Strongly impose tax on business via Facebook

The Tax Department will announce the identities of organizations and individuals doing business online that are found to be evading taxes. It is not impossible to close accounts of website owners, Facebook... that are doing business but do not declare and pay taxes.

This is one of a series of measures that the Ho Chi Minh City Tax Department proposed at the conference to review the first 6 months of 2017 to rectify the strict implementation of tax obligations for trading and business activities via Facebook.

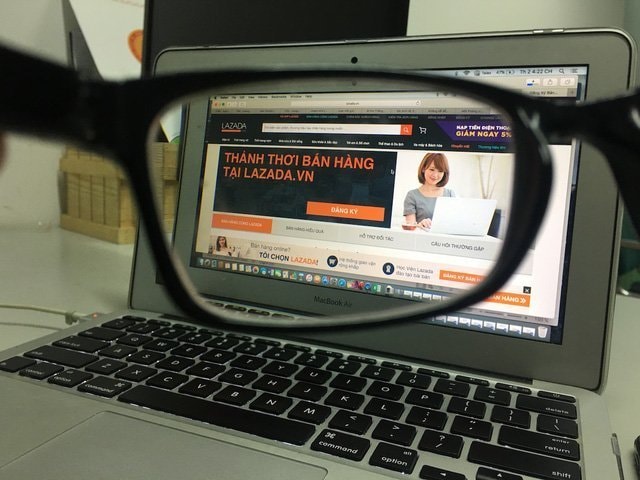

A representative of the Ho Chi Minh City Tax Department said that since June 2017, the agency has implemented a plan to collect taxes on e-commerce business activities, including: selling goods and services via the internet and Facebook.

To implement this plan, the Ho Chi Minh City Tax Department has assigned the tax branches of 24 districts to propagate and mobilize business people via Facebook to voluntarily come to register their business and declare taxes.

|

| Many e-commerce website owners do not cooperate with tax authorities. |

After nearly 2 months of implementation, reports from the district tax departments show that in addition to many individuals and organizations cooperating and declaring taxes, there are also many people who deliberately "avoid" doing business on Facebook because they think that doing business on Facebook is just a "side job" with low income. For example, the Binh Thanh Tax Department invited 172 website/Facebook owners to guide tax declaration, but 98 page owners cooperated. Among the 677 Facebook pages under the names of individuals doing business that were invited, more than 500 Facebook page owners did not "show up".

A tax officer said that recently, many Facebook owners have come up with many tricks to "avoid" business taxes via Facebook such as increasing cash transactions, creating multiple sales pages, changing business locations, not accurately declaring revenue, not publicly disclosing sales prices...

At the conference, leaders of many tax departments said that the Ministry of Finance needs to complete and supplement regulations on declaration and calculation of withheld tax at source; issue regulations on inspection and examination of online business activities.

|

| Tax collection based on voluntary declaration is very difficult to ensure fairness. |

To rectify tax collection and fairness in business, Ho Chi Minh City Tax Departmentwill publicize individuals and organizations that evade taxes in online business. If individuals and organizations do business online without declaring and paying taxes, they will be punished by the Tax Department.Ho Chi Minh Citysend a document requesting the Ministry of Information and Communications to close the account.Tax DepartmentHo Chi Minh Citysaid that the process of collecting business tax via Facebook is in the review and declaration guidance stage, but many problems have appeared when many Facebook page owners lack cooperation.

Ho Chi Minh City Tax Department said it has learned that Facebook account owners do not publicly disclose their addresses, account numbers, sales prices, or open multiple Facebook accounts, bank accounts, and increase cash transactions... to avoid being "exposed".

Faced with this trick, it is not impossible that tax departments in districts and towns in Ho Chi Minh City will act as buyers to "catch red-handed" sellers via Facebook without registering their businesses or paying taxes.

According to VNN

| RELATED NEWS |

|---|