insurance said: Currently, the Social Insurance agency is paying pensions to nearly 2.7 million pensioners with a monthly amount of nearly 14,475 billion VND. The current average pension is about 5.4 million VND/month, higher than the average income of people in 2021 (4.2 million VND/month), showing that pensions are a stable income that ensures the life of beneficiaries.

|

Nghe An province's Social Insurance Department on a mobile propaganda trip about policies when participating in insurance. Photo courtesy of Thanh Chung |

The pension level is not fixed at the time of retirement but is periodically adjusted to increase according to the consumer price index and economic growth to ensure life. Since 1995, the State has adjusted pensions 22 times and in the past 2 years, despite the difficult economic situation due to the impact of the COVID-19 epidemic, pensions have still been adjusted at a general rate of 7.4% from January 1, 2022. For those who retired before January 1, 1995, if after being adjusted to increase at a general rate of 7.4% but the pension level is low, it will continue to be adjusted (increased by VND 200,000 for those with a benefit lower than VND 2.3 million/month; increased to VND 2.5 million for those with a benefit from VND 2.3 million/month to less than VND 2.5 million/month). That further clearly demonstrates our State's policy of paying great attention to the income of pensioners.

Besides, the legal policy systemSocial insurance, Health insurance is also increasingly improved in line with the country's socio-economic development, ensuring the rights of participants in general and retirees in particular. Currently, according to regulations, the minimum time for employees to participate in Social Insurance to receive pensions must be 20 years, leading to many people having a short time participating in Social Insurance, so when they reach retirement age, they do not accumulate enough years of Social Insurance contributions to receive pensions.

|

Specific instructions on how to calculate pensions and social insurance benefits for people. Photo courtesy |

Faced with this situation, the Ministry of Labor, War Invalids and Social Affairs is proposing to amend the 2014 Law on Social Insurance in the following direction: Reducing the minimum number of years of social insurance contributions to enjoy retirement benefits from 20 years to 15 years, gradually to 10 years to create conditions for late-participating workers, with a short period of social insurance participation, to access and enjoy social insurance benefits; increasing the level of support from the State budget, supplementing the maternity allowance regime to increase attractiveness, attraction, and create conditions for people to voluntarily participate in social insurance;... The proposed amendment to the Law on Social Insurance this time aims to concretize the goals set out in Resolution No. 28-NQ/TW of the Party Central Committee, which is also to meet the aspirations of the majority of workers who want to receive pensions and have health insurance cards to take care of their lives and health when they retire.

In particular, in addition to receiving pension,workersThose who participate in Social Insurance when they are eligible for retirement will also be granted a free Health Insurance card, and enjoy the benefits of medical examination, treatment and lifelong health care paid by the Health Insurance Fund at a rate of 95% (higher than the average benefit of people participating in Health Insurance by household). In fact, the Social Insurance agency has paid hundreds of millions of VND, even billions of VND in health insurance examination and treatment costs for pensioners who have serious and incurable diseases - because this age group is often prone to health problems. Not only that, during the pension period, if the pensioner unfortunately passes away, their relatives will also enjoy the death benefit with many benefits.

Paying high social insurance for a long time will get high pension

According to current regulations, the monthly pension is calculated by multiplying the monthly pension rate by the average monthly salary for social insurance contributions. Thus, the pension level is proportional to the social insurance contribution level and the social insurance contribution period. This means that the higher the social insurance contribution level and the longer the social insurance contribution period, the higher the pension level will be.

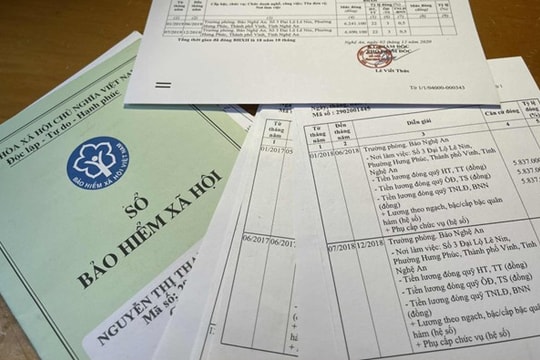

|

Employees can also track their social insurance payment progress through their Social Insurance Book. Photo courtesy of Thanh Hien |

Through the reflection of some localities and through the inspection of social insurance contributions at some labor-using units, it is shown that there is still a situation where enterprises only build salary scales and salary tables at the lowest level to pay social insurance for employees or some enterprises and employees agree to only use the salary stated in the contract as the basis for paying social insurance. This situation can originate from many causes: "Because the employer deliberately circumvents the law to reduce the responsibility for paying social insurance, health insurance andVoluntary social insurancefor employees (according to regulations, the employer's responsibility to pay accounts for 2/3 of the total amount of social insurance contributions of employees); reducing the social insurance contribution rate to increase the income payment for employees, thereby helping businesses increase competition in the labor market; or the employees themselves do not fully understand the legal policies, do not understand that high social insurance contributions will lead to high social insurance benefits, only care about immediate benefits, do not care about long-term benefits, do not have the awareness to save and accumulate through social insurance contributions when they are young...", Ms. Ly Hoang Minh analyzed.

To resolve the above situation, in the coming time, it is necessary to continue implementing synchronous solutions such as: Strengthening the inspection and examination of compliance with the provisions of the law on wages at enterprises; strictly and promptly handling violations of wages and social insurance; promoting propaganda work so that employees correctly and fully understand the benefits of participating in social insurance; raising awareness and compliance with the law on social insurance and health insurance of employers in correctly and fully paying social insurance to ensure long-term social security benefits for employees.

.jpg)