Nghe An Social Policy Bank improves the quality of savings and loan group activities

(Baonghean) - In the first 6 months of 2019, the Social Policy Bank, Nghe An branch, achieved many outstanding achievements. Mr. Tran Khac Hung - Director of the Social Policy Bank, Nghe An branch, talked with Nghe An Newspaper reporters about this field.

PV:To meet the needs of policy subjects in the area, the important issue is to ensure capital sources. SoCould you tell us about the capital situation recently?

Mr. Tran Khac Hung:The Board of Directors at all levels has promptly allocated additional capital assigned by the Central Government, thereby promoting the disbursement of credit programs without backlog, specifically: The capital announced by the Central Government to be additional in the second quarter of 2019 was 80.8 billion VND; in the first 6 months of the year, the capital assigned by the Central Government was 559.8 billion VND (up 2.3% over the same period last year).

By June 30, all basic capital sources had been disbursed, except for the housing loan program for poor households under Decision 33 and the social housing loan program.

In general, basic capital meets the needs of policy subjects in the area.

|

| Dien Chau Social Policy Bank transaction office disburses program capital to customers. Photo: Thu Huyen |

PV:Currently, Nghe An is implementing 19 policy credit programs. So what are the results of the credit programs, sir?

Loan turnover in the first 6 months of the year reached 1,657 billion VND, up 13% over the same period last year.

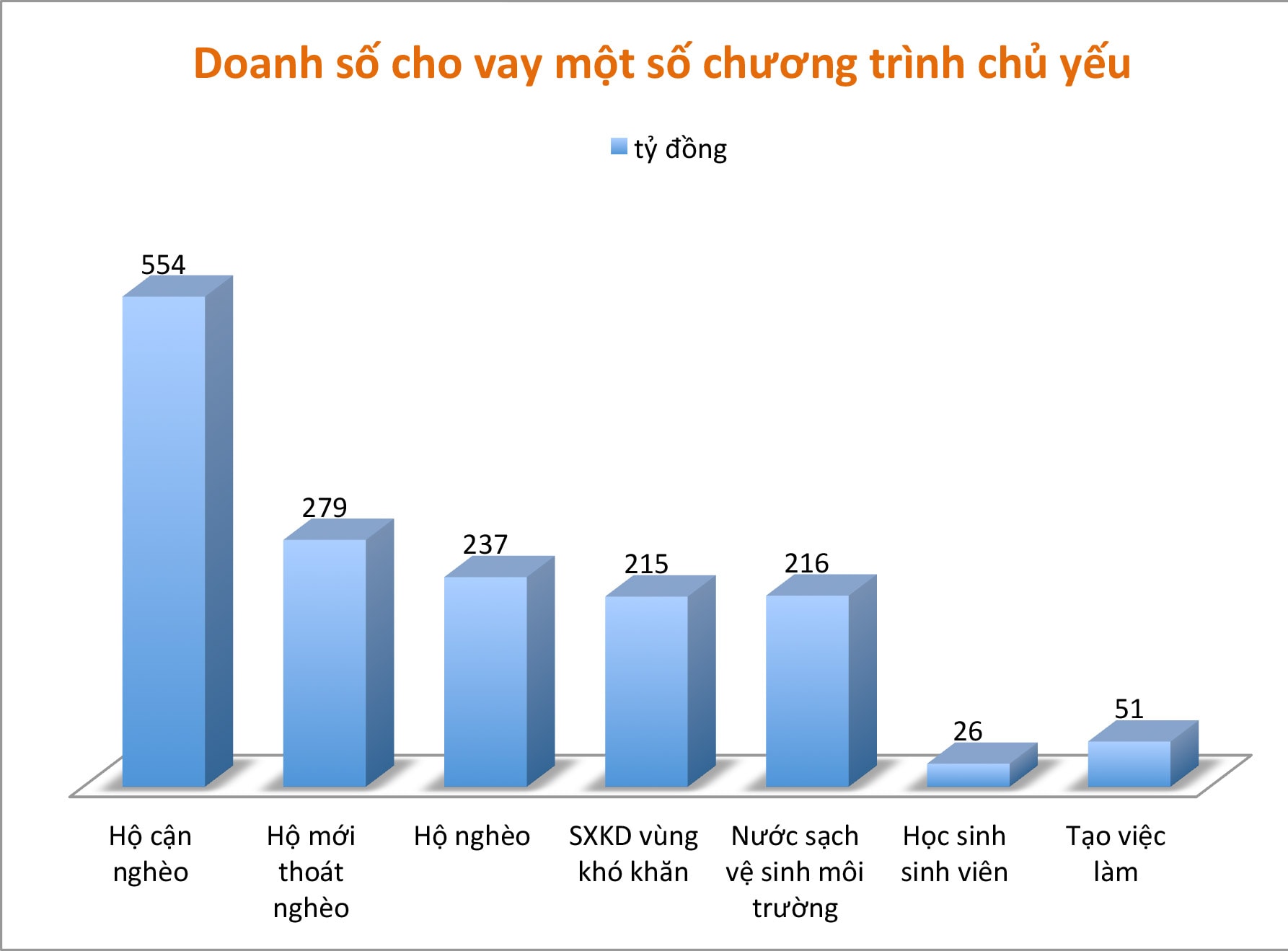

Large loan sales mainly focus on key programs for poor, near-poor, newly escaped poverty households, rural and disadvantaged areas.

In addition, new credit programs are being vigorously implemented to meet the needs of poor households and policy beneficiaries.

Implement the policy of increasing the loan limit and maximum loan term to serve production for poor households, near-poor households, newly escaped poverty households and ethnic minority households in accordance with Decision No. 12/QD-HDQT dated February 22, 2019 of the Board of Directors in a timely manner. The implementation is carried out closely, publicly and transparently.

In the first 6 months of the year, policy credit capital has provided capital to 43,094 poor households, near-poor households and other policy beneficiaries to invest in production and business, serving essential needs of life.

Policy credit continues to make important contributions to helping poor households and policy beneficiaries develop the economy, improve their lives, contribute to the goal of poverty reduction, new rural construction and security and political stability in the locality.

|

| Loan sales of some major 6-month programs in Nghe An. Graphics: Thu Huyen |

PV:The commune transaction point is where the main transactions with customers of the Social Policy Bank arise. Therefore, in order to serve customers better and better, what solutions has the Branch had to improve the quality of transactions?

Mr. Tran Khac Hung:In addition to continuing to innovate machinery and equipment; regularly updating and upgrading commune transaction software; strictly following the transaction schedule; transaction activities at the commune are monitored through the online camera system; monthly inspection, assessment and scoring; organizing meetings with local authorities, entrusted organizations and TKVV groups at transaction points periodically to inform about the results and implementation status of policy credit programs...

Thanks to that, the quality of transaction activities in the commune has been continuously improved, reflected through indicators reflecting transaction activities such as: disbursement (97%), debt collection (83%), interest collection (98%), savings collection (96%); quick transactions, saving time for customers; increasingly high customer satisfaction,...

|

| Ms. Le Thi Xoan in Hoang Tru 1 hamlet, Kim Lien borrowed policy capital to raise breeding cows. Photo: Thu Huyen |

PV:Trust activities and the network of credit institutions play a very important role in the credit quality of policy banks. Could you elaborate on the operation of this network?

The association at all levels has coordinated with the Bank to closely monitor the activities of the network of credit institutions, closely monitor the development of criteria for evaluating the activities of credit institutions on a monthly basis to take timely corrective measures; at the same time, regularly coordinate and review to advise the People's Committee at the commune level to merge and consolidate ineffective groups (due to low scale in terms of number of members and outstanding debt, inactive group management board, etc.).

Thanks to that, the network of credit organizations continues to operate stably, promoting its role as a focal point for managing policy credit capital sources in villages and hamlets.

|

| The domestic water project was invested with a loan from the NHCS of Mr. Bui Xuan Dai's family in village 5, Hoi Son (Anh Son). Photo: Thu Huyen |

PV:The results achieved are very remarkable, however, the tasks for the last 6 months of the year are very heavy. To fulfill the tasks set out for the year, what solutions does the Branch need in the coming time, sir?

Pay attention to maximizing capital channels from central to local levels, continue to submit to the central government for additional capital sources for loans for programs that have completed their planned targets, focus on receiving capital sources from local budgets and actively mobilize capital sources according to market interest rates, in order to complete the target of capital growth and outstanding debt in 2019 of over 7%.

Advise and assist the Board of Directors in completing the monitoring plan; strengthen departmental inspection; review, analyze, evaluate and classify bad debts and overdue debts to find appropriate solutions for handling and management; strengthen inspection and closely monitor the use of capital by customers. Coordinate with the provincial association to direct district and commune-level associations to step up inspection and monitoring work, strengthen thematic inspections; direct commune-level associations to inspect 100% of new loans within 30 days after disbursement to prevent, detect and promptly recover errors and violations (if any), etc.

The branch will also regularly pay attention to perfecting, rectifying and improving the quality of operations of the TKVV team, raising the rate of good teams to at least 94%, and weak teams to less than 0.1%; directing the commune-level association to seriously participate in the activities of the TKVV team to direct and supervise the loan evaluation to improve the quality of lending right from the evaluation stage./.

PV:Thank you!