Nghe An Social Policy Bank: Ensuring effective policy credit

(Baonghean) - In 2020, the Nghe An Provincial Branch of the Vietnam Bank for Social Policies (VBSP) deployed many synchronous solutions to ensure the effectiveness of policy capital allocated by the Government and entrusted capital.

Maximize capital mobilization

In 2019, the Nghe An Provincial Bank for Social Policies Branch successfully completed the plans and tasks set out: Successfully organized the conference to review the implementation of Directive No. 40-CT/TW of the Secretariat; exceeded the assigned capital target.

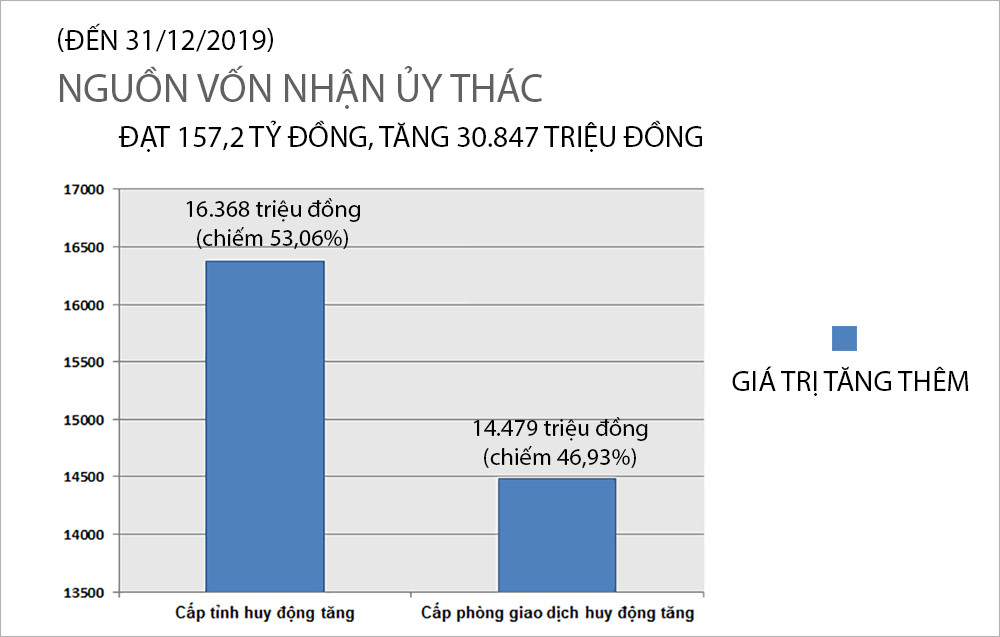

By December 31, 2019, the entrusted capital reached 157.2 billion VND, an increase of 30,847 million VND, completing 100% of the yearly plan. Of which: Provincial level mobilized an increase of 16,368 million VND (accounting for 53.06%), transaction office level mobilized an increase of 14,479 million VND (accounting for 46.93%). Some transaction offices completed the plan at a high level such as: Nam Dan, Anh Son, Dien Chau, Con Cuong, Que Phong, Quy Chau, Quy Hop, Tuong Duong... Of which, the two units Nam Dan and Anh Son made great efforts, creating a breakthrough in capital mobilization results from enterprises inside and outside the province.

|

| Nghi Loc Policy Bank transaction office disburses capital. Photo: Viet Phuong |

Actively make the most of central and local capital resources, attach importance to capital mobilization solutions in the area. The capital growth rate is quite good, up 8.05% compared to the previous year, total capital reached 8,376 billion VND. Mobilized capital in the area reached 1,562 billion VND, an increase of nearly 245 billion compared to the beginning of the year; in which: Local budget capital increased by 30.8 billion VND, savings through groups increased by 93.6 billion VND, deposits through other organizations and individuals increased by 120.3 billion VND.

|

| Graphics: Lam Tung |

Complete the capital mobilization growth plan assigned by superiors (expected: 60 billion VND in savings deposits through groups; 100 billion VND in deposits from organizations and individuals); complete the minimum outstanding loan growth target of 99% or more. Continue to comprehensively improve credit quality, achieving the following targets: Overdue debt does not increase compared to 2019; increase debt collection by periods, especially lending to poor households for housing and ethnic minority programs; debt collection by the end of the term reaches at least 85%.

Proactively increase loan levels

The leader of the Nghe An Provincial Bank for Social Policies Branch said: To achieve the set goals, the Branch focuses on closely following the contents of Directive No. 40-CT/TW of the Secretariat, Directive No. 29-CT/TU of the Provincial Party Committee, and directive documents of the Provincial People's Committee to promptly and effectively advise Party committees, authorities, and Board of Directors at all levels to maximize their roles and responsibilities in leading and directing policy credit; pay attention to arranging enough assigned capital targets; actively mobilize non-budgetary capital sources entrusted through the Bank for Social Policies, striving to exceed assigned targets.

Make the most of central capital and local budgets to ensure the borrowing needs of subjects in the area; strive to complete the target of capital mobilization from organizations and individuals in the area; direct the debt collection work well, focusing on debt collection in stages to proactively source capital while limiting the pressure of debt settlement at the end of the period and stabilizing credit quality; actively coordinate to review and inspect capital use to proactively increase the loan level to achieve good results.

|

| The Vietnam Bank for Social Policies inspects the production loan model in Ky Son. Photo: Viet Phuong |

For credit programs: Loans for poor households; Loans for near-poor households; Loans for households newly escaping poverty; Loans for clean water and rural environmental sanitation; Loans for production and business in difficult areas, while waiting for the Prime Minister to assign targets for the 2020 credit balance increase plan, to promptly serve capital for production and business and spring crop production in 2020; the General Director allows units to implement a maximum growth of 2% compared to the outstanding balance of each program as of December 31, 2019, and will assign the 2020 credit growth target to units immediately after the Prime Minister's decision to assign 2020 credit growth to the Vietnam Bank for Social Policies.

|

| Preferential capital is being transferred by the Nghe An Provincial Bank for Social Policies to the poor and policy beneficiaries, creating an important "push" for them to escape poverty sustainably and become rich legitimately. Photo: Viet Phuong |

In 2020, the General Director continues to allow units to report to the People's Committee, submit to the Head of the Board of Directors at the same level to adjust the outstanding debt plan targets between the three programs for poor households, near-poor households, and households escaping poverty, but must ensure the order of priority for lending to poor households, near-poor households, and households newly escaping poverty. For credit program targets: Loans for students; Loans for workers working abroad; Loans for labor export in poor districts according to Decision No. 27/2019/QD-TTg, the Branch shall disburse according to the actual loan needs of the borrower, ensuring the correct subjects according to regulations.

For the remaining credit programs: Branches manage and collect due debts to provide revolving loans up to the outstanding balance as of December 31, 2019 until the General Director's Decision (notification) assigns the 2020 plan targets. For programs and projects that have expired, branches will urge the collection of due debts and will not provide revolving loans.

Nghe An Social Policy Bank mobilizes many resources for effective lending

(Baonghean) - The capital transferred by Nghe An Social Policy Bank to the poor and policy beneficiaries creates an important "push" for them to escape poverty sustainably and become rich legitimately.

Social Policy Bank: A fulcrum for many households to escape poverty

(Baonghean) - Nghe An province has issued and implemented many solutions to promote socio-economic development, gradually reducing poverty. In particular, capital from the Social Policy Bank has actively contributed to poverty reduction, ensuring social security and building new rural areas in the area.