Nghe An Social Policy Bank: 15 years accompanying the poor

(Baonghean) -The Nghe An Provincial Social Policy Bank branch officially opened on April 9, 2003. After 15 years of operation, it has successfully carried out the political goals and tasks assigned by the Party and the State. Nghe An Newspaper reporter interviewed Mr. Tran Khac Hung - Director of Nghe An Provincial Social Policy Bank.

PV:Nghe An is a difficult province, the rate of poor households, near-poor households and other policy beneficiaries is nearly twice the national average, the demand for loans of these subjects is still very large. Could you please tell us about the results achieved in mobilizing resources to meet the demand for loans in the area?

Mr. Tran Khac Hung:Immediately after its establishment, under the direction of the Vietnam Bank for Social Policies, the Nghe An Branch of the Vietnam Bank for Social Policies has well organized the reception of capital sources of preferential credit programs transferred from the Vietnam Joint Stock Commercial Bank for Industry and Trade, the State Treasury and the Bank for Agriculture and Rural Development; at the same time, it received capital sources transferred by the Vietnam Bank for Social Policies; mobilized capital sources mobilized from organizations, individuals, and entrusted capital sources from local budgets. By August 31, 2017, the total policy credit capital sources managed by the Vietnam Bank for Social Policies Nghe An reached 7,076 billion VND, an increase of 6,759 billion VND (22.3 times) compared to the first day of establishment, the average annual capital growth rate reached 24%.

|

| Dien Chau Social Policy Bank transaction office disburses program capital to customers. Photo: Thu Huyen |

In recent years, the Board of Directors and the operational management apparatus together with the organizations entrusted by the VBSP from the provincial to district levels have had many drastic solutions to mobilize capital to complete the targets assigned by the Central Government. In addition, the People's Committees at all levels have paid attention to allocating a part of the budget from the source of increased revenue and annual savings to the VBSP to implement lending to policy beneficiaries in the area. Up to now, the total local budget capital entrusted through the VBSP branches is more than 99 billion VND, accounting for 1.4% of the total capital, of which: the provincial budget capital is 81.7 billion VND, the district budget capital is 17 billion VND, and the commune budget capital is more than 200 million VND.

Thanks to that, the basic policy credit capital has promptly met the demand for loans to develop production and business and serve the essential needs of the lives of poor households and other policy beneficiaries in the province, contributing significantly to the successful implementation of the national target program on hunger eradication and poverty reduction. The total loan turnover has reached 17,675 billion VND, with 1.3 million poor households and policy beneficiaries receiving loans. The total outstanding loan balance reached 7,060 billion VND, 23 times higher than the time of handover, the average annual outstanding loan growth rate reached over 23%. Especially in the last 10 years (2007-2017), the policy credit period had a very high growth rate, due to the implementation of many major policies of the Government for the implementation of poverty reduction and social security goals.

PV:Can you be more specific about some effective policy credit programs in recent times?

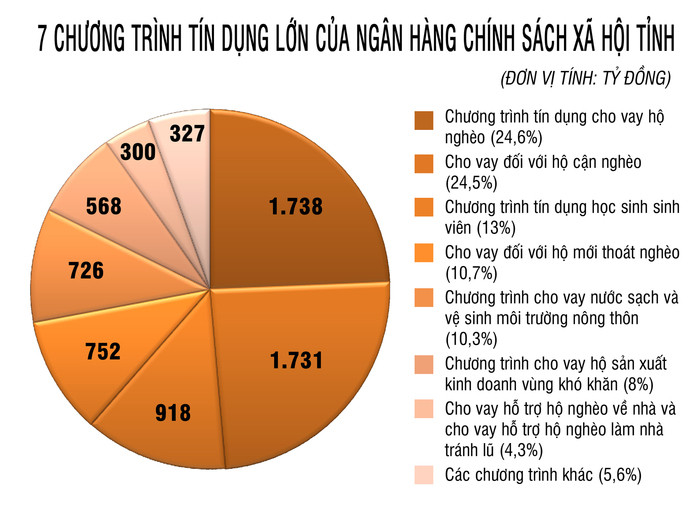

Mr. Tran Khac Hung:From 3 credit programs handed over with a total outstanding debt of 307 billion VND, after 15 years of operation, up to now, the Nghe An Provincial Bank for Social Policies Branch is implementing 18 credit programs assigned by the Government and a number of policy credit programs from capital sources entrusted locally, monitoring and managing over 297 thousand borrowing households, accounting for about 38% of the total number of households in the province.

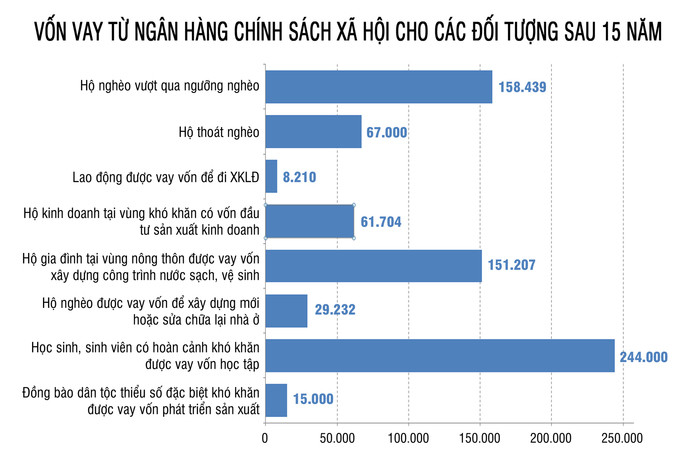

Some large-scale policy credit programs have achieved high efficiency such as: the program for lending to poor households, near-poor households, and households that have just escaped poverty, with more than 134,000 households using loans for livestock production with outstanding loans of 4,221 billion VND, accounting for 59% of total outstanding loans; loans in 15 years have helped more than 158,000 households have capital to develop the economy and escape poverty. Loans for students in difficult circumstances have outstanding loans of 921 billion VND, in 15 years have helped more than 244 students have the conditions to study. The program for lending to clean water and rural environmental sanitation with outstanding loans of 726 billion VND, in 15 years has contributed to the construction of more than 210,000 clean water and sanitation works.

|

| Graphics: Huu Quan |

In addition, there are a number of programs such as: Loans to create jobs for more than 24,000 workers; helping more than 8,000 workers go abroad for a limited period; supporting the construction of 28,164 houses for poor households; helping to protect and develop thousands of hectares of forest...

The Government's preferential credit programs implemented by the Vietnam Bank for Social Policies are truly an important capital channel, a "midwife" for poor households and special policy beneficiaries, especially in rural and mountainous areas with particularly difficult socio-economic conditions.

|

| Impressive numbers after 15 years of operation of Nghe An Social Policy Bank. Graphics: Huu Quan |

PV:In order to transfer policy credit capital to the right beneficiaries, how has the Vietnam Bank for Social Policies implemented policy credit management methods to be suitable to practice and effective?

Mr. Tran Khac Hung:We entrust socio-political organizations with some tasks such as: guiding the establishment and directing the activities of savings and loan groups, evaluating loan applicants, guiding borrowers in using capital, checking and supervising the process of using loans, and urging debt collection.

As of August 30, 2017, socio-political organizations are participating in managing 6,982 billion VND, accounting for 98.9% of total outstanding debt. The quality of entrusted credit has been continuously improved, the overdue debt ratio is now only 0.18%, down 1.63% compared to the time of handover. With the support of local authorities, entrusted organizations have coordinated with the Nghe An Social Policy Bank to establish and manage 7,701 savings and credit groups to borrow capital in 5,923 villages (hamlets, villages, hamlets). To date, 100% of villages (hamlets) in the whole province have had savings and credit groups of the Social Policy Bank operating in a disciplined and stable manner.

Implementing the direction of the Vietnam Bank for Social Policies on building a network of transaction points at communes, the Nghe An Provincial Bank for Social Policies has continuously built and strengthened the network of transaction points at communes. At the transaction points, the State's preferential credit policies are publicly listed by the Bank for Social Policies. Borrowers transact directly with the Bank for Social Policies on a fixed day every month to deposit, withdraw, borrow and repay debts in the presence of representatives of the local authorities at the commune level, entrusted organizations and the group management board. Thanks to that, the loss, embezzlement, corruption and abuse of preferential credit capital have been limited. All activities of the Bank for Social Policies related to the people are carried out at the commune transaction points: from receiving documents, disbursing capital, paying debts, interest, depositing savings, reflecting difficulties and problems, etc.

|

| People in Dien Ngoc, Dien Chau borrow capital from NHCS to process seafood and develop household economy. Photo: Thu Huyen |

PV:In the period of 2017-2020, the Provincial Social Policy Bank strives to provide access to capital for 100% of poor households and other policy beneficiaries who have needs and meet the conditions; the average annual credit growth rate is from 7% - 10%. To achieve that goal, what solutions has the Board of Directors of the Nghe An Social Policy Bank Branch taken, sir?

Mr. Tran Khac Hung:We will continue to closely coordinate with relevant departments, branches and agencies to advise Party committees and authorities at all levels in effectively leading and directing the implementation of Directive No. 40-CT/TW dated November 22, 2014 of the Party Central Committee Secretariat, Directive No. 29-CT/TU dated June 17, 2015 of the Provincial Party Standing Committee on strengthening the Party's leadership over social policy credit, in order to promote and enhance the role and responsibility of the entire political system to strongly participate in policy credit activities in the area; actively contribute to the implementation of the goal of sustainable poverty reduction, job creation, ensuring social security, supporting human resource training, promoting economic development, political stability and border security.

In addition, strengthen close coordination with entrusted socio-political organizations, commune and village authorities to strictly manage and effectively use policy credit capital; best ensure that poor households and other policy beneficiaries in need and eligible have access to policy credit capital in a timely, public, and targeted manner and use loans effectively...

PV:Thank you very much!

Thu Huyen

(Perform)

| RELATED NEWS |

|---|