Banks will consider raising student loan levels

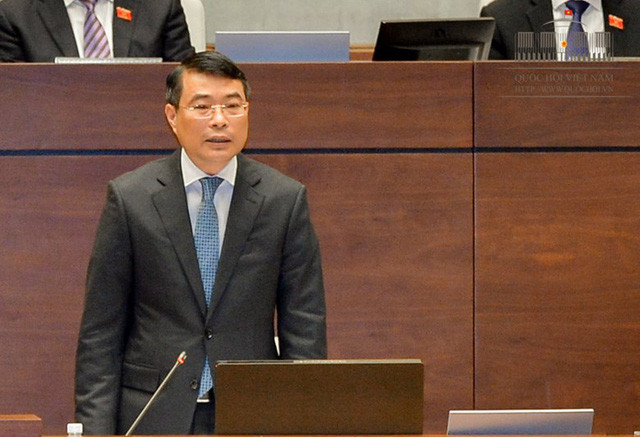

Governor Le Minh Hung spent half a morning today, November 17, answering questions before the National Assembly. Speaking for the first time, the governor of the State Bank had a rather lively question and answer session.

|

| Consider raising student loan limits - Photo 1. |

48 delegates signed up to question the Governor of the State Bank of Vietnam, Le Minh Hung, on the afternoon of November 16. Mr. Hung received "tricky" questions ranging from mobilizing gold and foreign currency from the people, to ensuring the safety of deposits, lending capital to BOT projects, buying banks for 0 VND, managing interest rates, and even a very new issue, the virtual currency bitcoin.

Answering concisely, almost without looking at the document, the governor gave some remarkable information.

The most fundamental, sustainable, and feasible solution to mobilize gold from the people (according to forecasts, there are about 500 tons of gold and 10 billion USD in the people), according to the governor, is: "The government and ministries need to firmly maintain the goal of stabilizing the macro economy, building trust among businesses... on that basis, capital will not be invested in financial assets such as gold and foreign currency. This requires time and a roadmap to transform resources."

According to Mr. Hung, in the past, Vietnam spent a lot of foreign currency to import gold, which affected the market and caused instability. For many years, this market has been stable, without losing foreign currency to import gold; the market is self-regulating. Thus, a large part of the resources from gold has been transferred to the economy.

Recently, the State Bank has applied a ceiling interest rate of 0% on foreign currency mobilization, and that resource is actually converted into VND. Recently, the exchange rate has been stable, and banks have been able to buy large amounts of foreign currency from the people.

Responding to a question about virtual currency bitcoin, Governor Le Minh Hung said this is an issue that countries are also researching, some countries acknowledge it, some countries acknowledge it but have recommendations, and some countries do not acknowledge it.

In Vietnam, according to current legal regulations, bitcoin is not cash, not a legal means of payment, so transactions using this currency are illegal transactions.

Mr. Hung said that the State Bank is coordinating with ministries and branches to conduct research, and believes that in an integrated world, this is something that must be thoroughly researched. In the case of FPT University allowing students to pay tuition fees in virtual currency, the State Bank has not yet received a proposal.

ReplyTuoi Tre Online, delegate Luu Binh Nhuong (Ben Tre) gave a good assessment of the answers on bad debt handling and the banking system management work which had "problems" from the previous period.

"I agree with the governor that this is a problem with many shortcomings and the governor is determined to work with the Government to resolve it. I hope the governor will continue to maintain this spirit so that he can resolve the delegates' questions in the next answer session," said Mr. Nhuong.

Will consider adjusting loan levels for students

Responding to delegate Nguyen Thanh Hien (Nghe An) about protecting customers borrowing from consumer finance companies, Governor Le Minh Hung said that the interest rates of these companies are higher than banks because the terms are short, the loan value is small, and the capital costs of these companies are also higher.

Recently, the State Bank has had specific regulations for this subject to increase transparency, publicly announce interest rates and interest calculation periods.

Responding to the issue of raising the loan amount and extending the loan term for students, Governor Le Minh Hung said that 3.5 million students have received loans, with a total outstanding debt of about 15,000 billion VND. The loan amount has been adjusted 7 times, currently at 1.5 million VND/month. However, this amount is not enough to meet the needs of living and studying.

Mr. Hung acknowledged this but also said that in the current difficult context, adjustments cannot be made immediately, and will be considered in the near future.

Regarding the repayment period, students are given a grace period of 1 year from graduation, and if there are objective difficulties, they can be extended by up to half the loan period.

There is collusion in ATM fraud.

Responding to questions about solutions for ATM card payments, the governor said that fraudulent card payments are increasing at a worrying rate.

According to statistics from international card issuing organizations, in 2015 the total amount of losses from fraudulent behavior in card payment activities reached 21 billion USD, on average, for every 100 USD transaction, there was a loss of 7 cents. In Vietnam, the loss rate is only 1/3 of the average level in other countries, but recently there has been a tendency to increase fraudulent behavior.

Regarding the cause, the governor affirmed that it was from the bank. "Because the ATM system was installed with data copying devices to steal data, the bank's security still had loopholes. On the other hand, cardholders also had negligence. In some cases, card acceptance organizations colluded with bad guys to commit fraud and misappropriate customers' money," the governor said.

The State Bank has issued regulations on procedures for handling damages caused by fraudulent acts in ATM payments, clearly defining the responsibility of credit institutions in compensating cardholders for damages. Some banks have advanced money to cardholders.

The solution, according to Mr. Hung, is to focus on perfecting legal regulations on security and safety, especially converting magnetic cards to more secure chip cards, applying international standards in monitoring the card system. On the other hand, it is to strengthen inspection of card payment services, and increase communication for cardholders to be careful to protect themselves when paying by card.

Delegate Nguyen Sy Cuong (Ninh Thuan) debated: "Regarding transaction safety, some customers suddenly lost money in their cards. Although only a few cases, the psychological impact was huge. What security solutions will be available in the future to bring confidence to customers?"

Governor Le Minh Hung replied: "Immediately after those incidents occurred, the State Bank directed banks to closely coordinate with the investigation agency, clarify each case, and handle it according to the law.

At the same time, we remind banks to strengthen security measures, thoroughly review internal inspection and control processes, and enhance safety and security of treasury, branches, and transaction offices...

In particular, we require banks to strengthen training and development of staff, and regularly rotate staff positions. We have organized online conferences in 63 provinces and cities, informing key staff of credit institutions to focus on preventing violations."

Bad debt is about more than 550,000 billion VND

Responding to the question about bad debt from delegate Bui Van Xuyen (Thai Binh), Governor Le Minh Hung said that the bad debt ratio as of September 2017 was 2.34%. However, if we carefully assess and include potential bad debt, it would be about more than 550 trillion VND, bringing the ratio up to 8.61%, a decrease compared to the figure of more than 10% at the end of 2016.

Responding to the question about credit rating of credit institutions from delegate Bui Thi Hien Mai (Hanoi), the governor said that the public announcement of this credit rating only applies within the scope of credit institutions. According to the practice of other countries, this rating is only for the purpose of state management, the basis for the State Bank to assess the level of safety, risk, and early warning.

Responding to the question of delegate Pham Tat Thang (Vinh Long) about the direction of monetary policy management, the governor said that the first and consistent goal is to protect the value of money. In recent times, the State Bank has focused on controlling inflation to stabilize the macro economy, stabilize the value of money while still ensuring reasonable economic growth.

Foreign exchange reserves reach 46 billion USD

Regarding the question of delegate Bui Thanh Tung (Hai Phong) about exchange rate management, the governor said that this is a difficult issue. The State Bank of Vietnam always assesses the impact on inflation control, the Government's foreign debt repayment obligations, and export prices, because our country both exports and imports. On the other hand, there is the psychology of market developments.

Since January 2016, the State Bank has been operating the central exchange rate policy. Through assessment from that time until now, the exchange rate market has been very positive.

"In 2016, we bought more than 9 billion USD, and in the first 6 months of this year, we bought more than 7 billion USD. Up to now, Vietnam's foreign exchange reserves have reached 46 billion USD. Currently, we have a trade surplus of 2.8 billion USD. Maintaining a stable exchange rate will maintain the confidence of investors, including foreign investors," Mr. Hung emphasized.

According to Tuoi Tre