Nghe An Banking Industry leads the North Central region in capital mobilization.

In the first 9 months of the year, Nghe An Banking sector led the North Central region in terms of capital mobilization results; effectively implemented monetary, credit and banking activities in the area.

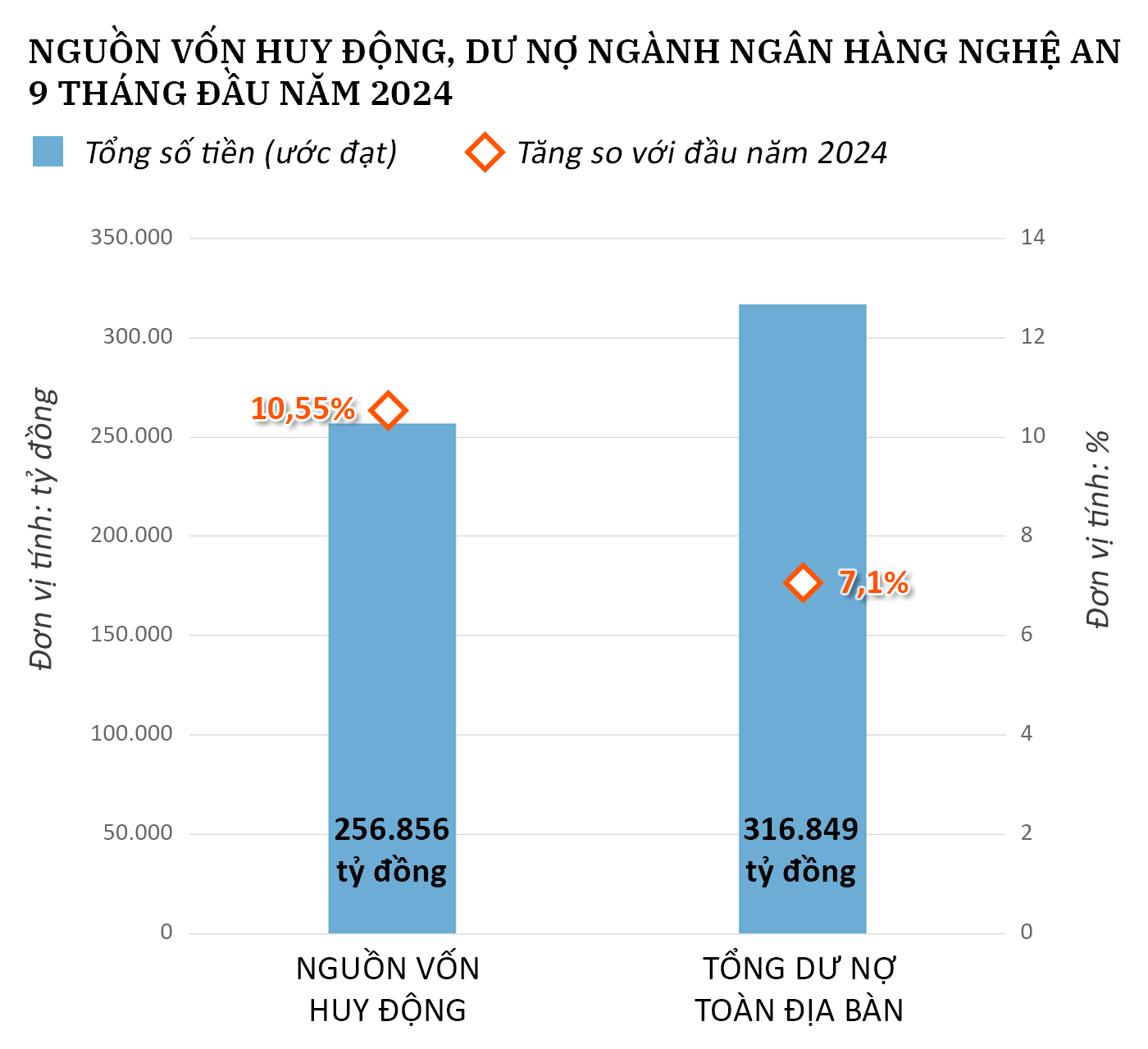

According to the State Bank of Vietnam, Nghe An branch, Nghe An banking sector is leading in terms of operating results in the North Central region with results up to September 30, 2024, mobilized capital estimated at VND 256,856 billion, up 10.55% (+ VND 24,512 billion) compared to the beginning of the year. Total outstanding debt in the whole area is estimated at VND 316,849 billion, up 7.1% (+ VND 21,070 billion) compared to the beginning of the year, higher than the increase in the same period last year (up 5% in the same period last year).

The leader of the State Bank of Nghe An branch said: In recent times, credit institutions in Nghe An have focused on effectively implementing the industry's goals and tasks for monetary, credit and banking activities in the area; maintaining stable and safe operations, effectively contributing to supporting and restoring economic growth, and ensuring social security in the province.

In the first 9 months of 2024, credit institutions in the province will increase capital mobilization and expand safe, effective and sustainable credit investment; continue to promote lending programs for poor households and policy beneficiaries; continue to implement solutions to support customers and effectively carry out restructuring and bad debt handling.

Continue to implement support loans for priority areas such as loans for rural agricultural development; loans to encourage the development of high-tech agriculture and clean agriculture and credit programs under the direction of the Government and the Prime Minister. Credit for poor households and policy beneficiaries in the area has always been of interest and promoted by the Nghe An Banking sector. Outstanding loans for poor households and policy beneficiaries through the Social Policy Bank account for 4% of the total outstanding loans in the area.

Direct, urge, and promote the restructuring of credit institutions associated with bad debt settlement and management of the People's Credit Fund's activities. Closely monitor the progress of bad debt settlement in the area and strengthen supervision of units with bad debt over 3% and units with potential risks in operations. By September 30, 2024, bad debt of banks in the area is estimated at VND 6,140 billion, accounting for 1.94% of total outstanding debt.

In addition, the banking sector continues to promote digital transformation; coordinate with Nghe An Provincial Social Insurance to implement the plan to deploy the application of the National Population Database in the payment of pensions and social insurance benefits through non-cash payments. Coordinate with the Department of Education and Training, the Department of Health, direct credit institutions to promote the payment of tuition and hospital fees by non-cash payment methods to ensure the completion of the set targets. Deploy the development of non-cash payments in the payment of pensions and social insurance benefits based on the National Population Database...