Adjusted salary and income levels for social insurance contribution in 2019

The Ministry of Labor, War Invalids and Social Affairs has issued Circular 35/2018/TT-BLDTBXH regulating the adjustment of salary and income for social insurance contribution in 2019.

- Specifically as follows:

Accordingly, for the subjects specified in Clause 1, Article 1 of Circular 35, the monthly salary for which social insurance has been paid is adjusted according to the formula:

Adjusted monthly salary for social insurance contribution = Total monthly salary for social insurance contribution of each year x Adjusted level of salary for social insurance contribution of the corresponding year.

In case of Clause 2, Article 1 of Circular 35, monthly income for which social insurance has been paid is adjusted according to the formula:

Monthly income for voluntary social insurance payment after adjustment of each year = Total monthly income for social insurance payment of each year x Adjustment level of monthly income for social insurance payment of the corresponding year.

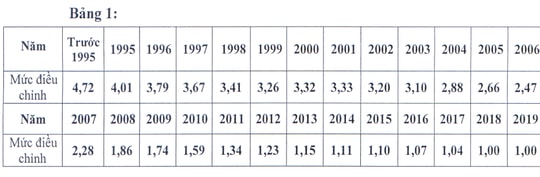

In particular, the adjustment level of salary and monthly income for which social insurance has been paid for each year is specified in detail in Table 1 and Table 2 issued with this Circular.

Circular 35/2018/TT-BLDTBXH takes effect on January 15, 2019. The provisions of this Circular are applied from January 1, 2019.