Banks need to create conditions for farm owners to borrow capital.

(Baonghean.vn)- That is the opinion of farm owners at the meeting and exchange program between Agribank Nghe An and farm owner representatives in the province.

On the morning of May 25, Nghe An Bank for Agriculture and Rural Development coordinated with the Provincial Farm Economics Association to organize a meeting and exchange program with farm owners in Nghe An province.

Up to now, there are 2,245 farms in the province, of which only 482 farms meet the new criteria according to Circular 27 of the Ministry of Agriculture and Rural Development.

|

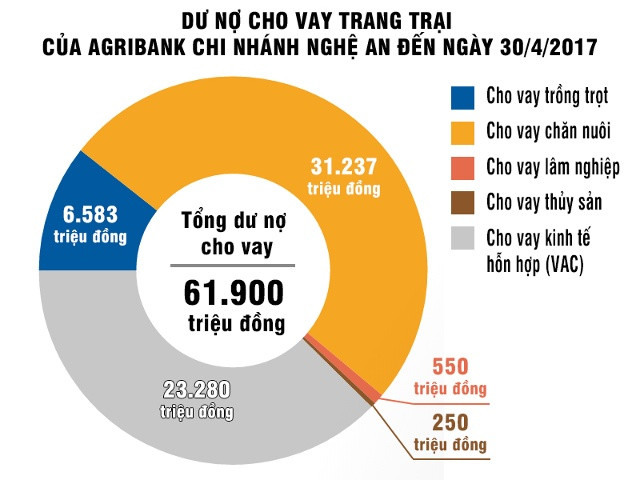

| Graphics: Huu Quan |

In recent times, Agribank Nghe An branch has closely followed the bank's guidelines and the local socio-economic development goals, proactively offering appropriate solutions for farm economic lending. Outstanding farm loans reached 61,900 million VND, of which: outstanding loans for crop cultivation were 6,583 million VND, livestock: 31,237 million VND, forestry: 550 million VND, aquaculture: 250 million VND, mixed economy (VAC): 23,280 million VND.

|

| Mr. Tran Van Duc - Deputy Director of the Bank for Agriculture and Rural Development, Nghe An branch, said that currently many businesses are spontaneous and lack long-term strategies, so they have difficulty in borrowing capital from banks. Photo: Thu Huyen |

|

| Overview of the conference. Photo: Thu Huyen |

At the meeting, representatives of farm owners shared their experiences in production and business; at the same time, they said that all levels and sectors need to have more synchronous policies on the farm sector, open training courses to improve knowledge on management skills and farm economic investment for farm owners; create conditions for granting land use certificates to farm owners when conditions are met according to Circular 27 of the Ministry of Agriculture and Rural Development.

Delegates also suggested that there should be a mechanism to support interest rates and costs for purchasing breeds, crops and livestock; and to form a guarantee fund to create conditions for farm owners to boldly invest and apply scientific and technical advances in production and livestock breeding.

According to Mr. Tran Van Duc - Deputy Director of the Bank for Agriculture and Rural Development, Nghe An branch, currently many farms operate spontaneously, lack long-term strategies, input and output sources are mainly free markets, there is no joint venture in production and consumption of products, so the quality of input and output cannot be controlled, leading to unstable business efficiency. That is the reason why some farm owners cannot take advantage of the loan guarantee mechanism according to the credit policy for agricultural and rural development in Decree 55/2015/ND-CP of the Government, which is to be considered for loans without collateral due to lack of trust for banks when considering loans.

|

| Mr. Le Van Khoi's tangerine garden in hamlet 6, Nam Thai commune, Nam Dan. Photo: Thu Huyen |

On the part of farm owners, it is necessary to innovate the production and business model in the form of clean, sustainable agricultural production, applying high technology. Farm owners build joint ventures and associations in crop production, livestock breeding, etc. between farms as well as with processing and export enterprises in the market, supermarkets and restaurants in product consumption and distribution.

To ensure the harmony of interests between banks and customers, and expand credit investment for farm economy, Agribank proposes that in the coming time, it will focus on implementing the Government's credit policy on agriculture and rural areas according to Decree 55/2015/ND-CP and the Government's Resolution on agriculture, rural areas and farmers. Agribank continues to maintain contact with the Chairman of the Provincial Farm Economy Association to promptly grasp the problems and difficulties in loan relationships, promptly meet loan needs, and best serve customers...

| As of April 30, 2017, Agribank's total capital reached VND21,845 billion, an increase of VND1,285 billion compared to the beginning of the year. Total outstanding loans reached VND19,203 billion, an increase of VND470 billion compared to the beginning of the year, of which, loans for agriculture and rural areas were VND16,267 billion, accounting for more than 86% of total outstanding loans with more than 151,658 customers. |

Thu Huyen

| RELATED NEWS |

|---|